Has The FTX Dust Settled?

News

|

Posted 22/11/2022

|

9576

As the dust settles following the FTX fallout, and with a few more weeks of data available, we can assess whether recent market weakness has shaken the confidence of Bitcoin holders. The market continues to consolidate this week, however, did trade down from the early-week high of $17,036, to close at $16,248, one of the lowest closing prices of the cycle.

Outflows from exchanges and into investor wallets of almost all sizes have been historical in scale, as BTC holders seek safety in self-custody. As a result, the 30-day net position change of all exchange balances has reached a new all-time high for outflows this week.

BTC is currently flowing out of exchanges at a rate of -172.7k per month, eclipsing the previous peak set following the June 2022 sell-off.

Total confirmed transactions have also seen an uptick over the last two weeks, reaching a multi-month high of 246k confirmed transactions per day. Out of this total, around 29.2% were related exchange withdrawal transfers (77.1k withdrawals), and 18.2% were exchange deposit transfers (48.1k deposits).

This burst of exchange-related activity pushes the dominance of exchange deposit or withdrawal transactions to 47.4% of the total, the highest level year-to-date. Historically, higher exchange dominance can be associated with bull markets (sustained trends), and high-volatility sell-off events (short-term spikes).

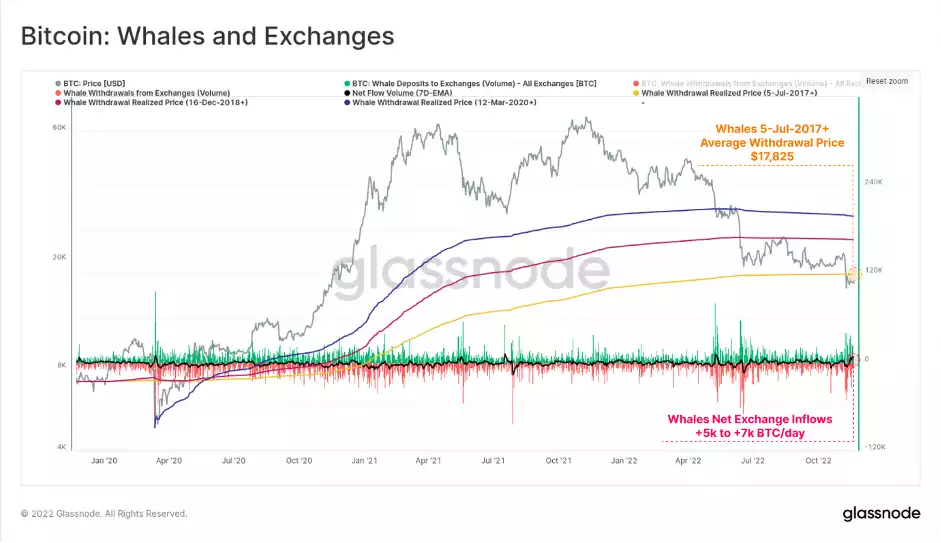

A driving factor of this may be the financial position of Whales (entities > 1k BTC). The yellow trace below shows the average withdrawal price of the Whale cohort since 5 Jul 2017.

With spot prices currently at $15.7k, this is the first time since March 2020 that this Whale cohort has been at an unrealised loss. In response, Whales have been depositing coins to exchanges, with an excess of between 5k and 7k BTC per day in net inflows over the past week…

This magnitude of financial pain is being expressed across the broader market, with one of the largest spikes in Realised Loss in the 2020-22 cycle. A peak daily value of -$1.45B in the realised loss was locked in this week, ranking as the fourth largest in history. Always remember, the bottom is found at times when the market experiences maximum financial pain. We’re close.

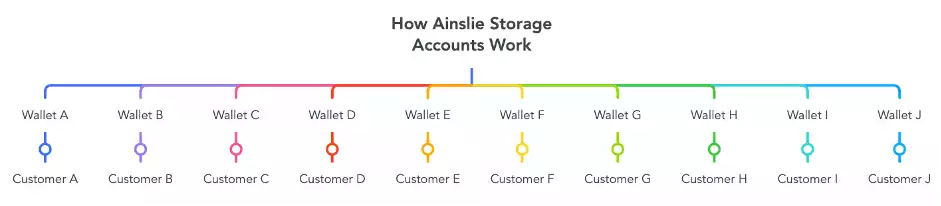

If you are joining the trend of crypto investors who are withdrawing their funds from opaque exchanges, consider an Ainslie Storage Account.

Ainslie is Australia's leading provider of custodial or fully managed cryptocurrency purchases and cold storage. We sell and cold-store cryptocurrency products, making us the ideal way to safely purchase crypto without the worry of knowing how to transfer and store it or your account being hacked or stolen.

Our Secure Custody service ensures your purchase is kept completely offline, while also giving you peace of mind that your purchase is kept away from your home. You can also add additional purchases to your cold storage with ease.

When you set up your Ainslie Storage Account, you get access to our Storage App Dashboard where you can view the current value of your bullion and crypto holdings. Additionally, you can see your transaction history and export a statement of holdings for your EOFY tax obligations.

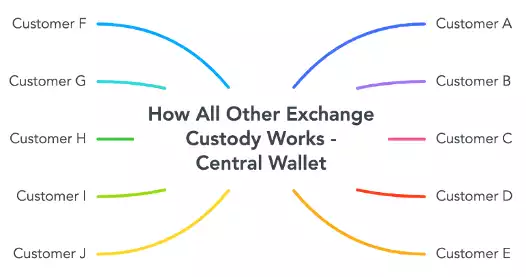

Most exchanges or other custody solutions use a central wallet for all customers' holdings. This also means that there is a central point of failure.