Gold’s $37,000 AUD/oz Long-Term Price Target and Macro Hyperwave Theory

News

|

Posted 08/10/2025

|

3875

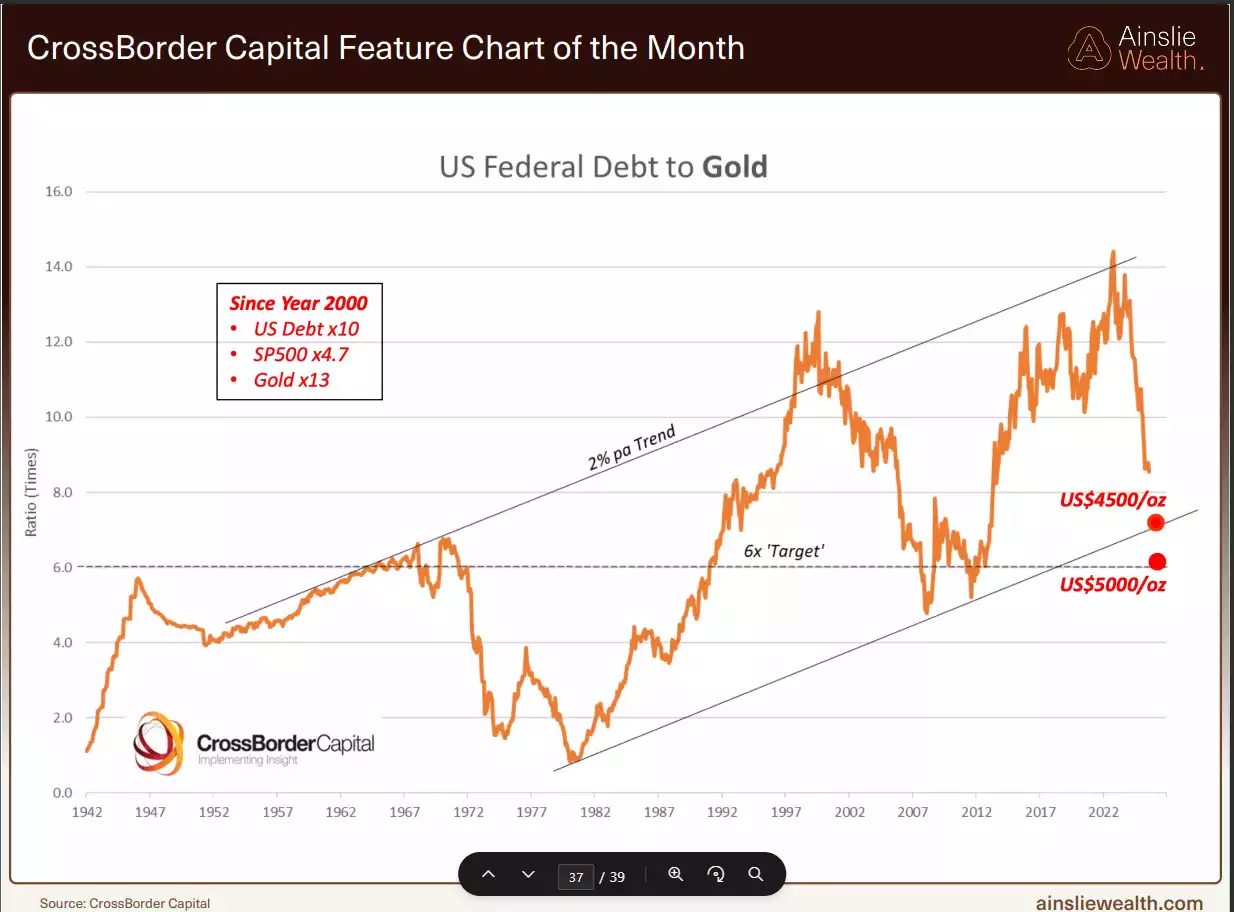

When viewed through the lens of macro technical analysis, gold appears to be following a textbook hyperwave formation—currently sitting within phase 3.

The chart below highlights phase 1 spanning from 1982 to 2006.

While hyperwave theory suggests extreme price targets during phase 3 and potentially into phase 4, such outcomes are not only plausible—they are logical responses to the significant currency debasement that has accelerated since 2020. This debasement has tracked closely with the exponential growth of US government debt.

With US government debt now exceeding US$37 trillion and projected to continue rising exponentially, further debasement of the US dollar seems inevitable in order to maintain debt servicing.

While the chart illustrates a medium-term gold price target of US$4,500/oz (around AU$6,800/oz), extending the current debt trajectory out 15 years suggests a possible gold price of US$25,000/oz—or AU$37,000/oz.

Gold has effectively become a barometer for US government debt: as debt levels rise, so too does the gold price.

This is largely due to the inverse correlation between US dollar strength and government debt. The more debt there is to service, the more dollars are required—placing downward pressure on the currency. Since gold is priced globally in US dollars, its price naturally rises as the dollar weakens.

Despite central banks’ rhetoric around fighting inflation, governments ultimately rely on it to erode the real value of their debts. Inflation becomes, in effect, a silent and deeply regressive tax.

The enduring hedge against this system remains what it has always been: gold—a form of honest money grounded not in politics, but in intrinsic value.