Gold on the Verge of a Breakout

News

|

Posted 09/06/2023

|

14058

Gold’s consolidation at the top of the ‘handle’ portends a ‘third leg’ up since Nixon closed the gold window. As we’ve covered previously, the gold spot price has been playing out a decade long cup and handle formation, with the end of the second handle signalling lift off.

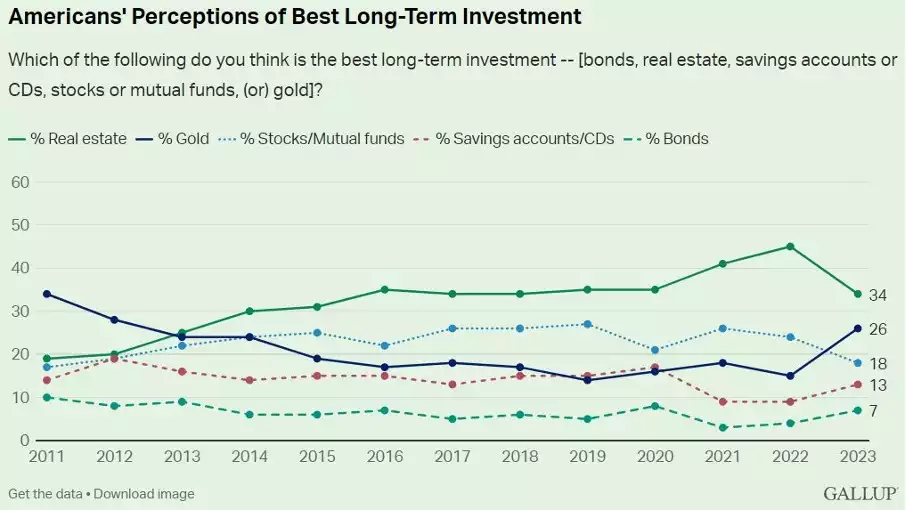

There is plenty of evidence that mainstream investors are opening their eyes to the yellow metal at an accelerating rate. A recent Gallup poll showed gold to be the second best long-term investment in the eyes of retail American investors. PMs now rank 2nd behind real estate with 26% of respondents choosing Gold as their “Best Long-term investment” and 34% sticking with Real Estate. Interest has spiked in gold in 2022, with both real estate and stocks taking significant dives.

Sticking with the mainstream attention, Market Insider recently covered the news that we have known for years, that Central Banks are stockpiling gold while views on the US dollar grow dimmer. They covered the recent World Gold Council survey, which found that 62% of banks expect gold to account for a greater share of total reserves over the next five years, compared with last year's reading of 46%. In contrast, the same survey predicted that dollar reserves as a percentage of global trade would continue their protracted decline to 40-50% over the next five years.

With stock markets around the world rebounding in 2023, there has been a shift back towards ‘risk on’. Gold has held the line amidst a generalised ‘sigh of relief’ that the world hasn’t careened headlong into global depression yet. The charts tell us otherwise however, as the calm before the storm has gold setting up for its next leg up.

Gold in the $1900-$2000 range sits poised on the verge of a breakout from a 3-year consolidation, which is quite similar to 2016-2019 one. Back in 2019 gold added 15% within 2 months post breakout and 50% within 14 months. A 15% move from all-time high could catapult gold to $2,400 level by late August 2023.

For those waiting on the sidelines for gold to crash back down, they may well be “Waiting for Godot”.