Grantham Calls “Epic Finale” to this Superbubble – Crescat Agrees

News

|

Posted 01/09/2022

|

12184

Another turbulent night last night as Euro inflation rocketed higher than expected and US employment figures continued to weaken and confirm recessionary fears. High inflation, low growth stagflation continues unabated. Today we present 2 separate salient warnings for investors from 2 very respected sources.

First there are few more respected Wall Street stalwarts than Jeremy Grantham. At 83 years he has seen every market imaginable and learned the lessons along the way. This is the conclusion of his latest investor update:

“Prepare for an Epic Finale

Previous superbubbles saw a much worse subsequent economic outlook if they combined multiple asset classes: housing and stocks, as in Japan in 1989 or globally in 2006; or if they combined an inflation surge and rate shock with a stock bubble, as in 1973 in the U.S. and elsewhere. The current superbubble features the most dangerous mix of these factors in modern times: all three major asset classes – housing, stocks, and bonds – were critically historically overvalued at the end of last year. Now we are seeing an inflation surge and rate shock as in the early 1970s as well. And to make matters worse, we have a commodity and energy surge (as painfully seen in 1972 and in 2007) and these commodity shocks have always cast a long growth-suppressing shadow.

Given all these negative factors, it is unsurprising that consumer and business confidence measures are testing historic lows. And in the tech sector, the leading edge of the U.S. (and global) economy, hiring is slowing, layoffs are rising, and CEOs are increasingly bracing for recession. Recently, we have seen a bear market rally. It has so far played out exactly in line with its three historical precedents, the bear market rallies that marked the middle phase of deflating superbubbles. If the bear market has already ended, the parallels with the three other U.S. superbubbles – so far so strangely in line – would be completely broken. This is always possible.

Each cycle is different, and each government response is unpredictable. But these few epic events seem to act according to their very own rules, in their own play, which has apparently just paused between the third and final act.

If history repeats, the play will once again be a Tragedy. We must hope this time for a minor one.”

Crescat continue to perform at the head of the pack in their investment funds. They lay out their thesis of persistent inflation, strong commodity growth but a plunge in equities. We laid out some of their argument earlier this week and complete their analysis below courtesy of author Tavi Costa’s twitter summary.

“Maybe it is just a coincidence, but 774 CEOs have left their roles this year in the US alone. That is the highest number in 20 years!

What do these high-profile executives know that investors don’t?

There have been significant changes in labor market indicators recently.

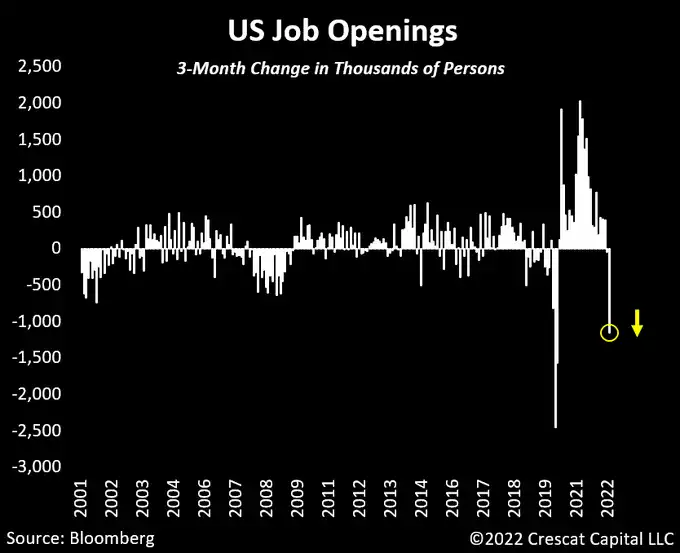

Job opening just had their largest 3-month decline in the history of the data, excluding the initial shock of the pandemic.

This is probably just the beginning [last nights print confirmed this is getting worse]

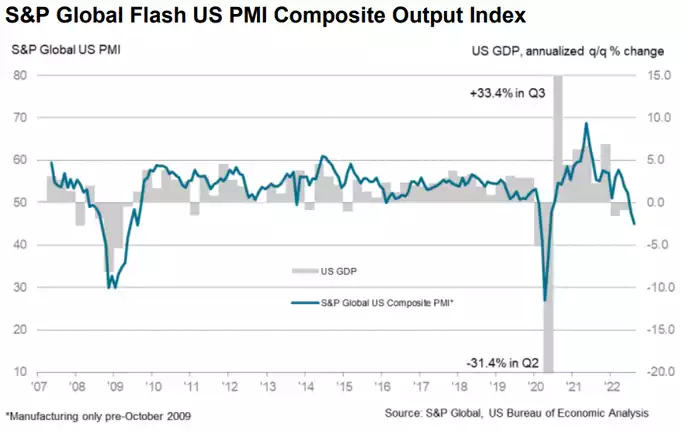

Fed tightening with PMIs already at levels only seen in the Global Financial Crisis is just one more nail in the coffin for the economy.

Another interesting data:

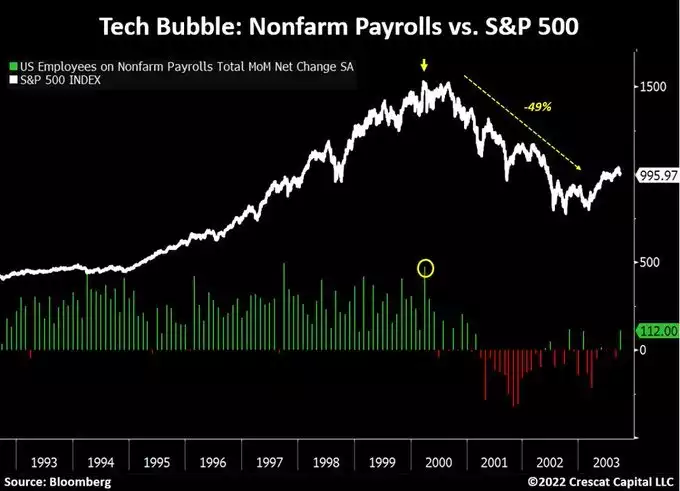

Nonfarm payrolls recently surprised the markets with a surge of 528,000.

Despite what seems to be very positive news, here is a reminder that nonfarm payrolls also surged by almost 500,000 right at the peak of the tech bubble in March 2000.

In contrast to what most investors believe:

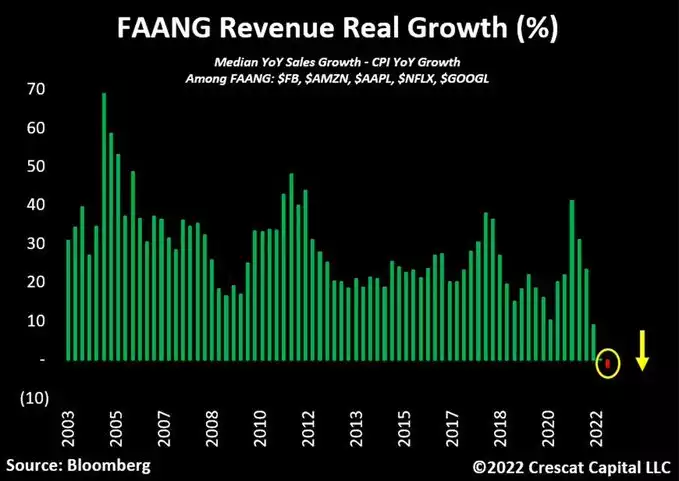

The “FAANG” stocks are starting to show serious signs of weakness in their fundamentals.

The median real revenue growth for these companies has officially turned negative for the 1st time in almost 2 decades.

"Growth" stocks, really?

After years of attracting investment flows from capital markets on the back of incredibly successful business models, these stocks are deteriorating fundamentally, and most investors are not even paying attention.

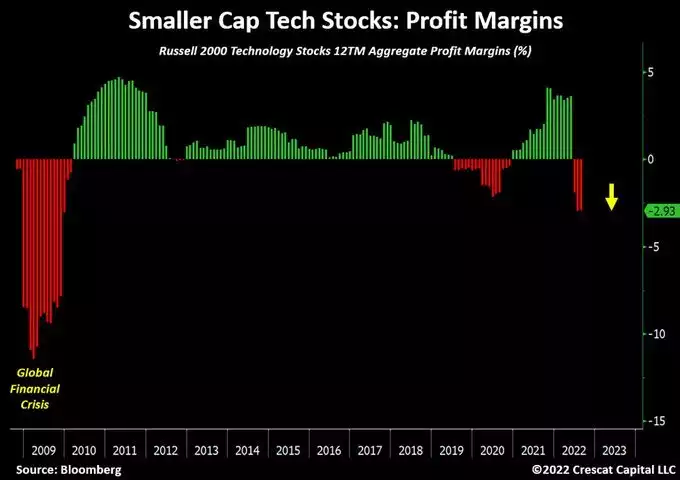

Aggregate profit margins for the Russell 2000 Technology index members are now at their lowest level since the Global Financial Crisis.

Let's not forget:

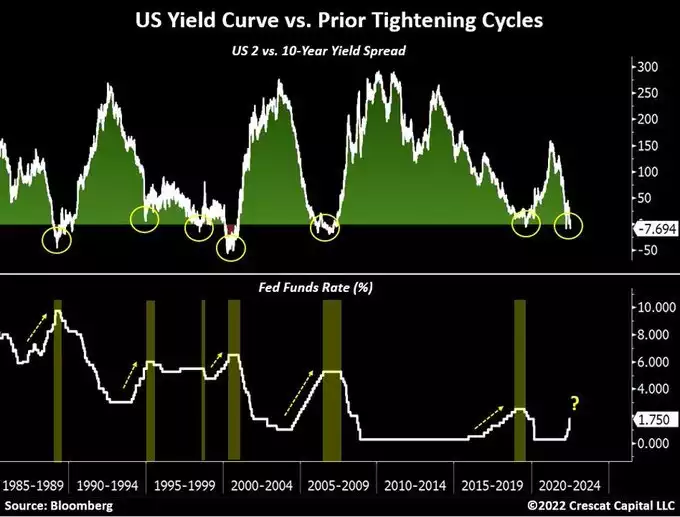

In the last 30+ years, every time the yield curve inverted, the Fed was forced to end its tightening cycle as the economy was heading into a recession.

Over time, the sharp reversal of these policies, i.e., subsequent easing cycles, are what have fueled the excesses we see in financial asset valuations today.

For every economic downturn we have had since the late 1980s, government and Fed support became progressively larger.

Such policy behavior is only achievable in a macroeconomic environment where inflation is not a long-term problem.

In the inflationary late 1960s to early 1980s, in contrast, central banks were much more limited in their ability to deploy liquidity measures during recessions.

We think we are entering a similar macro setting today.

This potential lack of liquidity is yet to be reflected in the prices of risky assets, which remain near historic high levels.

Nonetheless, despite the steep inversion in the US yield curve, we think the Fed will be forced to remain hawkish for longer.

In our strong view:

The tightening of financial conditions in a fragile economy should be detrimental to equity markets.”

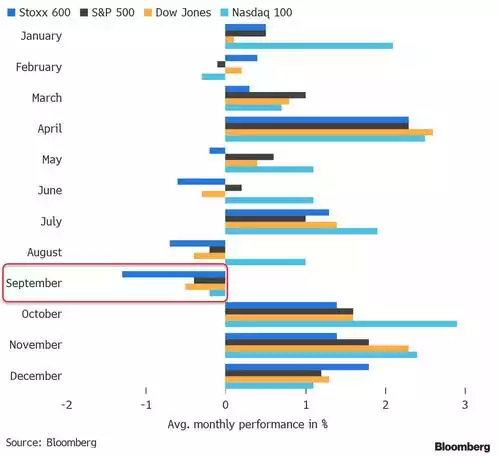

If reading this on the day of publishing you will note it is the 1st of September. It is worth noting that September has been the weakest month on US and Euro sharemarkets for the past 30 years posting a negative average performance.

But its probably different this time yeah?..... :/

This afternoon’s Gold & Silver Standard Insights interview and analysis with our Chris Tipper should be very interesting as he is clearly on record with an opposing view that the Fed will capitulate sooner than such views assume.

For gold and silver investors you likely have an each way bet. If Grantham and Crescat are right we would ordinarily see money flow to precious metals as a safe haven and early play on the Fed and government stimulus flooding back to revive the patient. If Chris is right, the pivot would be the ultimate loss of faith in the Fed, the fuel to more inflation not yet dealt with, and gold and silver benefiting from the gross currency debasement, inflation hedge play.

If you missed it, we’ve had a huge response to yesterday’s SMSF article (a must read) and the interview with Cass Smith late yesterday on Gold & Silver Standard Insights. You can watch it here.

************************************************************************************

GOT A QUESTION about today's news?

This afternoon, the Gold & Silver Standard Insights team will be breaking down the news and answering YOUR questions.

Submit your question to [email protected] and SUBSCRIBE to the YouTube Channel to be notified when the GSS Insights video is live.

**********************************************************************************