Gold’s Mid-Cycle Correction – Sprott says this is not 2013

News

|

Posted 04/08/2021

|

9045

Sprott, the giant global precious metals investment manager, just released an update on their outlook for gold. Regular readers will recall our article comparing this bull market to previous and the current apparent bounce out of the classic mid market ‘bear trap’ correction. The Sprott piece, titled ‘Gold’s Mid-Cycle Correction’ goes on to outline their technical analysis confirming that view that we are now coming out of it and destined for much bigger things for the gold price. Importantly too they address the 2013 smack down in gold on the first time the Fed instigated a ‘taper tantrum’ and why this time is markedly different.

“During July, spot gold rose $44.08 per ounce (2.49%) to close the month at $1,814.19. We believe the June smackdown on gold was more likely due to an across-the-board fund de-grossing event than any fundamental gold driver. July saw a recovery in gold bullion investments as positions were repurchased and the fall in real yields to all-time lows added to the buying rationale. With new all-time lows in real yields, the U.S. dollar (USD) topping out, positioning still light and tapering/tightening fears waning, we believe that gold is well-positioned for the typical August-September rally.

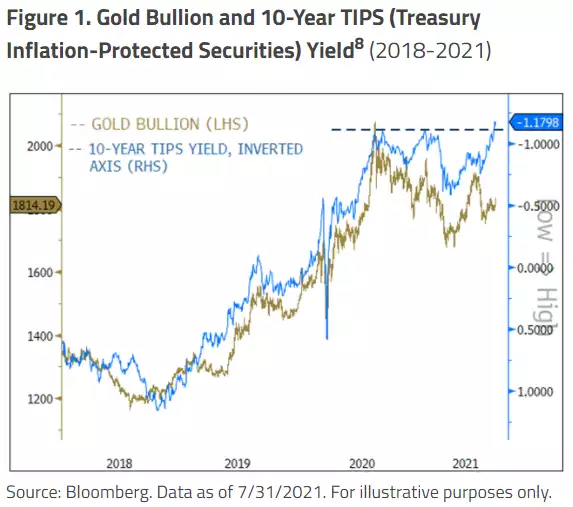

After the surprising June Federal Open Market Committee (FOMC) hawkish reaction, the Federal Reserve (“Fed”) messaged a more consistent statement that the market received as dovish. Real yields fell to an all-time low, as shown in Figure 1, as the market appeared to be pricing in a peak rate of change (but not peak levels) in seemingly everything (growth, profits, stimulus, gross domestic product [GDP], etc.).

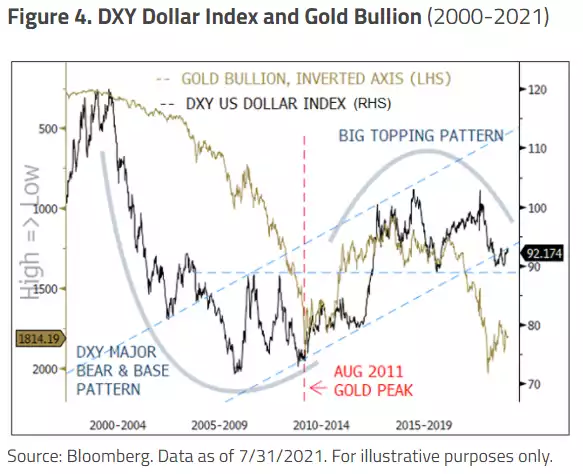

The recent surge in the COVID-19 Delta variant has recently raised the specter of a return to shutdowns and a possible hit to the economy. The USD has also put in a short-term top in July. The long-term picture on the USD remains bearish with a large top in progress but not triggered yet.”

“Figure 2 is a weekly chart of the 10-year TIPS yield since the global financial crisis (GFC). We marked the price action of the 2013 Taper Tantrum effects on the TIPS yield. Back in 2013, there was a near 200 basis-points ramp up in real yields. In early May 2013, the breakout was triggered on the 10-year TIPS yield, and the shocking rate of change wiped $200 per ounce off the gold price in a little more than a week. Up to that point, the market had not discounted the Fed’s message of tapering and tightening. The USD had already made its low in 2011 after a decade in one of the worst USD bear markets. By 2013, the USD was in a choppy bottoming process. The red lines, bottom right, in Figure 2 shows a clear technical breakdown of real yields.”

“As a reminder, the 2013 Taper Tantrum was Fed-driven. Today’s “taper tantrum” is bond market-driven. The Fed has a printing press (quantitative easing [QE] program of $120 billion per month) and it can crush the bond market any time it wishes.”

“When one hears the term “Fed tapering/tightening,” the reflex action or muscle memory is the painful 2013 experience. Figure 2 shows how TIPS yields are nowhere close to repeating the 2013 action. The long-term DXY chart also indicates a non-2013 pattern as well. During the last gold bull cycle, the USD bear market was a primary driver of the 2001 to 2011 gold bull market for a decade. From the peak in July 2001 to the trough in March 2008, the DXY fell 40%, one of the worst bear markets on record. A few years before the August 2011 gold peak, the DXY started carving out a basing pattern. Today’s DXY pattern is a large pending double-top formation after a relatively tepid 13-year long bull run since the GFC. The March 2020 USD squeeze lesson is clear; no central bank (least of all the Fed) wants a significantly stronger USD. A USD funding squeeze would wreak havoc on global flows and economic expansion.”

“The Fed initiated the 2013 Taper Tantrum. The bond market at the time dismissed the initial Fed signals only to reverse course and reprice aggressively. As a result, real yields exploded higher, rising almost 200 basis points. The DXY had a bullish breakout after a decade-long major bear market. At the time, the Fed appeared to be on its way to a “normalization path.”

In this current cycle, the bond market has initiated the taper tantrum, although the Fed continues to message patience. Real yields continue to make new all-time lows. The DXY is in a multi-year topping pattern after a choppy recovery from its GFC low. The Fed is now on an AIT/ZIRP (average inflation targeting/zero interest rate policy) path, which essentially translates to a dollar debasement and financial repression path. Aside from the phrase “taper tantrum,” market conditions are near the opposite of the 2013 Taper Tantrum. Yes, the Fed may begin the taper process in early 2022, but it will not be anywhere close to the 2013 experience.”

“Gold bullion remains below its 2020 August highs ($2,067 on August 7, 2020) but well supported above the March 2020 lows. If this is not a cycle peak (it’s not), we are most likely in the latter stages of a mid-cycle gold correction. During the 2001 to 2011 gold bull market, there were two significant mid-cycle corrections that lasted over a year (2006 and 2008).

In Figure 5, we created an average of the two corrections in gold bullion, reindexed the values to 100 at the peak, and overlaid the current correction to compare. The current correction is following the prior cycle corrections very closely in terms of trading magnitude ranges and patterns.”

The market action last night further reinforced this view with 10yr yields falling again to just 1.15%. And remember that is the nominal yield. The real yield subtracts inflation which remains strong. The Sprott piece included the following statement:

“The relationship is clear: Real yields are one of the primary drivers of the gold price.”

Take very special note then of Figure 1. Last night that negative real yield on the 10yr fell further to an all time low of -1.1879%. Looking at the chart below and projecting that red line to the left (being the gold price) and you would be looking at nearly USD2,050 gold to restore historical correlations between the two.