Goldman Sachs Raise Gold & Silver Forecast for “the currency of last resort”

News

|

Posted 29/07/2020

|

15342

Despite gold hitting an all-time high yesterday, the world’s pre-eminent investment bank, Goldman Sachs, has just again upped their price forecast for both gold and silver “the currency of last resort”, stating "with more downside expected in US real interest rates we are once again reiterating our long gold recommendation from March and are raising our 12-month gold and silver price forecasts to $2300/oz and $30/oz respectively from $2000/oz and $22/oz."

Since that correction for gold in March it is up 33% even after the inevitable ‘over bought’ correction yesterday after hitting an all-time high of $1960 and even breaching $2000 on futures. Silver’s low in March appeared to be a secular bottom from its $50 high in 2011 and it has rallied an incredible 105% from that $11.94, again even after the big correction yesterday. Few things rally like silver has without a big correction and so yesterday wasn’t a huge surprise for many.

Whilst gold hit an all-time high in nominal terms, in real, inflation adjusted terms, it is still below the 1980 highs and looks to have plenty to run even without a breakout of this pennant.

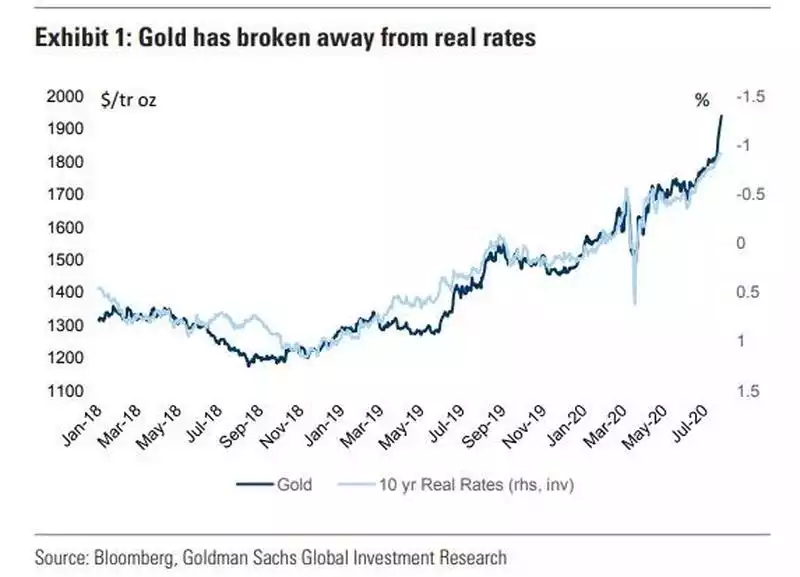

Gold has largely tracked the inverted 10 year Treasury real rates (yield less inflation) which are now firmly in negative territory as you can see below. Negative real rates mean you are literally going backwards in real terms with your yield of a 10 year US debt note:

As you can see, since this latest rally, that is disconnecting somewhat and Goldman’s believe this "is being driven by a potential shift in the US Fed towards an inflationary bias against a backdrop of rising geopolitical tensions, elevated US domestic political and social uncertainty, and a growing second wave of covid-19 related infections."

That this is all occurring in lockstep with quickly growing debt at already record levels, the weaponisation of the dollar and the growing strength of the Euro after the ground breaking deal reached last week leads Goldmans to proffer "real concerns around the longevity of the US dollar as a reserve currency have started to emerge." Whilst that is a big statement it is not a new one for them, noting they have "long maintained gold is the currency of last resort, particularly in an environment like the current one where governments are debasing their fiat currencies and pushing real interest rates to all-time lows, with the US 10-year TIPs at -92bp is 5bp below the 2012 lows,"

Part of the reason for so many being so bullish on gold and silver right now is the bet each way they present. Whether you believe we are heading straight for inflation or first deflation the fundamentals for both on precious metals are bullish, as the response to both is further debasement of currencies. As Goldman’s explain:

“The deflationary shock caused by the pandemic drives the need to expand balance sheets to support demand today, as seen in the latest US $1.0 trillion Phase 4 stimulus and the €750 billion pan-EU recovery fund. The resulting expanded balance sheets and vast money creation spurs debasement fears which, in turn, create a greater likelihood that at some time in the future, after economic activity has normalized, there will be incentives for central banks and governments to allow inflation to drift higher to reduce the accumulated debt burden.”

And from the point of view of the large asset manager’s:

“When discussing the drivers of investment demand for gold and commodities, it is important to distinguish between debasement and inflation. The key is that the current debasement and debt accumulation sows the seeds for future inflationary risks despite inflationary risks remaining low today. While debasement in many cases leads to inflation, it is not always the case as witnessed over the past decade. Equally, the best debasement hedge (gold) is not always the best hedge against inflation (oil). Indeed, the word debasement comes from adding base metals like tin or copper to the precious metals that acted as hard currency; therefore, owning the pure precious metal is then the best hedge against debasement.”

Speaking to how long this plays out, particularly relevant when gold hits an all-time high, their answer is clear and sensible:

“We see this trend persisting for some time as investment allocations into gold increase inline with allocations to inflation protected assets, similar to what happened after the financial crisis. Following the GFC, inflation fears peaked only at the end of 2011 as the bounce back in inflation ran out of steam, bringing the gold bull market to a halt. Similarly, we see inflationary concerns continuing to rise well into the economic recovery, sustaining hedging inflows into gold ETFs alongside the structural weakening of the dollar, we see gold being used as a dollar hedge by fund managers.”

Speaking specifically to silver and in the context that over half of silver demand is industrial, they expect the price to be “pulled upward by higher gold prices and better prospects for silver industrial demand, particularly in solar energy (c.15% of silver demand). Both the European Green Deal and Biden’s war on climate change plans imply a doubling every year of solar panel capacity installations in both the US and Europe. At the same time, silver demand in consumer electronics is benefiting from the transition to working from home as it is heavily used in consumer items such laptops, mobile phones and televisions. Even housing demand, where silver is used in light switches, looks to be better than expected with property sales in both US and China rebounding strongly. Silver has rallied almost 30% over the past few weeks but its ratio with gold is only back to its level at the beginning of this year of 80."