Gold v Inflation & Strong USD – The end game

News

|

Posted 08/04/2020

|

29007

On the back of a dramatically worsening US economy the US government is set to unleash another $1 trillion of stimulus directly into the patient. That saw gold rise strongly before coming off a little last night. The USD fell on the news and also came off again last night along with pretty much every asset including shares. However these are short term gyrations on an ever evolving crisis and financial markets torn between stimulus and reality. From a macro sense it is hard to ignore the longer term effects of both, and they are both pointing to stronger gold.

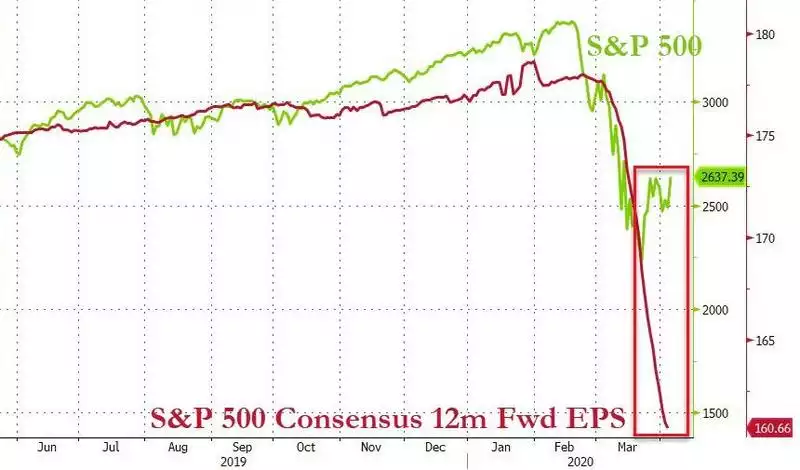

On shares, and remembering the massive price support corporate buybacks gave US shares amid tepid fundamentals in recent years and the reality of said tepid (and now catastrophic) fundamentals on earnings, Bloomberg economist Michael Regan noted:

“Forget all that for a moment. Instead, as the equity market rips higher to leave the S&P 500 down less than 20% from its last record, just ponder the potential for this: A 50% drop in buybacks and a 25% decline in dividends in 2020. (Those are Goldman’s forecasts, and due to the abundance of uncertainty, I’d view them as perhaps only slightly better than spitball estimates -- but that’s about the best anyone can do at the moment. Would greater reductions be much of a surprise? We won’t even mention their estimates for a 33% decline in EPS.)

Hate to be the Eeyore on a beautiful spring day when the market is ripping higher. But just ask yourself: Is this bear market really over?”

On the USD there is no doubt an extremely bullish case for short term gains. Consider the world has an unprecedented $260 trillion of debt and a large portion of that is denominated in USD at a time where that debt needs to be paid down, therefore needing USD to do so. The scramble for USD has put huge strains on liquidity seeing the Fed step in and the price rise. But this is a reserve fiat currency being debased like never before in history. Legendary Raoul Pal of Real Vision maps the dilemma:

“Less available dollars, in a world of a massive dollar shortage, drives up the dollar creating a shortage both home and abroad. Money printing does not make the dollars available. They get stuck in the financial system and hoarded.

Money for the banks, no money for the debtors...

The domestic shortage of dollars means that money gets hoarded while defaults rise. And the shortage abroad means that $13tn of debt scrambles for the available dollars as world growth slows and banks are less free with capital.

Don't forget - the $13tn short dollar positions (foreign dollar debt held mainly by foreign corporation and investment vehicles) is the largest position ever taken in the history of global financial markets.

It can only mean a massive, uncontrolled dollar rally.

QE will not fix this. Swap lines will not fix this. A debt jubilee would fix this or multiple trillions of dollars in write-downs and defaults.

It is the dollar strength that brings to world to its nadir (just like the 1930s). It is the dollar system that is the really big problem.

The dollar has eaten all of its competitors and now it is going to eat itself.

This eventually breaks the dollar after a super-spike as global central banks are forced to find alternatives.”

Pal hints at it and yesterday we were reminded too that in desperate times you may just choose to default on that debt. Argentina did exactly that on $10b of its USD denominated debt.

For now that rampantly printed USD is not seeing anything like inflation. It is happening at a time when things are so bad, disinflation must rule. As Bloomberg noted yesterday:

“The sinking global economy is suffering through a colossal disinflationary shock that could briefly push it into dangerous deflation territory for the first time in decades.

With many national economies all but shutting down in an effort to contain the coronavirus, prices on everything from oil and copper to hotel rooms and restaurant take-out are tumbling.

“A powerful disinflationary tide is now rising,” said Joseph Lupton, global economist at JPMorgan Chase & Co.

That’s worrying because it could lengthen what may be the deepest recession since the Great Depression. Ebbing pricing power makes it harder for companies that piled on debt in the good times to meet their obligations. This could prompt them to make additional cuts in payrolls and investment or even default on their debts and go bankrupt.

While weak or falling prices may seem like an unalloyed good for consumers, a widespread deflationary price decline can be deleterious for the whole economy. Households hold off buying in anticipation of ever lower prices, and companies postpone investments because they see limited profit opportunities.”

Of course at some stage the tide turns but there is no way of simply pretending all that money wasn’t printed.

““What will then happen as the lock down gets lifted and recovery ensues, following a period of massive fiscal and monetary expansion?” London School of Economics Emeritus Professor Charles Goodhart and Talking Heads Macroeconomics founder Manoj Pradhan wrote for VOX on March 27. “The answer, as in the aftermath of wars, will be a surge in inflation, quite likely more than 5% and even in the order of 10% in 2021.”

And so for gold and other hard, supply constrained assets like silver and Bitcoin the stage is set. Gold thrives in times of disinflation amid economic crises as a safe haven, and in high inflationary periods as an historic hedge against that debasement of fiat money in its role as real money. Both scenarios currently see negative real interest rates. Official interest rates are near zero and inflation, even incredibly week inflation, takes that into negative territory.

Should we see the eventual collapse of the USD as the reserve currency and a move to the much touted international currency alternative like the SDR, gold then potentially has an official monetary role again as well.

Raoul Pal has been very bullish on the USD for some time now and has profited strongly in that macro call. So what is his ideal portfolio now?

25% Bitcoin

25% gold

25% cash [USD]

25% trading opportunities

On a final note, we remind you that everything is relative as there are 2 sides to any ‘price’. The USD index is the USD against other major fiat currencies. So when you have a view that the USD will fall, in traditional speak, you are effectively saying you think the Euro (by far the other major currency in the index) is strong. Really? Look at the mess that Europe is in. The Yen. Really?

However look at the USD priced against gold and you get a very different, very instructive picture on where this ends.