Gold v US Treasuries – Heralding a Change of Guard for Global Safety

News

|

Posted 09/10/2023

|

2283

In Aussie dollars, gold jumped nearly $50 on market open this morning off the back of the escalating war in Gaza. The USD also jumped but didn’t hold gold back as the go-to safe haven. This however isn’t the only break of traditional correlations as gold increasingly stamps its authority as the one global safe asset.

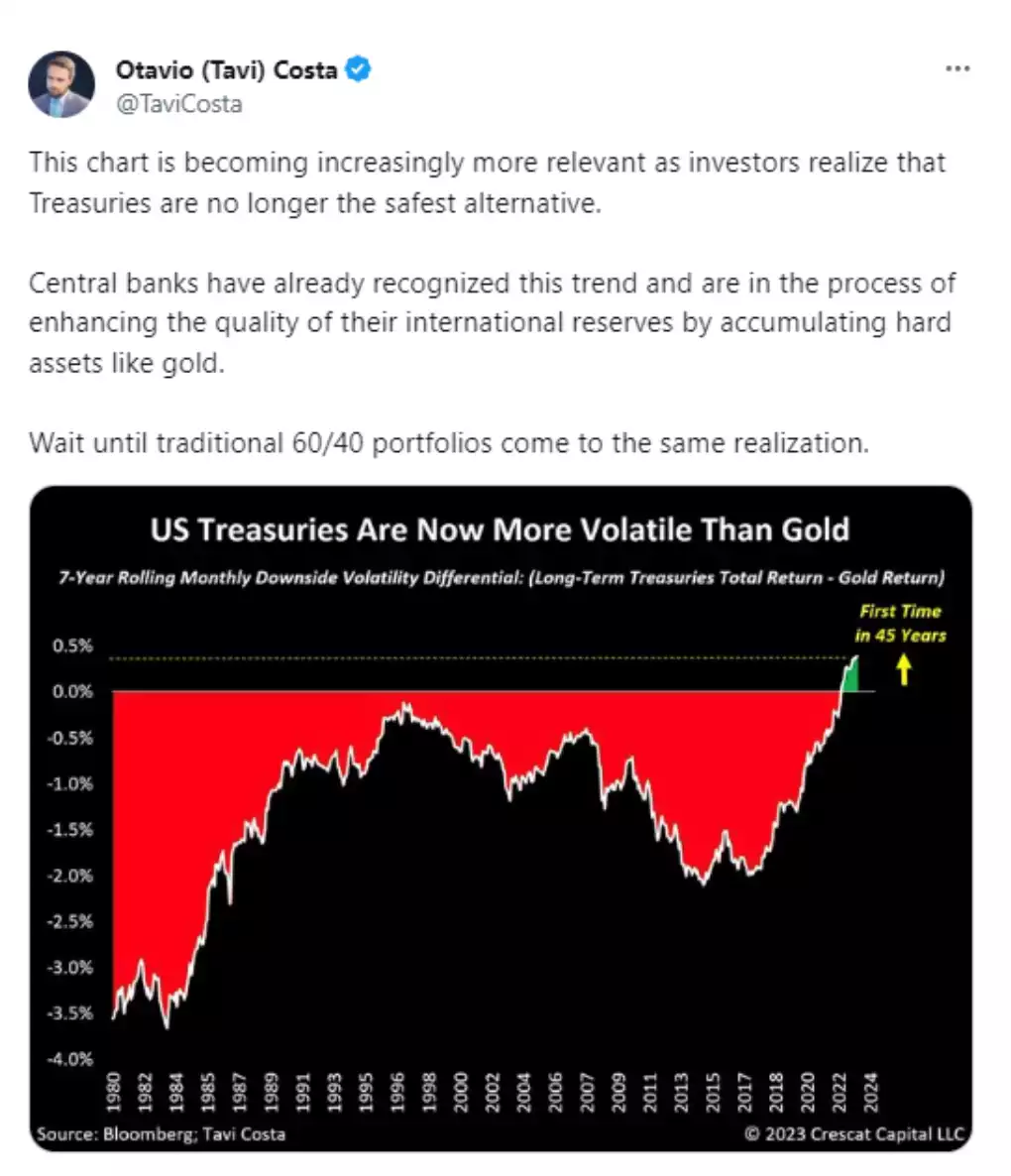

We have written at length about the increasingly volatile and ‘less safe’ US Treasuries. US Treasuries were once the benchmark of ‘risk free asset’ but are increasingly NOT as its issuer, the US Government, continues to recklessly abuse the power entrusted in it as the world’s reserve currency issuer. As we all know, the US has produced over half the US dollars ever created in just the last few years. It is debasement of a Zimbabwean or Venezuelan order and the US Treasuries underpin it all. That same dollar has been unilaterally weaponised against enemy states to the point where the BRICS bloc increases talking of an alternative and the Saudi’s, custodians of the petro dollar pact providing a safe base to that reserve status, have joined that very same group and are trading oil for gold.

In short, the US has to issue unprecedented amounts of bonds to pay for its deficits at the same time the world has alarmingly scaled back its purchases of them. Supply and demand fundamentals has seen US Treasury prices both generally falling but also becoming volatile. And so we get the following observation from Crescat Capital’s Tavi Costa:

A key theme of recent years is the rapacious accumulation of gold by central banks as we have reported numerous times. Topically on that disconnect between bonds and shares, he earlier tweeted about bonds v NASDAQ….

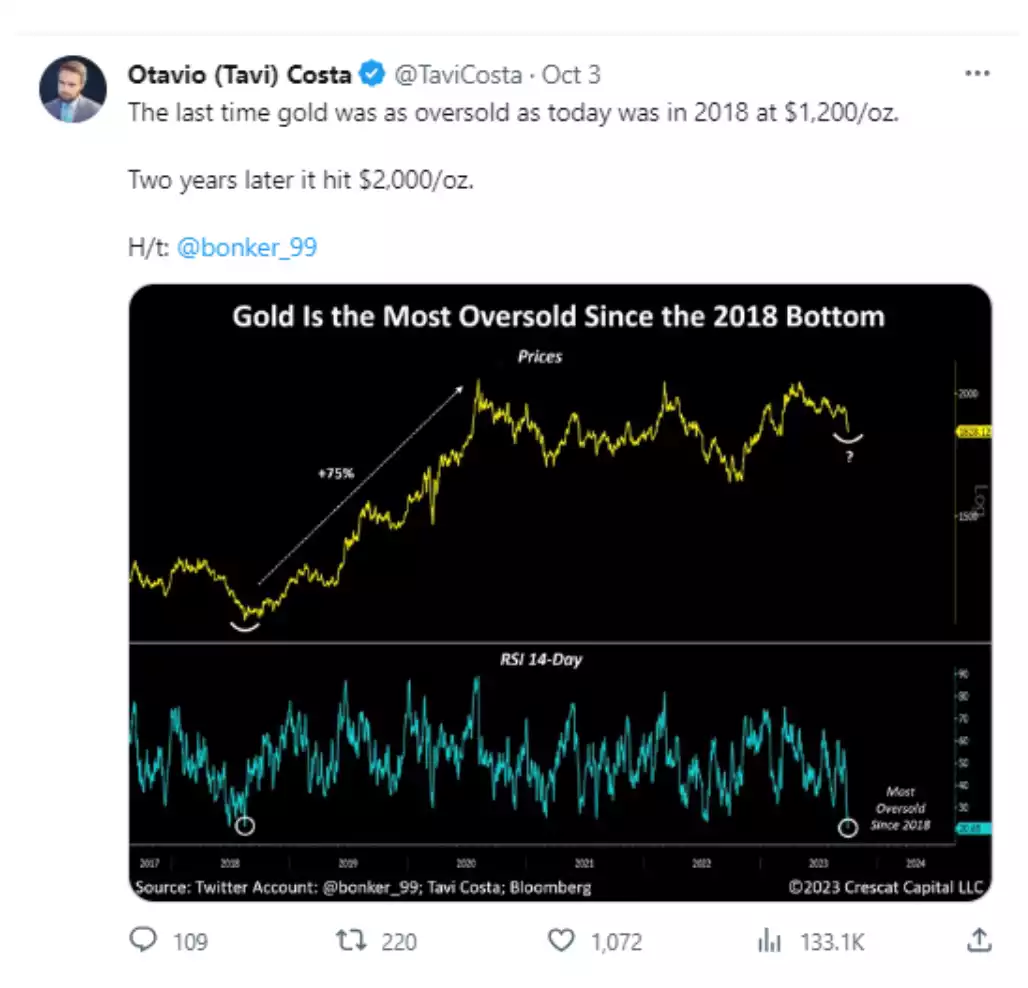

What has some confused is why gold is relatively languishing given the macro back drop. This is largely because those higher yields (off lower bond prices) are traditionally a head wind for gold which does not yield. However, with bond yields around 5% you would ordinarily expect gold much lower than it is now. It is being incredibly resilient in the face of those high yields because people are reading the play on WHY the yields are high and what will inevitably follow. The following highlights just how oversold gold still is though and what happened last time…

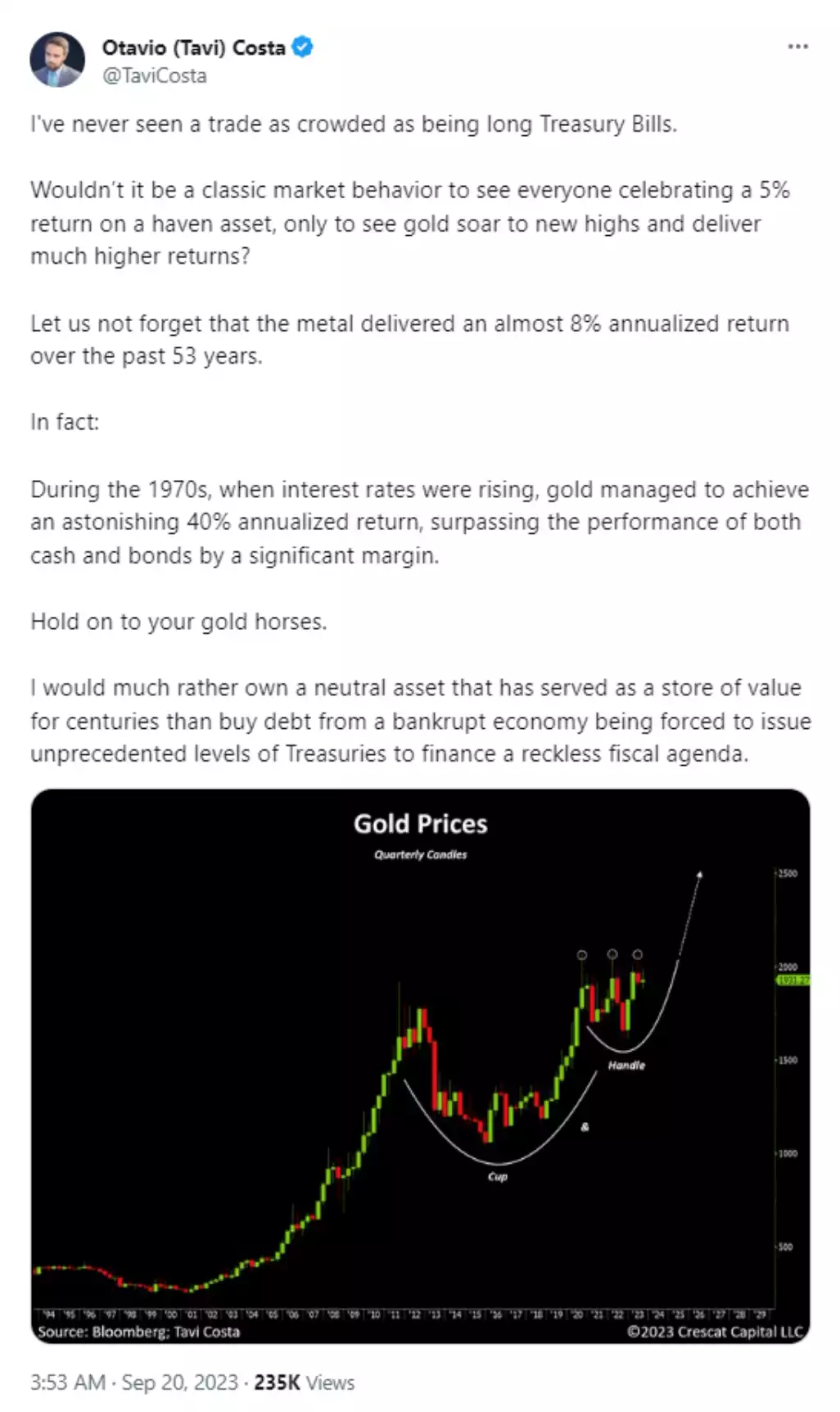

And so, to bring all that together, we will let Mr Costa summarise beautifully:

Mic drop.