Gold's Unstoppable Surge?

News

|

Posted 10/10/2025

|

1917

Gold surged past the US$4,000/oz earlier this week before, up an impressive 54% so far this year. This isn’t just a rally; it marks a structural shift in sentiment towards the metal, driven by a mix of global instability, a weakening US dollar, and sustained demand. From financial desks to social media, gold is once again being recognised as the go-to safe haven.

What’s behind the surge? Geopolitical uncertainty remains front and centre. US election risks, Middle East tensions, and the ongoing war in Ukraine have markets on edge. A sliding US dollar—lower against most major currencies—has made gold increasingly attractive to offshore buyers. Meanwhile, expectations of a rate cut by the Federal Reserve, potentially as early as this month, have only strengthened gold’s appeal over yield-based assets.

Central banks, especially China and India, are stockpiling gold at a record pace, with over 1,000 tonnes bought annually for the third year running. ETFs are riding the wave too, with holdings nearing 3,900 metric tons—closing in on the 2020 record of 3,929 tonnes.

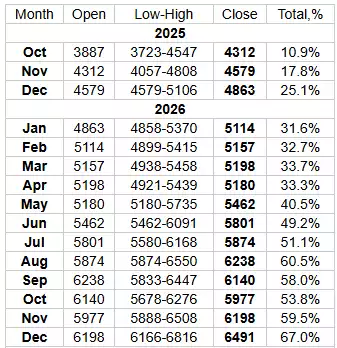

Of course, no rally comes without sceptics. A rebounding equity market—the S&P 500 is up 20% this year—and the potential easing of geopolitical tensions could put downward pressure on prices, with some suggesting a retracement to US$3,800 is possible. Even so, the broader outlook remains positive. Forecasts from Goldman Sachs and UBS—calling for US$3,675 by Q4 and US$4,000 by mid-2026 respectively—have already been surpassed. If inflation remains sticky—what some are calling “stagflation lite”—outlier forecasts such as LongForecast’s US$4,547 high by month-end or even US$6,000+ by late 2026 can’t be entirely ruled out.

LongForecast Gold Forecast 2025 and 2026

From bullion bars to retirement portfolios, investors are continuing to increase their exposure, viewing gold as both a hedge against uncertainty and a store of long-term value. With an average annual return of 7.9% since 1971, gold’s breakout above US$4,000 may prove to be more than just a milestone—it could be a new baseline.