History Repeating – JP Morgan & Rothschilds Redux

News

|

Posted 18/07/2023

|

6444

Little bit of a history of the gold/silver standard and what amounted to the Panic of 1896. What’s interesting in this history lesson are the players and what they were trying to achieve – Rothschild and JP Morgan. 130 years later the same lessons are being told but the main players have not changed and the ultimate gain is banking as opposed to railway.

JP Morgans undocumented manipulation of the gold and silver market has long been a speculated rumour and somewhat difficult thing to prove. So today we thought we’d take you on a journey back to 1895 – where speculation and government collusion were in fact tools used by JP Morgan and Rothschilds to both save the US from economic collapse and line their own pockets. The result was the strengthening of these financial institutions, which over the years have used the same playbook to further enhance their market dominance and back-handed deals rewarding and not punishing their financial prowess.

The playbook? Wait for the government to fall into a panic or a financial crisis. Save the day. Manipulate markets to your advantage, and walk away with monopolistic powers. In 1914 JP Morgan emerged as the major player and owner of railways in the US. 2023 JP Morgan emerges as the major player in US banking. Both a mechanism of trade control – 1914 Industrial revolution trade control and 2023 banking and finance trade control.

What’s a Panic?

Rather than googling financial crisis – google panic, Pre-1900 the panic terminology appears to apply to any bubble or distorted market leading to market manipulation and panic, otherwise now known as a financial crisis. Some examples include:

Panic of 1819

This was the first US widespread panic, driven by the end of the Napoleonic wars, it was compounded by asset bubbles in speculation in public lands – fueled by the unrestrained issue of ‘paper money’

Panic of 1837

Another panic set off from a real estate bubble and erratic American banking policy. Deflation set in with profit, prices and wages dropping.

Panic of 1873

This panic started in Europe with a stock market crash leading to investors liquidating bonds, in particular railway bonds in the US due to overdevelopment and speculation in railway.

The Panic of 1893 and 1896

Triggered by factors such as a failed coup in Argentina, a run on gold in the U.S. Treasury, and an oversupply of silver.

You see the gist here – gets a little 1800 repetitive and it was no wonder property prices remained fairly subdued throughout the 19th Century. It appears in the 20th Century, those Panic lessons may have been well and truly forgotten and the same old real estate lax banking bubbles emerged.

But for this history lesson we will focus on 1873 and 1893, and the great fortune JP Morgan was able to accumulate during this time and the role of gold and bonds that saw JP Morgan emerge as the US’s most powerful financial and railroad tycoon.

Railroad Playbook

JP Morgan cofounded Drexel, Morgan and company in 1871, becoming JP Morgan and company in 1895. What seemed like a bad time to be in business turned out to be fortuitous to JP Morgan. The Panic of 1873 started with the rampant inflation driven from overspeculation in railroads and the demonetization of silver in Germany and the US. Following the American Civil War, 33,000 miles of railroad were built between 1868 and 1873. Within the railroad craze a large infusion of cash was raised via bonds. In 1871 Germany demonetized silver leading to an oversupply of silver, particularly in the US who mined most of the supply. In 1873 the US passed the Coinage Act of 1873 backing the US dollar to a de facto gold standard. This immediately depressed silver prices further, reduced money supply and raised interest rates hurting farmers. People then shied away from long term bonds and collapsed the railway bond market.

In 1873 the precipice of the Panic happened when Jay Cooke and Company couldn’t sell millions of dollars of Northern Pacific Railway Bonds leading to its bankruptcy. By 1874 60 railroads had gone bankrupt

In 1875 Congress backed the USD with gold helping to curb and stabilize the dollar.

It was 10 years after the collapse in railway bonds that JP Morgan emerged as a railway force, this time reorganizing railways, merging them and taking stakes, such as in 1885 when he arranged a merger between New York Central Railroad and the Pennsylvania Railroad.

Morgan-Belmont Syndicate

Following the 1893 Panic, paper money was being exchanged for gold from treasury, draining the US Treasury of gold. The hot money movement as it was later known had all the hallmarks of a self compelling bank run on Treasury due to a distrust of the US government’s gold reserve. There was a rapid decline in gold reserves from $121,0000,000 on January 1st 1893 to $66,000,000 on February 1st 1894. Under these circumstances the government used 4 subscriptions of $50,000,000 of 5% 10 year bonds over a 1894-1895. But each time treasury again saw gold continue to pour out of treasury. Speculative international transactions prompted by the fear of the ceasing of the gold standard saw another net outflow of $84,000,000 between October 1894 and January 1895, investors were liquidating bank balances and railroad bonds for gold and sending this gold to Europe at an increasing rate.

To assist with the US predicament a famous meeting between President Cleveland and JP Morgan in 1895 produced a syndicate and its contract on February 8th 1895. The contract failed to name syndicate members with a veil of secrecy, although it is now known the syndicate included both Rothschilds and JP Morgan to name some of the more notable firms. The contract was for the syndicate to bolster gold stock and stop outflows. The syndicate agreed to purchase 3,500,000 ounces of gold and sell it to the government with 4% 30 year bonds.

The syndicate acquired $62,315,400 in government bonds at a 4% return, which they sold at 3 ¾% almost immediately for $68,833,591 – a tidy $5,000,000 immediate profit. Additional to the gold they delivered, within a week the syndicate saw other gold inflows of $10,000,000 from domestic holders.

The second condition was the syndicate exert control on the market (manipulate) to stop gold outflows. The syndicate contract lasted 6 months, with the Syndicate manipulating control over the exchange rate to ensure enhanced profits from the arrangements

‘The unique and imprecise manner by which authority was delegated by the government to a private syndicate to control the foreign-exchange market would be unthinkable in modern time’

During this time it was also identified that the syndicate used moral suasion (more manipulation) to ensure other gold holders/investors did not withdraw further gold. They appealed to these investors by giving bonds at preferential terms they would adhere to the ‘ship no gold’ agreement. Articles at the time supported the Syndicate and the moral suasion such as the United States Investor revered the Syndicate for stopping the previous deflation

‘To those persons to criticize the bond syndicate for keeping the price of the exchange at such high figures, it is sufficient to say that had the Syndicate not intervened, the cost of paying debts cold be even greater than at present, because gold would be in transit instead of exchange.’

The Syndicate succeeded in reinvigorating faith in the US government and dollar and saw a period of prosperity follow, but it seems from this point the US Government owed the architects of the syndicate a favour. And it appears during this time the Syndicate learnt the economic benefits of precious metal manipulation.

The end of the agreement saw Europe liquidate some of these railway bonds, which we’re sure became the icing on JP Morgans Railway cake as he emerged in 1902 as the largest US railway owner, controlling 5,000 miles of US railroads.

JP Morgan and First Republic Bank today

We all know this more recent story of JP Morgans takeover of multiple banks – Bear Sterns, First Republic Bank with the government again leaning on the financial Behemoth to help save the US dollar. But just like in 1895 the favors and profits to be made are enhancing both the strength and influence of JP Morgan.

During the First Republic deal laws were broken and profits were made, putting JP Morgan in a stronger monopolistic position in US banking, just like the railways in 1902.

The US law that needed to be circumvented, as JPMorgan ‘is so big that by law it would not be allowed to buy First Republic because no one bank can have more than a 10 per cent market’

And the profit made by JP Morgan: ‘Recognize an upfront, one-time, post-tax gain of approximately $2.6 billion, which does not reflect the approximately $2.0 billion dollars of post-tax restructuring costs anticipated over the next 18 months’

History Repeats.

Finally just a little bit of 2023/1873 comparison

- 1998 tech boom leading to the 2000 collapse- with overinvestment and hype in a new technology – railway vs internet (Panic of 1873)

- 2008 Financial Crisis and deflation (Panic of 1895)

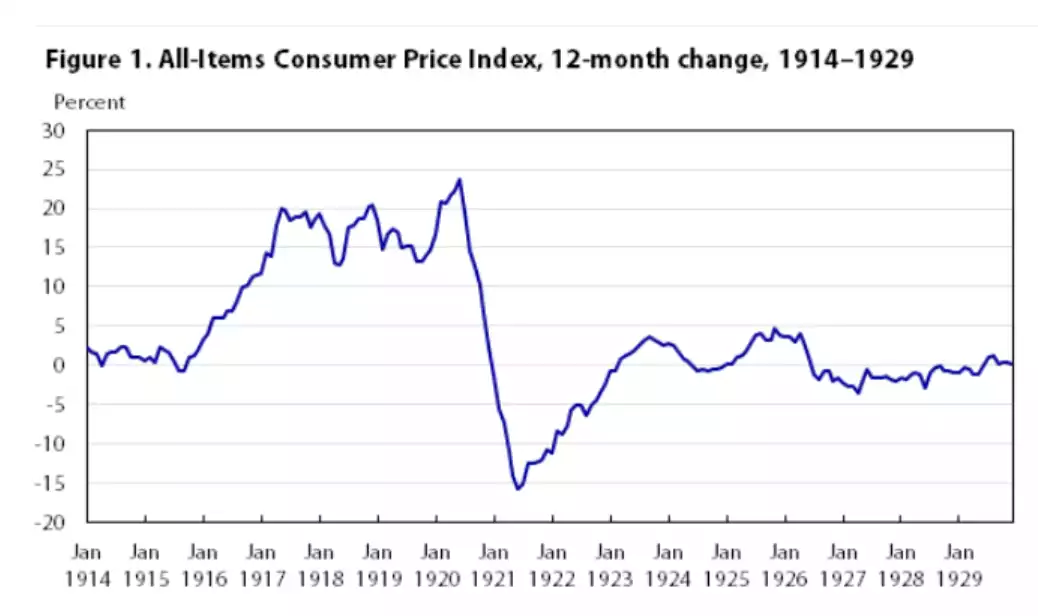

- And finally 2022 inflation, 14 years after the GFC, bought on by Covid, compared the 1917 during and proceeding World War 1. With inflation in 1920 hitting 25% and 1921 a sharp reversal -15% so will we see a similar pattern in 2024/2025?

History clearly tells us it may be a good time to start gold and silver stacking because if 2024 looks anything like 1921 we are in line for a deflationary shock…. Its sometimes hard to find historic context – but this comparison finally feels a little more compelling.