Governments "Spending Like Drunken Sailors" - Jamie Dimon

News

|

Posted 14/09/2023

|

2202

Small Businesses Struggling

According to NFIB, small business optimism has just lowered 0.6 of one point during August. That marks the 20th month in a row that it has been stuck under the 49-year average. It appears that inflation is still seen as one of the biggest problems that they are facing.

28% blamed lower sales and 24% blamed a rise in costs. We are told that inflation is no longer a problem but these two factors reveal that it's still a major factor for these small businesses. When they are spending more to get the same products, it's difficult to raise prices to depleted consumers who are already shopping less.

Jamie Dimon Gives a Reality Check

Jamie Dimon of JP Morgan has just reminded investors that as inflation falls, so too does compensation. He also stated that "to say the consumer is strong today, meaning you are going to have a booming environment for years, is a huge mistake." He also blamed governments for "spending like drunken sailors."

Most businesses might feel okay now based on their current numbers, but everything could change in the next 12-18 months, Dimon said. "If and when you have a recession, which you're eventually going to have, you'll have a real normal credit cycle." This sounds like Dimon is stating that we are definitely going to have a recession which will lead to corrections in the world of investing.

US Dollar Flashes a Bad Signal

The US Dollar Index has just broken a major resistance level in the last 6 days. As discussed previously, this is typically a bad sign for risk markets. As people sell off investments, this creates a spike in the demand for dollars. It is also indicative of the current credit situation, which is proving extremely difficult for average spenders. As access to easy credit tightens up, less money can be created and the overall money supply shrinks, thus increasing the value of each dollar still in circulation.

Flight to Safety

If the head of the world’s biggest bank, JP Morgan's Jamie Dimon, is correct, things for small businesses are about to go from bad, to worse. There could be a potential flight to safety in the coming months out of risk markets and into safe havens, such as assets which will hold their value. A broken credit cycle can easily lead investors into hunting short-term gains by, for example, helping pump up tech companies which run at losses. This is reset once the liquidity level lowers and, as Warren Buffet famously stated, "When the tide goes out, you find out who is swimming naked."

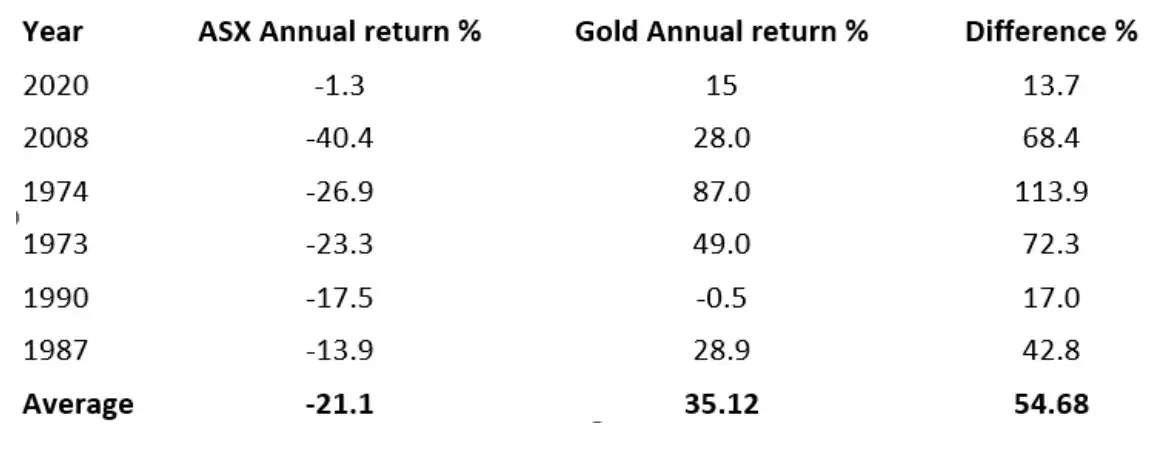

As a reminder, here is how that played out in the 6 worst years in the last half century in Australia…