Gold and Silver: Steady Players in a Changing World

News

|

Posted 10/06/2025

|

1332

In a time when tech giants often steal the headlines, the gold and silver markets are quietly reminding investors of their staying power. Recent insights shared by Katusa Research and Tavi Costa paint a fascinating picture: these precious metals aren’t just holding their ground, they’re proving to be serious contenders in the global market. Could this be a sign that more people are turning back to solid, tangible assets in an unpredictable economy?

A Surprising Market Size

According to Katusa Research, the global gold sector is worth around US$590 billion, with silver miners adding another US$140 billion. When you bring in related sectors, the broader precious metals market swells to an impressive US$3.10 trillion. That’s bigger than Tesla’s market cap at US$950 billion and even the entire US oil and gas sector at US$1.36 trillion. It’s roughly on par with the entire cryptocurrency market and not far behind Apple’s massive US$3.48 trillion. These figures show that precious metals are far from an afterthought, they’re a serious force in the financial world.

Why Gold and Silver Still Matter

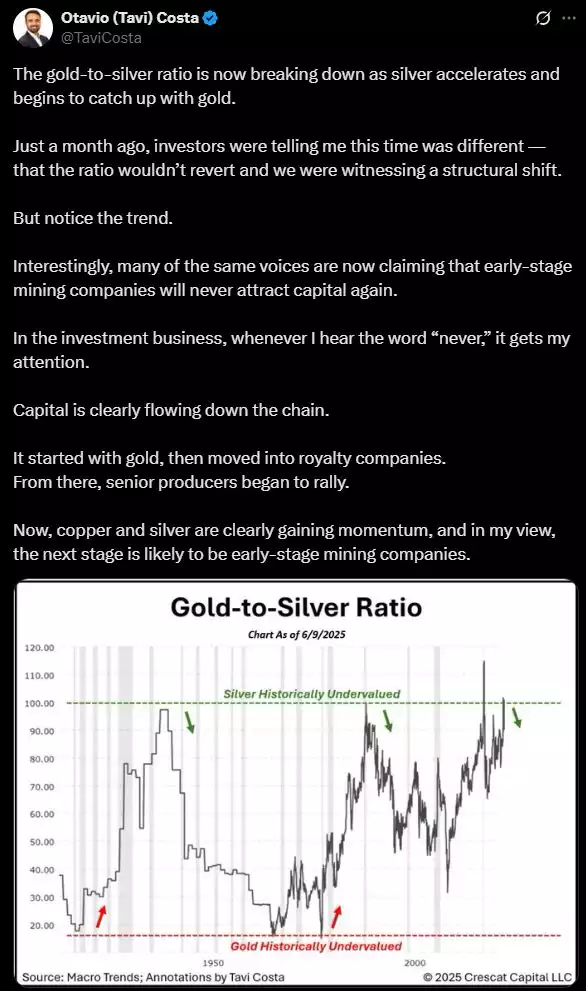

Tavi Costa’s analysis helps explain why gold and silver are making a comeback. In a world grappling with inflation, geopolitical tensions and unpredictable monetary policies, these metals are proving to be a safe haven once again. Unlike shares that can swing wildly with market moods, gold and silver have been trusted stores of value for thousands of years.

What This Means for Investors

The rise in gold and silver’s market cap raises an important question: is this a sign that investors are rediscovering the value of real, tangible assets, or just a knee-jerk reaction to current uncertainty? The insights from Katusa and Costa suggest it’s more than just a blip. As global risks keep piling up, precious metals look set to keep playing a key role in diversified portfolios.

For investors navigating today’s choppy waters, gold and silver deserve a close look. They’re reliable anchors that can help steady a portfolio when other assets are getting tossed around.