“Haven of Last Resort” – Goldman Sachs say go to gold

News

|

Posted 28/02/2020

|

28950

Last night was a bloodbath on Wall St with the market now officially in a correction (+10%) and the Dow Jones seeing its biggest single day point fall in history, down 1199 points or 4.42% in just one session. The speed of this correction too is extraordinary in that it got there in just 6 days from the all time high, the fastest pace since 1928 as the Great Depression was getting started.

In contrast gold was steady and silver came of a little with that pushing the GSR to an incredible 92.4 as we write. We shared a version of the following chart just 2 days ago (here) and you can see the extent of the falls of shares versus the safe havens of gold and US Treasury bonds.

Goldman Sachs have just released a report outlining why they see gold as the “Haven of Last Resort” and predicting US$1800 for the metal within 12 months (and silver to $19/oz). They point out however that it is not just Coronavirus driving gold but the rise in popularity of far far left Democrat candidate Bernie Sanders and the prospect of him being in the White House. As ludicrous as the land of the free and liberty electing a radical socialist sounds, we remind you of the groundswell of social revolt of the 90% against the 10% who have prospered during this central bank driven ‘everything bubble’ at their expense. Ironically it was this social revolt that got the far far right Trump elected in the first place. Whilst the odds of re-election are firmly in Trumps favour, so they were for Hillary….

Over to Goldman Sachs:

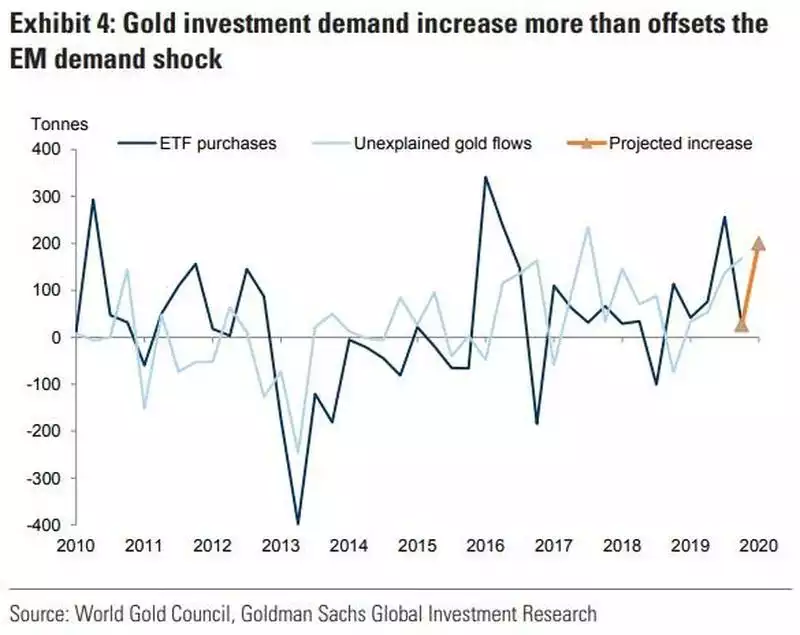

“1. This surge in ‘fear-driven’ investment demand has been significantly larger than the consumer demand lost owing to any negative wealth shock to EM consumers as a result of China’s shutdown.

We estimate that gold purchases fall 2.6% for every 1% hit to Chinese real GDP growth. Therefore, our Economists’ forecast of a 6% contraction in Chinese GDP in Q1 implies only a 28 tonnes loss in gold demand. Adding losses for other East-Asian countries implies a total loss of 40 tonnes. This is small relative to 130 tonnes of additional demand from gold ETFs since January 12. If it continues at this pace total ETF demand could reach 200 tonnes by end of Q1.

The actual increase in gold investments could be up to twice as large owing to non-transparent purchases. Therefore, for gold, the fear-effect from Covid-19 more than offsets any wealth shock as the result of quarantines.

While the number of new cases in China has been declining, Goldman warns that it is premature to say we are out of the woods yet. The Chinese economy is yet to materially restart and the effects on global supply chains are only now becoming visible.

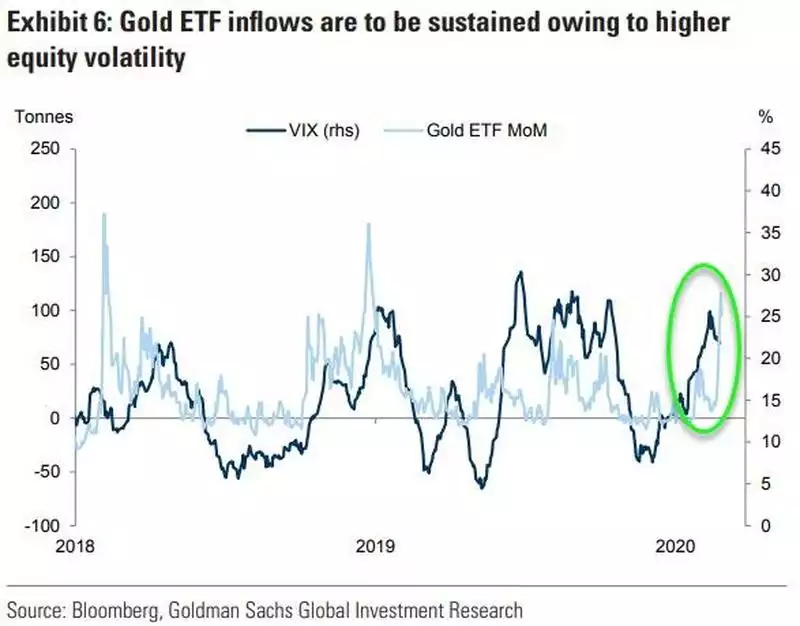

Our Strategy team sees risks of further equity downside which should keep volatility high and ETF inflows strong.

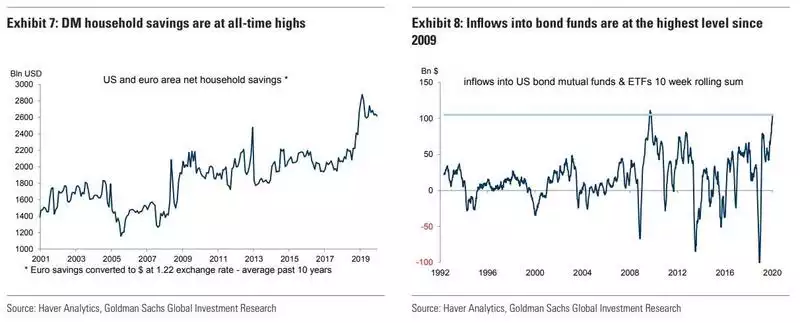

2. Investment demand for gold is further supported by the large global savings glut.

Household savings in developed markets are at historically high levels while global capex remains depressed creating a shortage of places to invest. Inflows into bond mutual funds and ETFs – a good proxy for retail demand of defensive assets – is at its highest level since 2009. At the same time, supply of government bonds globally is restricted owing to central bank purchases creating a deficit in high quality assets. This supports demand for alternative portfolio diversifiers such as gold.

We continue to believe that gold remains attractive relative to bonds. It has a greater capacity to increase during the next recession as bonds may be constrained by the lower bound on central bank rates. Gold is also a better hedge against the risk of inflation overshoots.

Additionally, gold’s share in investor portfolios remains at a very depressed level. The value of gold ETFs relative to the NAV of funds in North America and Europe indicates that the value of gold ETFs is only 0.3%-0.4% of the funds’ NAV and that we are materially below gold’s peak allocation of 2011-2012. As such we see scope for material rotation of investment funds into gold.

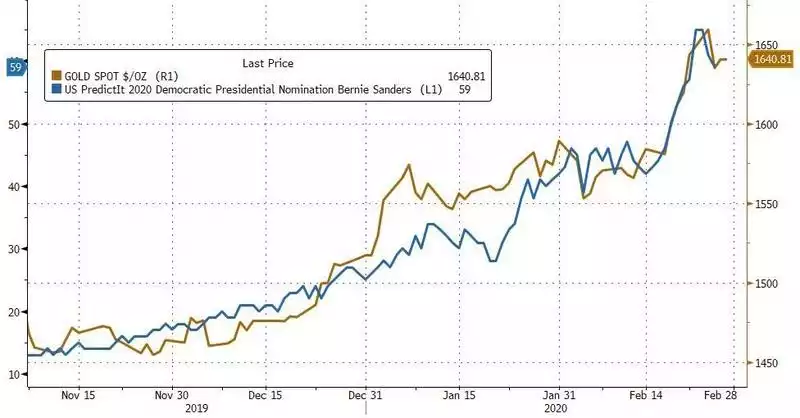

3. Finally, the increase in the probability of Bernie Sanders winning the Democratic nomination could further boost investment demand for gold.

Sanders' proposed tax hikes could pose risks to equities, and he has proposed a large increase in government spending.

The last time this happened in the US outside of a recession was during Regan’s stimulus in the 1980s. Gold rallied as market participants became concerned regarding increases in inflation.

Finally, the proposed wealth tax could incentivize high net worth individuals to buy physical gold bars and store them in a vault, where it is more difficult for governments to reach them.”

That however is all in USD. The other key factor for us is the Aussie Dollar and the downward pressure on it that has already seen AUD gold gains twice that of the USD spot price this year. If you read our news yesterday and watched ABC’s 7.30 report last night you understand the broader ramifications for what was already a weak Q4 for Australia now to play out in Q2. MacroBusiness’s David Llewellyn-Smith summaries this well:

“The global recession will be upon us in Q2 as the virus sweeps Europe and, probably, North America as well. There are going to be major corporate casualties. The credit markets are already freezing up because they do not know who is at risk. This will take down good firms as well as bad.

Central banks will do what they can. But how can they arrest a freeze based upon such an unknown foe? This is analogous with GFC counter-party risk for credit. If you can’t tell who is at risk of insolvency then everyone is. Liquidity only goes so far in such circumstances.

So, from here, and into Q2, commodity prices worldwide are going to crash. This alone is going to land a massive income shock on Australia. It will join the services crush emanating from the student and tourism blockade. These will drive Australia into recession.

But there are two other great risks lurking. How will Australian households respond to the unfolding global crisis? They will bunker and the housing market stall.

Worse, as the global shock arrives Downunder in Q2 and the domestic economy reels, so, in all likelihood, will the virus. The risk case is that just as our external economy falls apart, the domestic economy is forced to shut down through the winter to contain the virus.

That presents household debt as the major risk. What does a domestic shutdown do to house prices? Hard to say but nothing good! And given the external shock will very likely come with rising funding costs for our banks, a nasty feedback loop scenario presents itself in which asset prices begin to fall and real interest rates to rise just as stimulus can’t help owing to physically bunkered households.

This is still a risk case and it may not get so bad. The RBA will turn to QE to keep interest rates under control and we’ll see limited fiscal stimulus.

But we need not enter the darkest reaches of the COVID-19 Financial Crisis for it to be very bad indeed.”