“Golden Week” Presents Golden Opportunity

News

|

Posted 30/09/2019

|

7601

The gold price has had a rough week, coming off over US$1530/oz to now just under US$1500 despite the clear pressures of the REPO market and the Fed’s POMO response, a Fed rate cut, further trade tensions and the threat of Trump being impeached.

Just as we learn that China imported 79.73 tonne of gold in August alone (on top of keeping all that they mine) history tells us we shouldn’t be too surprised at the gold price action as we see China enter their week long holiday, topically called ‘Golden Week’, starting tomorrow.

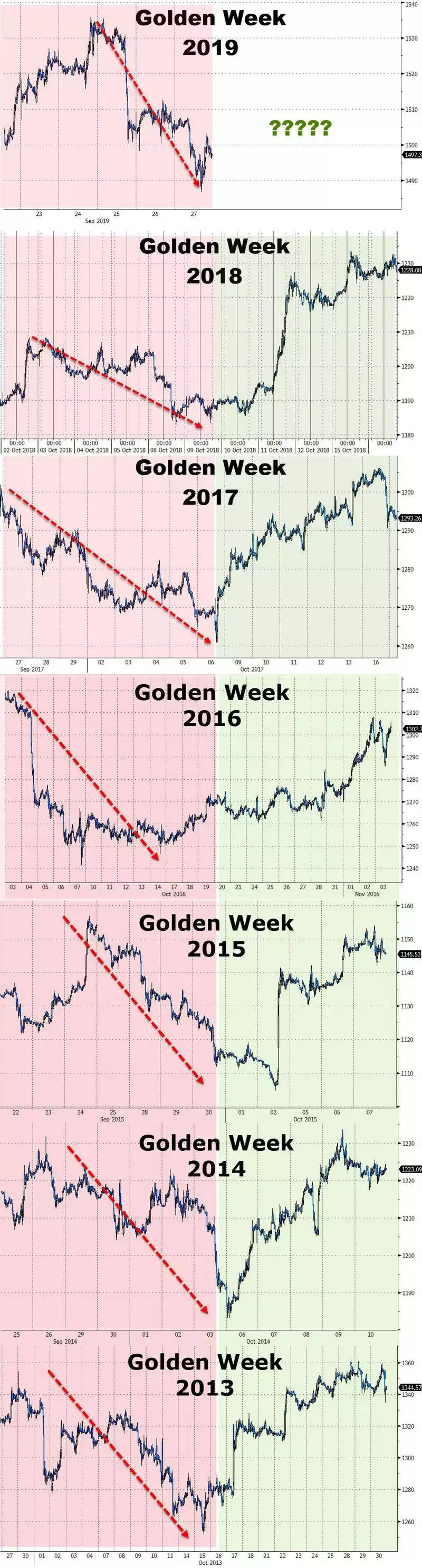

Whilst history is not an accurate predictor of future events, as they say, it often rhymes, and the charts below tell a rhyme of now being a great time to buy.

Whilst simplistically it looks like the world’s biggest customer has a week long nap, some commentators also point out that it also means the Shanghai Gold Exchange, the largest physical competitor to the ‘shenanigans’ on COMEX, is closed too….