Growing Wealth for the Next Generation: Why Precious Metals Beat Traditional Savings for Kids

News

|

Posted 08/05/2025

|

2738

When it comes to planning for a child’s future, the traditional advice has always been simple: open a bank account, make regular deposits, and hope the interest adds up over time. But in today’s world, with savings rates struggling to outpace inflation and banks offering little real growth, many parents and grandparents are looking for smarter, more tangible options.

That’s where precious metals like gold, silver, and platinum come in. And it’s why an increasing number of Australian families are choosing bullion over bank books for the next generation.

Why Precious Metals?

Precious metals have stood the test of time for centuries, weathering wars, recessions, inflation spikes, and market crashes. Unlike the digital numbers in a bank account, a gold or silver bar is a real, physical asset — one that can’t be devalued by printing more currency or eroded by low interest rates.

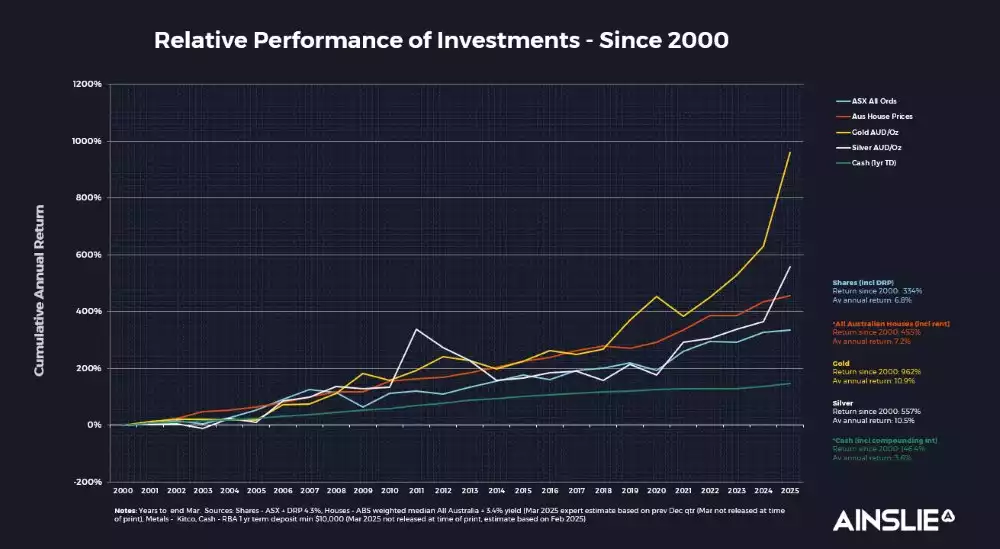

While traditional savings accounts offer interest rates as low as 1–2% (often below real inflation), gold alone has appreciated by almost 1000% since the turn of the century in 2000 (AUD). Silver and platinum, too, have delivered strong returns in certain cycles, especially when industrial demand and monetary policy line up.

For kids who have the luxury of time on their side, precious metals offer a powerful combination of long-term security, inflation protection, and the chance for substantial growth over the years.

The Future Benefits for Children

Imagine gifting a child a small gold bar or a few ounces of silver every birthday or milestone, assets that could significantly appreciate by the time they turn 18 or 21. Instead of facing the usual rollercoaster of stock markets or relying on the minimal returns from traditional bank products, they’ll hold physical wealth that has historically outpaced many mainstream investments.

Some of the future benefits include:

- A hedge against inflation: Precious metals tend to rise as the cost of living increases.

- Financial literacy: Children learn early the value of tangible assets and real wealth preservation.

- Global liquidity: When the time comes, gold and silver can be easily sold anywhere in the world.

- A potential launchpad: Whether it’s to help fund higher education, a first home, or even start a business, bullion investments can provide real, meaningful support when they need it most.

How Bullion Dealers Can Help

At a trusted bullion dealer, investing for a child’s future doesn’t have to be complicated. Whether you start with a few silver coins, a fractional gold bar, or a tailored precious metals savings plan, there are options to suit every budget.

Plus, with flexible storage solutions and transparent pricing, you can build a precious metals portfolio in their name (or as part of a family trust), ensuring the investment is safe, secure, and ready for when they need it most.

Secure Their Future with Something Real

Savings accounts can be a nice start. But for parents and grandparents serious about leaving a lasting legacy, precious metals offer something far more powerful: real assets that grow with them.

Because when it comes to a child’s future, “safe” shouldn’t mean “stagnant.” It should mean strong, lasting, and real.

Talk to us today about setting up a precious metals investment for your child — and give them a future built on strength.

Watch the insights video inspired by this article here: https://www.youtube.com/watch?v=QqziIA-fcU4