Goldlocks or Goldishocks? – Here comes Stagflation

News

|

Posted 19/03/2024

|

1789

Last night saw another surge in oil prices as Chinese demand looks set to increase and attacks on Russian oil refineries (together with the Red Sea attacks) threatens the supply side of the equation. That saw oil hit a 4 month high and adds yet more weight to inflation resurgence fears. Combined with reports of the Bank of Japan about to announce their first tightening move since the GFC saw U.S. Treasuries sold off further and odds of a U.S. rate cut drop even further. Despite the rising USD, gold strengthened. Why?

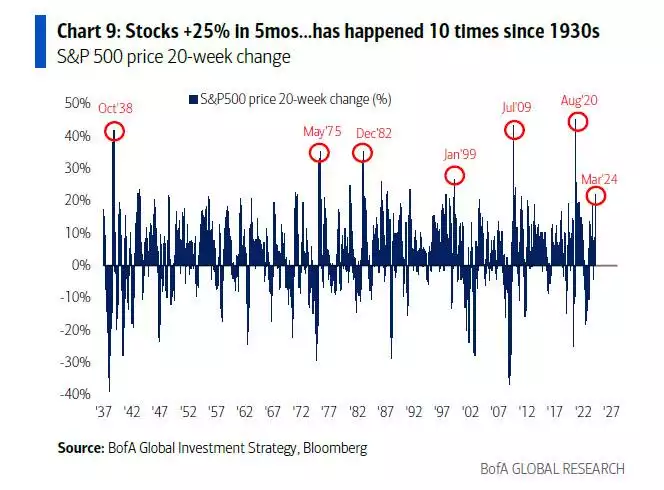

Bank of America’s Chief Investment Officer Michael Hartnett is watching this all play out with no small amount of concern. Off the back of yet another tech driven surge in the S&P500 last night he points out the recent performance of the world’s largest share index, a 25% surge in only 5 months, has only happened in extreme events such as recession lows (as in 1938, 1975, 1982, 2009, 2020) or at the start of bubbles such as what many see this Magnificent 7 lead rally:

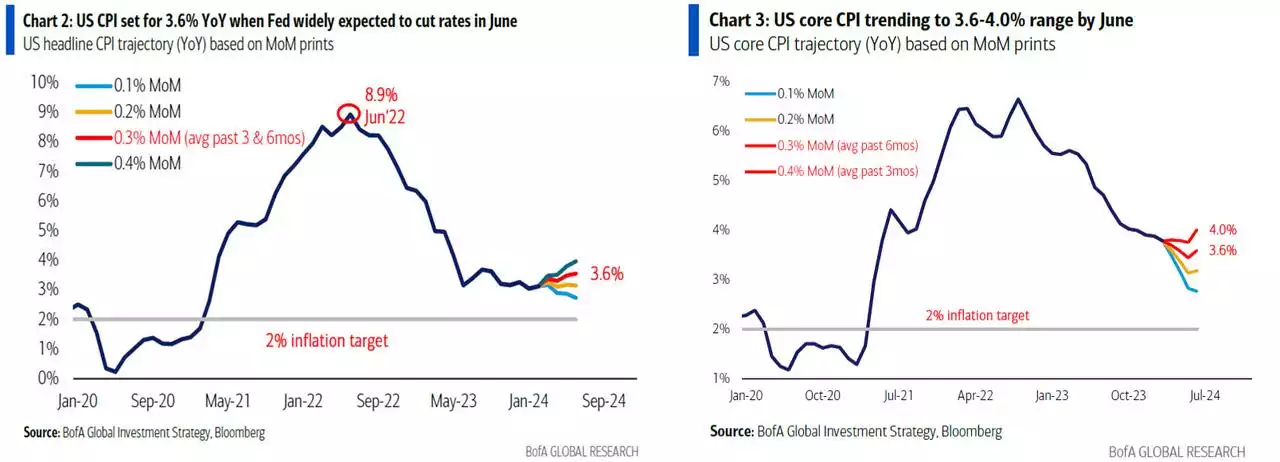

Hartnett points out that the pin that often pops a bubble is rising inflation, and as we discussed last week, he believes there are real signs that it may be about to reverse its disinflationary course before the Fed is ready.

Indeed Hartnett believes the Fed has quietly softened its stance on a 2% target. With a U.S. government debt of $34.5trillion and no means of paying it off, inflating it away becomes the only viable option. That of course though sees a weaker USD and in Hartnett’s own words "why crypto & gold at all-time highs."

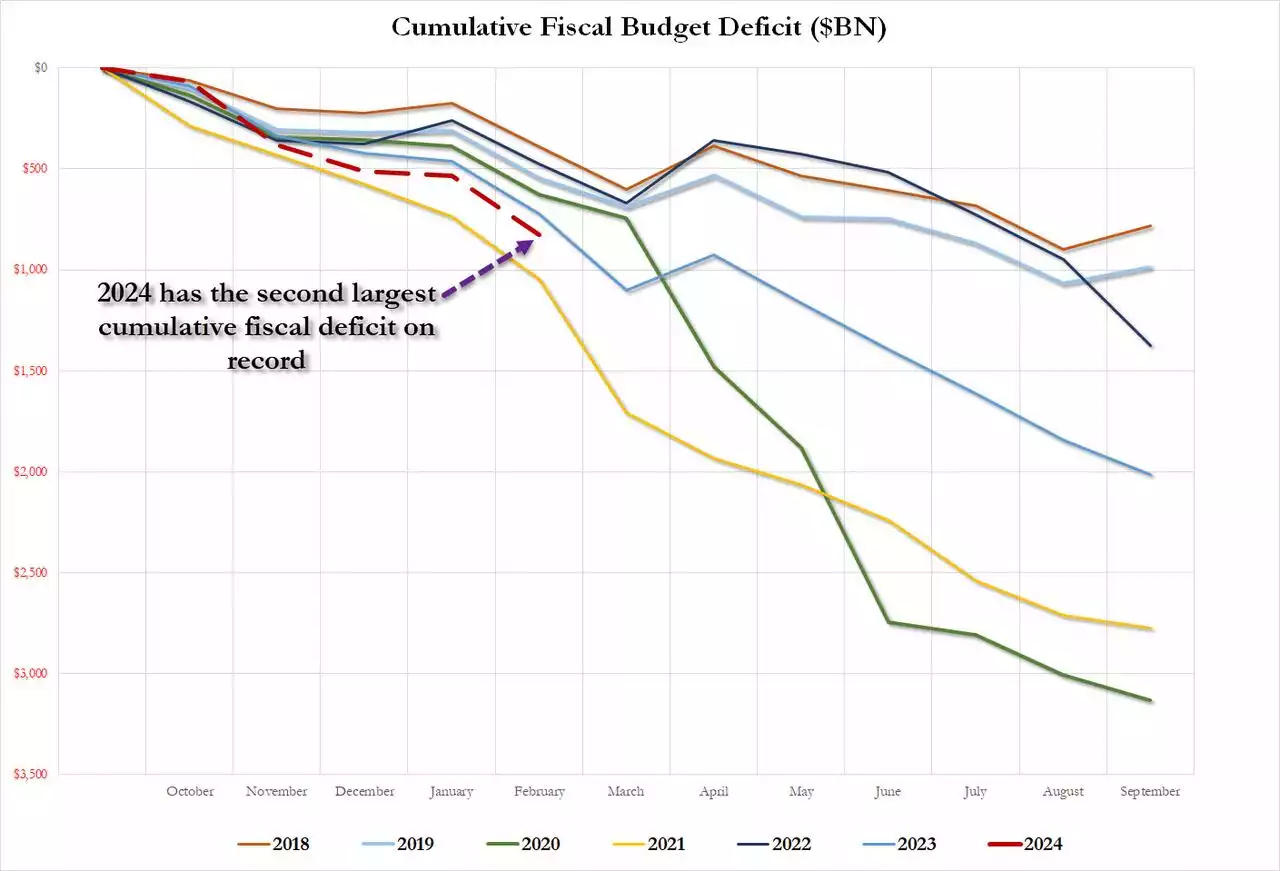

He points out that the U.S. government is doing nothing to ease that pressure, indeed its deficit funded fiscal spending is on track to be the second highest on record, with only the eye watering COVID recession response being bigger. Annualised, that equates to a whopping $2 trillion..

As we saw last night yet again, U.S. treasury yields are climbing as bonds are sold off. Seeing Treasury yields breaking through 4.5%, Hartnett says we are moving from the much wished for Goldilocks soft landing scenario with 3% growth and 2% inflation, to what he calls a ‘Goldishocks’ scenario of stagflation with sub 2% growth (which he thinks is deliberately inflated to help Biden get back in) and 3-4% inflation.

So what does this stagflationary ‘Goldishocks’ scenario mean for asset prices?

“a new bout of stagflation means outperformance of gold, commodities, crypto, cash, a big steepening of the yield curve, and a very contrarian equity barbell of resources & defensives.”

That combo of monetary asset and commodity strength is particularly bullish for silver.