Hi Ho Silver !

News

|

Posted 12/12/2014

|

6360

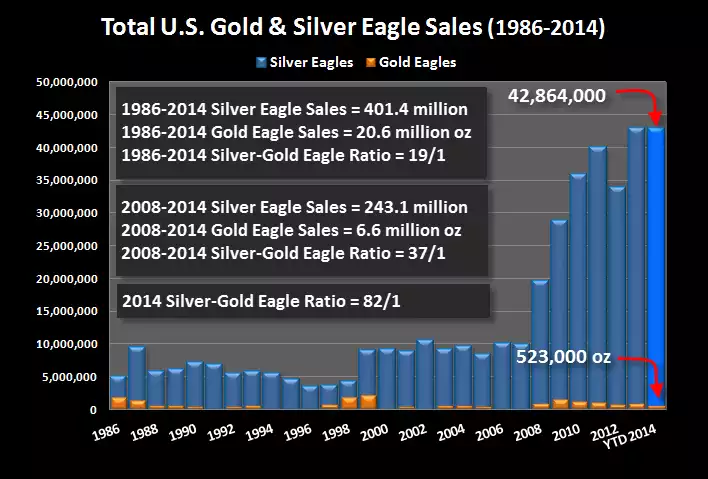

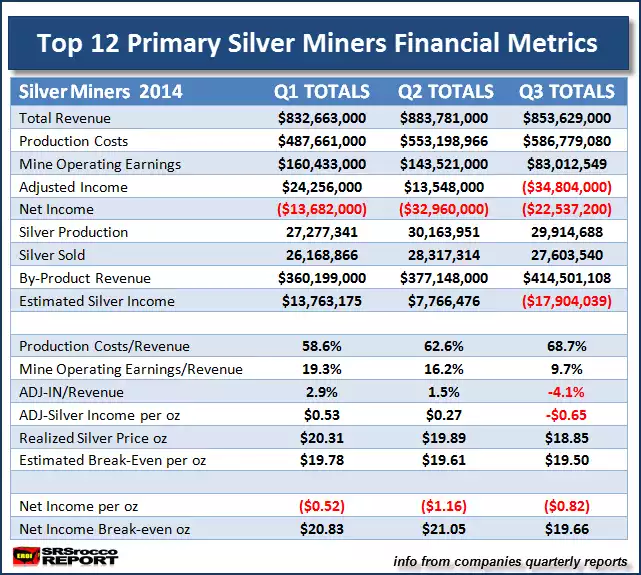

The 2 charts below are certainly interesting individually but amazing in combination. This week saw the 2013 record for the world’s biggest selling silver coin, the US Silver Eagle, surpassed with still 3 weeks to go. Over 43m of them have been sold this year (ignore the out of date 42.86m in the graph), and even that after a halt in sales in November as production couldn’t keep up. Also just have a look at how sales have exploded since ‘the penny dropped’ for many after the GFC that maybe it was a forewarning of what was to come. And as you look at not just the volume but it’s ratio to gold coins (in the context of the gold:silver ratio being c72), it is apparent that more are seeing silver as the pick of the two. So in a free market, with such incredible demand one always gets rising prices yeah? Well clearly not and not only that, as we sit at c$17/oz, prices remain well below the cost of production of the 12 top primary miners (2nd ‘chart’ below)! The COMEX dictated price on silver is certainly not “real”. What it may well be though, is the greatest opportunity to stock up on one of the most undervalued assets around. Not a fleeting spec IPO, but a metal that has stored wealth for 5000 years…