Gold on sale at 69c!

News

|

Posted 13/11/2019

|

22072

Business news was atwitter yesterday as we learned that Reserve Bank of Australia boss Philip Lowe will speak on “Unconventional monetary policy: some lessons from overseas” at the Australian Business Economists dinner in Sydney on November 26.

Many analysts are taking this as confirmation that the RBA will turn to QE as the effectiveness of dropping rates to zero may have limited effect. Currently at a record low 0.75% the market is pricing in a 50% chance of another rate cut in March as the RBA admitted last week that it was more than 2 years away from lifting inflation back into its 2-3% target as well as its unemployment target of 4.5%.

CBA’s economist Gareth Aird notes:

“Once the lower bound is reached it is not possible to further stimulate the economy via standard interest rate cuts. Any additional monetary policy stimulus would most likely take the form of Unconventional Monetary Policy [including] quantitative easing – i.e. asset purchase programmes – forward guidance and new central bank lending operations……But [unconventional monetary policy] is only one option and comes with a number of potential negatives. There are a raft of other policy options available to stimulate aggregate demand. The other options generally fall under the umbrella of “fiscal policy” and include tax cuts, more infrastructure spending and more government recurrent expenditure.”

Those ‘other policy options’ are 3 different ways of saying more government debt. We wrote on the choice of fiscal spending before the Morrison government and the lessons from the US in that regard.

From the AFR:

“JPMorgan economists said this week that the RBA was likely to cut rates in February, leaving the door "wide open" for unconventional policy in late 2020.

The investment bank believes the package will include purchasing up to $50 billion of Australian federal government bonds and continued use of forward guidance.

As the RBA runs out of room to cut interest rates, Dr Lowe has repeatedly called for government fiscal policy, such as infrastructure spending, to help stimulate the economy.”

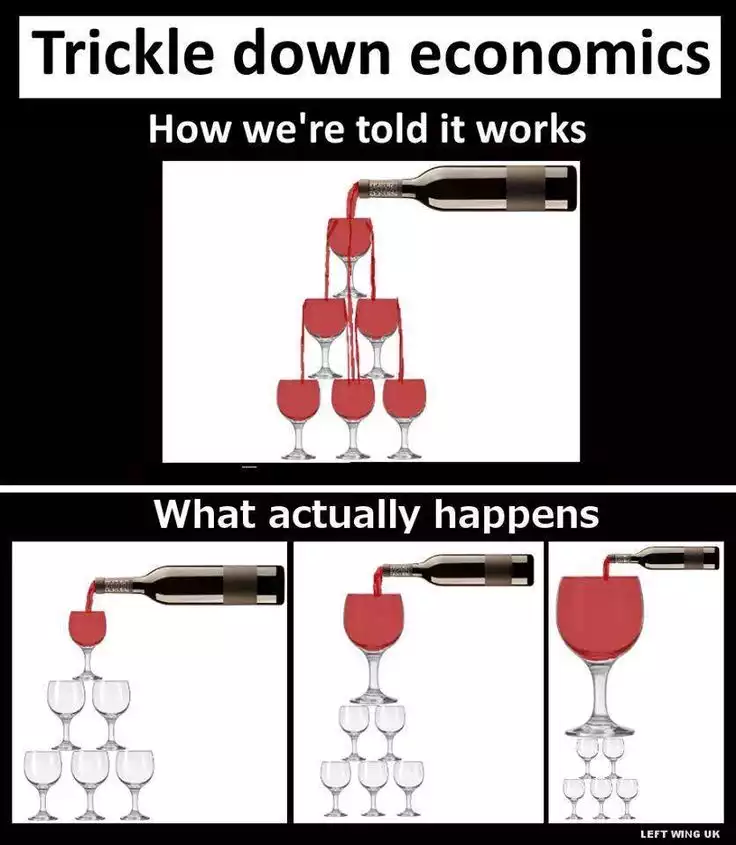

The problem is that QE has not exactly worked overseas like they desired. QE, central banks printing new money by buying assets such as bonds and even shares, was supposed to ‘trickle down’ into the broader economy, ignite inflation and wage growth. Sometimes a picture paints a 1000 words:

QE in the US, Europe and Japan has been both ineffective and inflationary only in financial assets owned by ‘the rich’. The ensuing overvalued financial markets and social discontent and rebellion is well documented and playing out right before our eyes.

Albert Einstein once said, “The definition of insanity is doing the same thing over and over again, but expecting different results.”

And therein lies the RBA’s conundrum. Take rates negative and risk damaging our banks when Australia has the most heavily weighted sharemarket in financial institutions in the world, try QE and expect a different result to that achieved everywhere else in the world, or somehow convince the government to try and deficit spend our way out of a recession. OR, and this crazy I know…. let natural economic cycles be economic cycles and have the hard but necessary clean out of a recession.

One thing seems almost certain in all of this, and that is the Aussie dollar at 69c may not be long of this world. Be it lowering rates or QE, they both have the intended effect of lowering the currency.

Buying gold and silver and bitcoin when the AUD is at 69c means any drop in that Fiat money used to buy that real money, sees the relative value of your real money rise. You can’t simply ‘print’ more precious metals (much) or bitcoin (at all) and hence its intrinsic value courtesy of its scarcity protects you from that falling fiat being printed at will.

The caveat to that of course is that all central banks everywhere are doing the same thing and the value of your AUD is only ever relative to the value of the other devaluing currencies. It’s a race to the bottom. That said, Australia came to the party late and potentially has more scope to fall relative to the others.