“Gold: the most effective commodity investment”

News

|

Posted 27/08/2021

|

11885

“Gold: the most effective commodity investment”

Listen to the news and under ‘commodities’ you’ll hear oil, gold and maybe copper quoted. Many take issue with this as a commodity is more often thought of as something that is ‘used’ whereas gold’s industrial use is now miniscule and its asset leading stock to flow ratio is based on exactly that. The World Gold Council just published an interesting research paper titled “Gold: the most effective commodity investment - 2021 Edition” addressing exactly this.

They conclude as follows:

“A commodity is defined as an economic good, which is valued and useful and has little or no difference in composition or quality regardless of the place of production. While gold fits this definition, its market dynamics and the diversity of its application make it very different from other commodities.

This difference is underlined by gold’s robust performance profile in terms of returns, volatility, and correlation. Taken together, these characteristics produce a more diversified portfolio than one with a simple, broad-based commodities exposure.

Looking at other commodities, some can be considered luxury goods, some have technological applications, and some are basic, everyday products. Some are used to hedge against inflation, some protect against currency devaluation, and all provide a degree of diversification in an investment portfolio. However, only gold performs all these functions.

Indices such as the S&P GSCI or the Bloomberg Commodity Index are widely used by investors as benchmarks for their commodity allocations. While gold’s weight in these indices is increasing, it remains too low. More importantly, we find that under these conditions, an investor who only holds gold via a diversified commodities index will not achieve optimal returns (per unit of risk) or minimise expected losses.

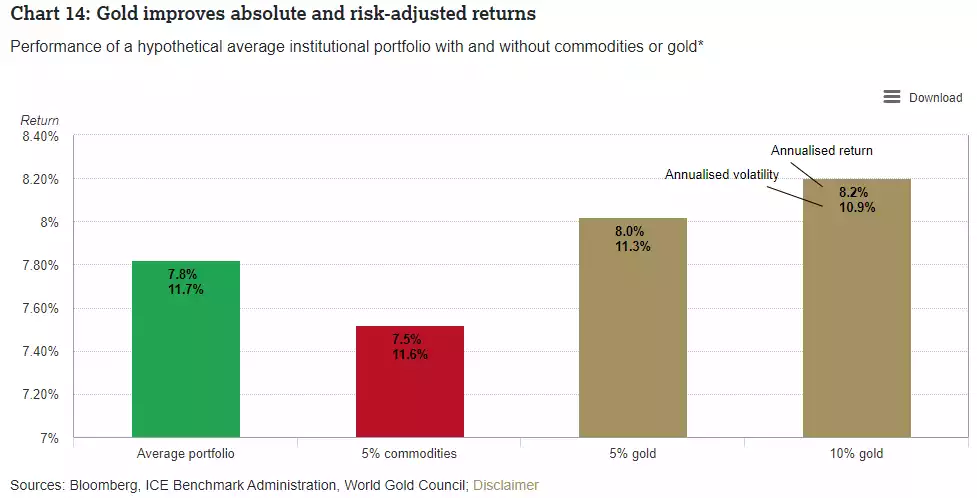

Implementing an outright or supplemental position to gold reduces risk without diminishing long-term expected returns. In particular, strategic allocations ranging from 2% to 10% can significantly improve and protect the performance of an investment portfolio, while providing the exposure desired by the commodities investment itself.”

They break it down to 6 characteristics:

“Our analysis suggests that gold is still the most effective commodity investment in a portfolio as it continues to stand apart from the commodities complex. It deserves to be seen as a differentiated asset as it has historically benefited from six key characteristics:

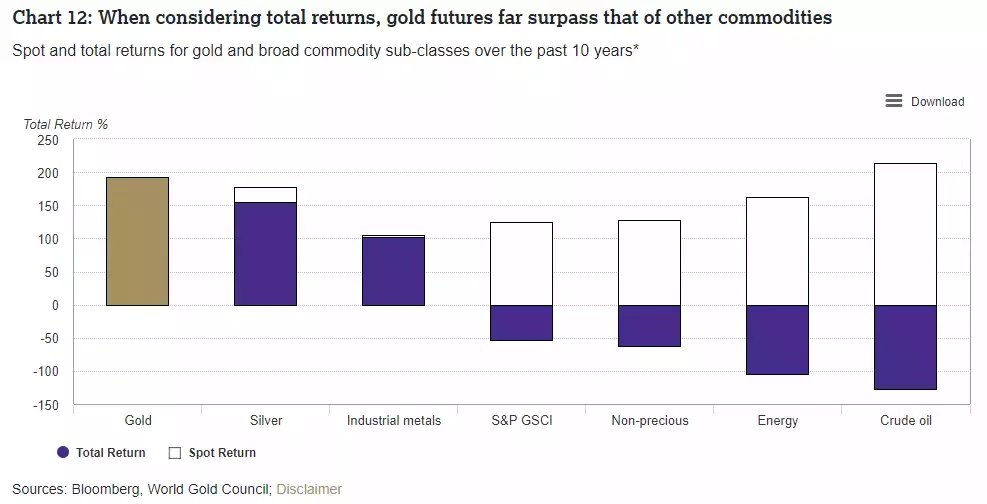

- It has delivered superior absolute and risk-adjusted returns to other commodities over multiple time horizons

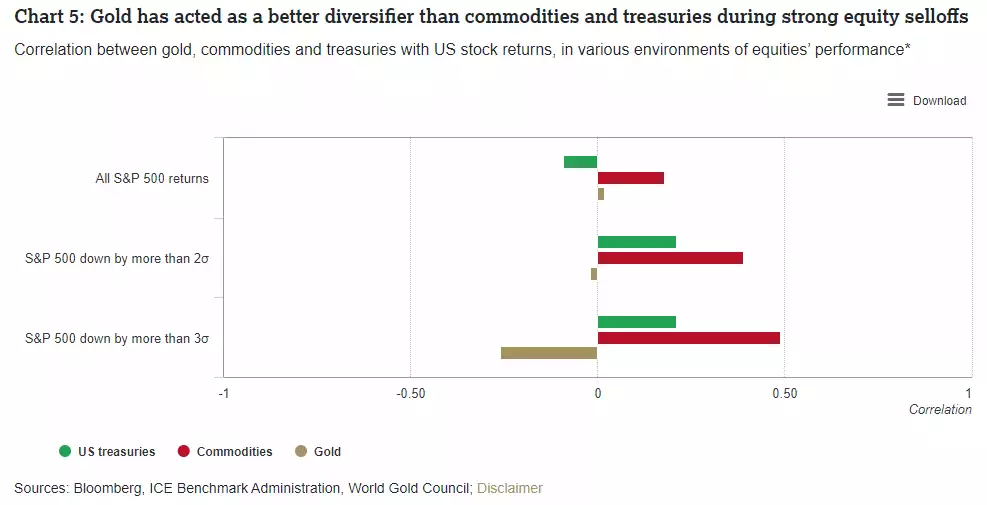

- It is a more effective diversifier than other commodities

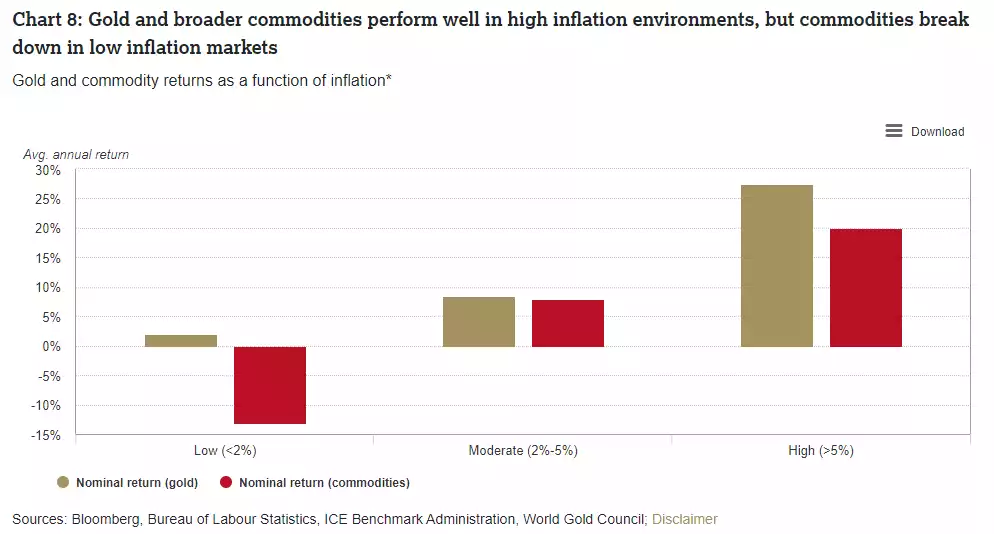

- It outperforms commodities in low inflation periods

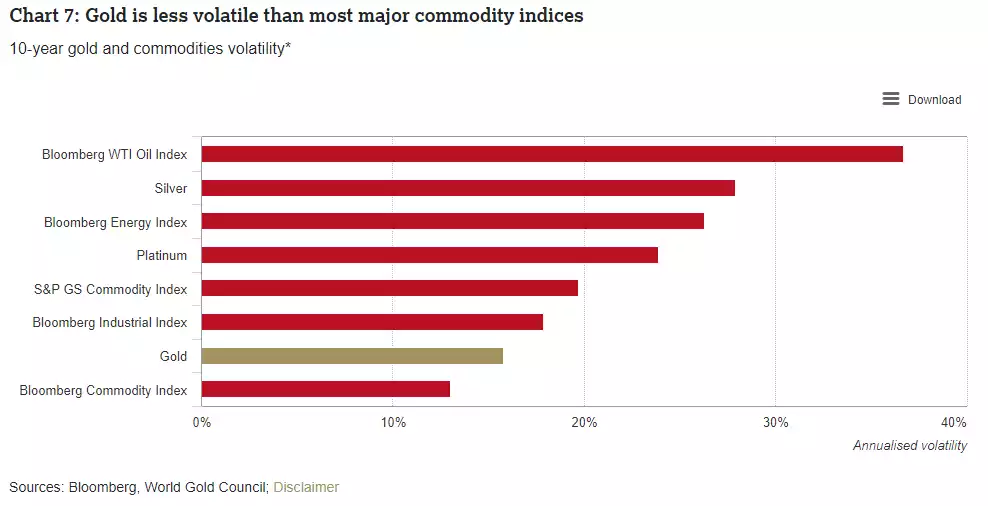

- It has lower volatility

- It is a proven store of value

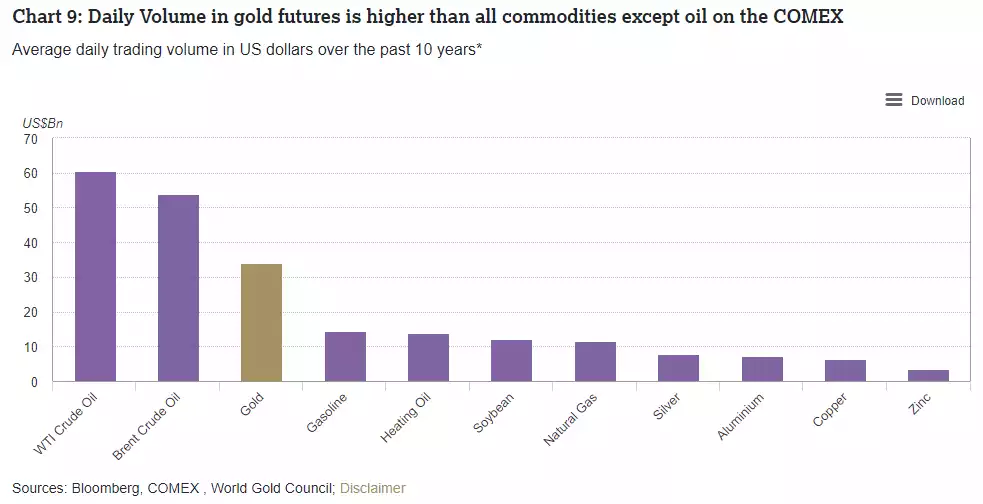

- It is highly liquid.”

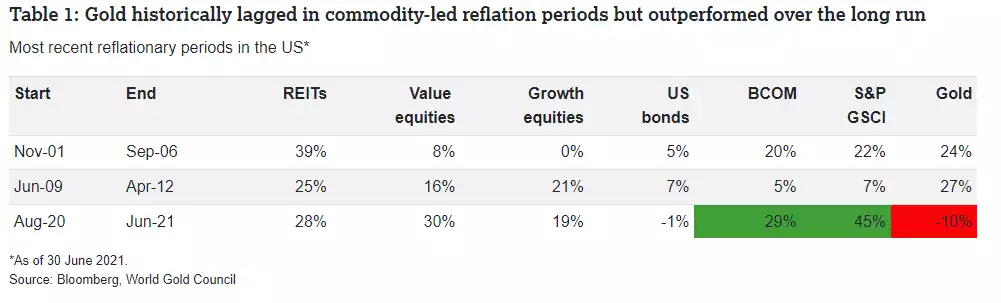

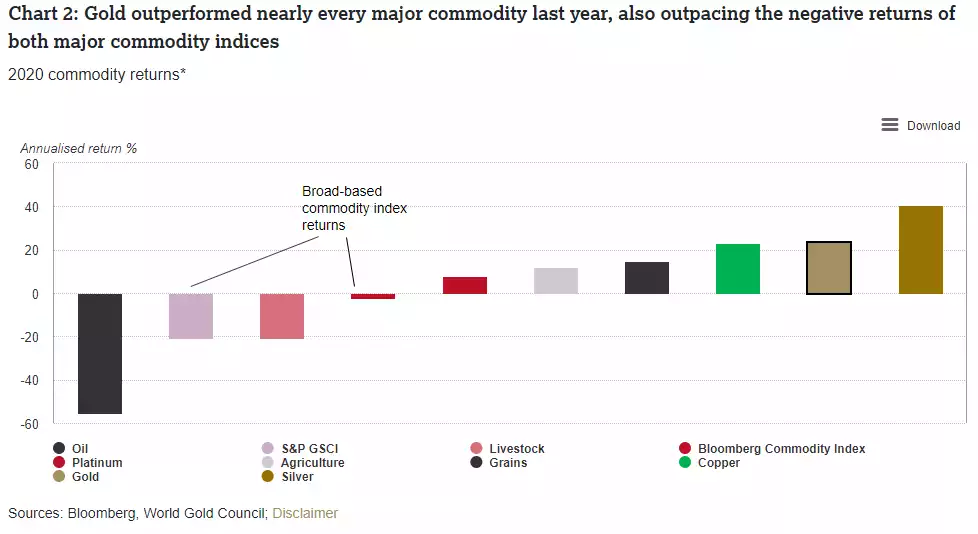

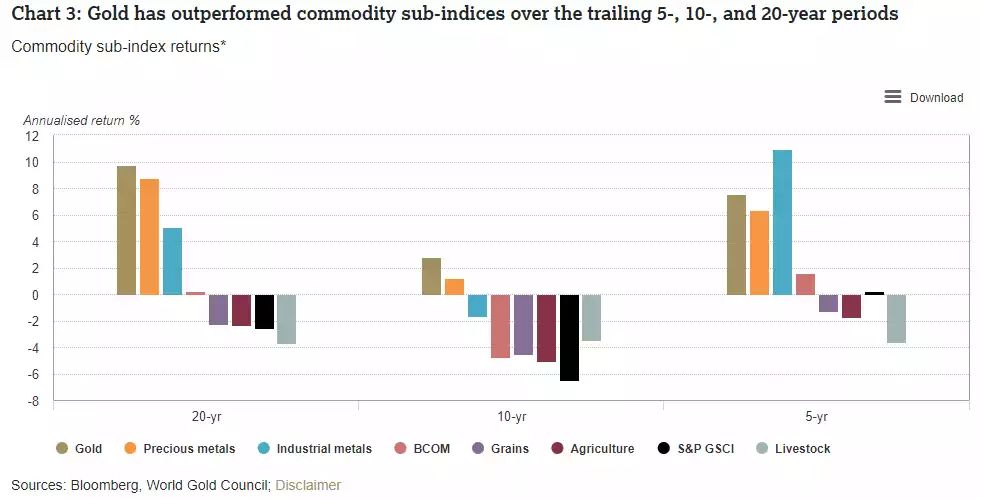

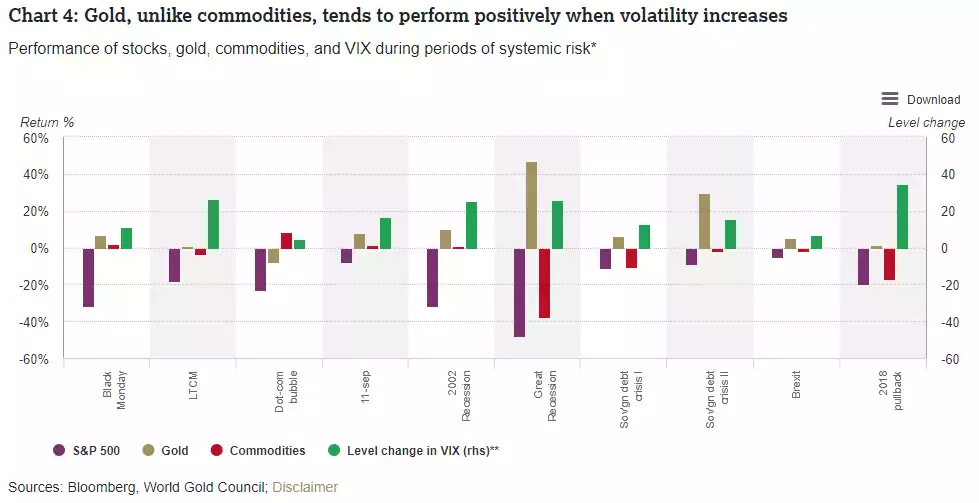

It’s a longish report and you can read it in full by clicking here over the weekend. For those who want a shorter journey, here are some of the self explanatory charts and tables from the report in line with the above 6 dot points:

- It has delivered superior absolute and risk-adjusted returns to other commodities over multiple time horizons

- It is a more effective diversifier than other commodities

We’ve written a bit lately about how the odds of a high volatility market shock is looking more and more imminent.

With the prospect of a sharp equities sell off we are reminded how uncorrelated gold is to equities:

- It outperforms commodities in low inflation periods

- It is a proven store of value

And finally, and as we always remind you, its about balance with our trademark “Balance your wealth in an unbalanced world”. The final chart below shows the effect of having 5% or 10% gold in a typical institutional investment portfolio over the last 10 years. Gold clearly leads to better returns and less volatility over the longer term. But maybe critically for current context, we are looking at this chart at a time of shares being at all time highs and nose bleed valuations based ALL on central bank stimulus amid the biggest, the US Fed, about to try and taper said stimulus. i.e. take head of the ‘unbalanced’ bit of that trademark….

Again the link to the full research paper is here.