Hanging By a Thread. But...

News

|

Posted 20/09/2022

|

11335

This Ethereum upgrade or "Merge," as it's being referred to, changed how new crypto transactions take place on the blockchain.

Previously, the Ethereum blockchain, like the Bitcoin blockchain, ran on a proof-of-work model, which involves nodes — computers that are part of a large network — competing with one another to solve complicated math problems. The successful ones are then able to mine the next block of a transaction and create new coins.

The upgrade transitioned Ethereum to the proof-of-stake model, which is a more energy-efficient and environmentally-friendly system. It entails nodes being selected via an algorithm that has a preference for nodes that hold more of a network's currency.

In other words, their "stake" in the network is rewarded over the computer power that's rewarded in the proof-of-work system. The switching of the consensus mechanism from Proof-of-Work (PoW) to Proof-of-Stake (PoS), has been on the Ethereum roadmap, and actively worked on since genesis and is a remarkable milestone for the project.

If you hold ETH or any native ETH tokens (such as ERC20) you do not have to do anything.

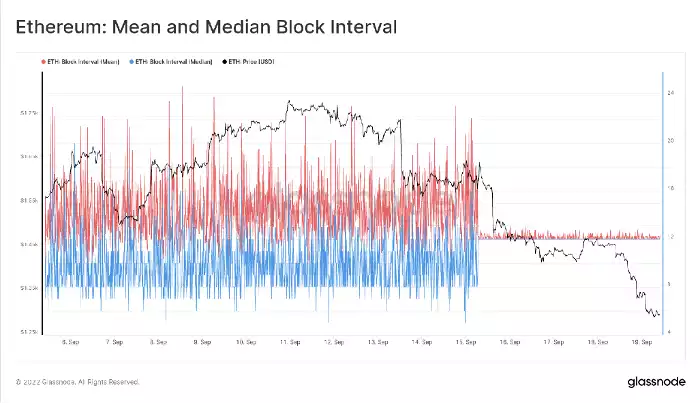

Arguably, there is no better chart to demonstrate just how dramatic this transition was than observing Ethereum Mean and Median block times. Here we can see the end of the probabilistic, and naturally variable PoW mining, and the switch to the engineered precision of PoS, sporting a consistent 12-second block time.

Whilst being a significant engineering achievement, markets positioned themselves for a “buy the rumour, sell the news” style event, which is exactly what happened. ETH prices have sold off, from a weekly high of US$1,777 to around $1,650 at the time of the Merge, before collapsing to a low of $1,288 yesterday. The market has effectively given back all gains made since mid-July. Such a sell-off is the result of multiple factors, not least of which is traders taking profits after ETH's recent out-performance. Being one of a small handful of assets that performed well during recent months in the prevailing macroeconomic conditions, it is quite unsurprising that profits were taken, where profits were available.

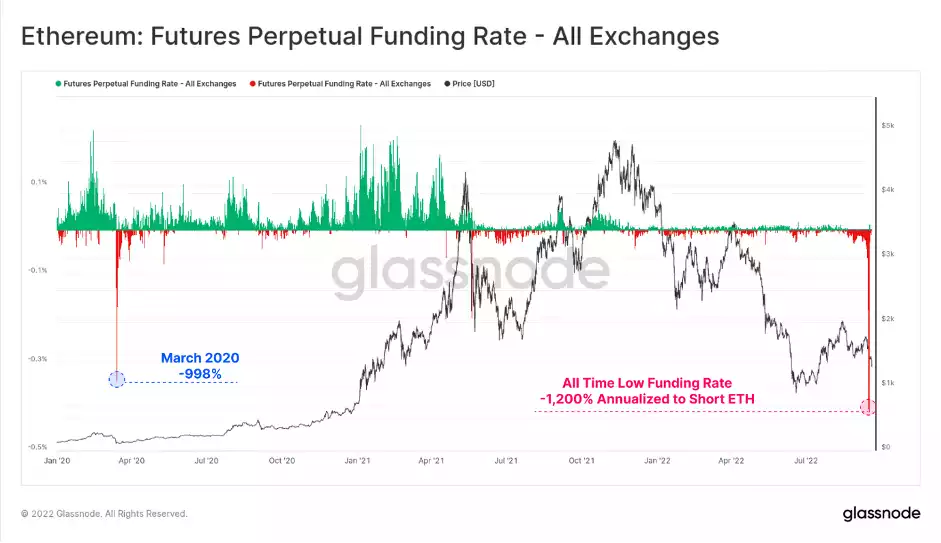

Right up until the Merge, traders in perpetual futures markets were paying an eye-watering 1,200% annualised funding rate to maintain their short ETH positions. This is a new all-time low negative funding rate, eclipsing the previous peak of -998% hit during the March 2020 sell-off.

Despite the localised weakness in the market, ETH bulls maintain that The Merge will lead to eventual long-term gains due to the supply-side dynamics changing in the network. One of the most talked about components of the Merge has been the dramatic decline in supply issuance, which when coupled with the EIP1559 burn, is expected to lead to a degree of ETH supply deflation.

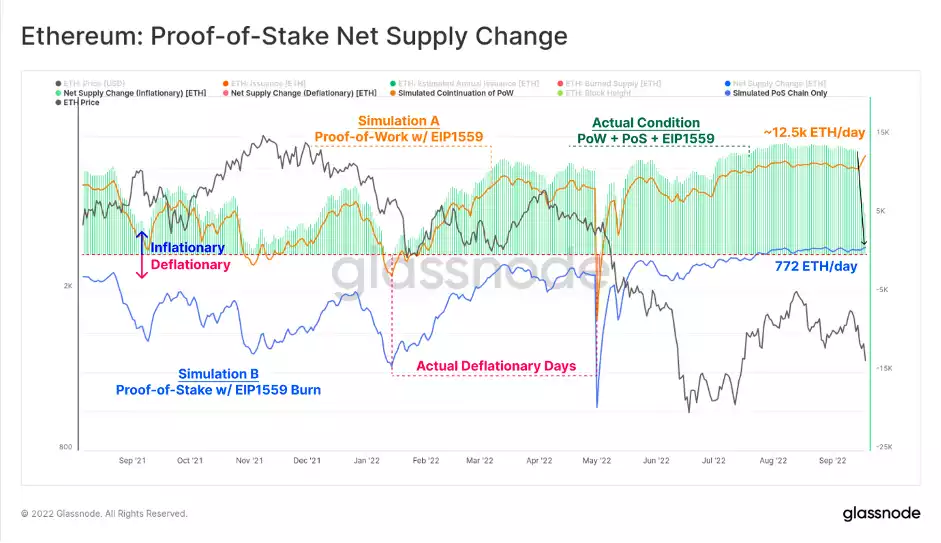

Since the Beacon Chain genesis on 1-Dec-2020, Ethereum has had two sources of net supply issuance, the PoW chain, and the PoS chain. In Aug-2021, EIP1559 was implemented, which created a fee burn feature on the PoW chain, a feature which has now moved to the PoS chain.

The chart below shows the net daily ETH issuance under various simulated, and actualised conditions. It attempts to model and visualise the daily net change in the ETH supply, in the time since EIP1559 was implemented.

It can be seen that the PoS model leads to a dramatically lower issuance rate of ~772 ETH/day, compared to 12.5k ETH for the PoW model. However, it is noted that net ETH issuance is, at present, still inflationary. This is primarily a result of extremely low blockchain congestion and low network utilisation.

The Ethereum Merge was a success, and a historic one to say the least. Many years of dedicated research, development, and strategy have now come together to achieve a remarkable engineering feat. However, with the USD wrecking ball still demolishing markets, crypto is hanging on by a thread at historically significant support zones. While crypto has not been able to dodge the carnage of 2022, the developments, innovations and upgrades in the space are a good sign of things to come!