Gold To Silver Ratio Short, Medium, and Long-Term Forecast

News

|

Posted 15/01/2026

|

4813

As expected at this stage of the macro 18.6-year land cycle, the Gold to Silver Ratio (GSR) has been trending steadily lower as we approach the cycle peak.

Below, we can see the previous land cycle peak, showing land (blue), stocks (pink) and the GSR (green).

Historically, stocks and land roll over after the cycle peak and spend years in recovery. Gold and silver, by contrast, tend to continue into sustained bull markets. In the lead-up to the stock market peak, the GSR trends lower as silver outperforms gold, a dynamic that is once again playing out in real time.

Looking ahead to the stock market peak and subsequent crash, history shows the GSR typically spikes for a few months during the initial downturn. This reflects a classic flight-to-safety environment. As equities and property fall sharply, large investors are often forced to sell whatever liquidity they can access to meet obligations.

After the crash, however, while most markets continue to struggle, precious metals have historically recovered within months. It is during this phase that mainstream interest in silver tends to accelerate. While both gold and silver outperform most asset classes in the aftermath, silver has typically outperformed gold, sending the GSR sharply lower.

In practical terms, the GSR may continue trending down in the short term, followed by a brief spike around a market dislocation. Over the medium term, history suggests the ratio could then fall aggressively.

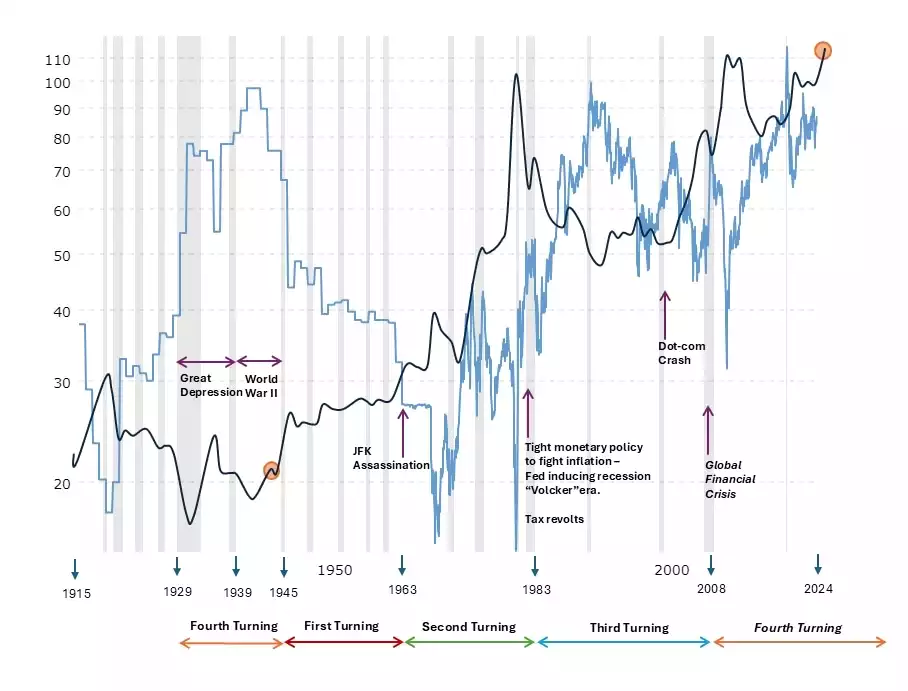

While this framework covers a multi-year outlook, it is also useful to consider the GSR over much longer time horizons. To do this, we can step beyond the 18.6-year land cycle and examine the 80-year socio-economic cycle commonly referred to as the Four Turnings.

In the chart above, the GSR (light blue) remains elevated during the Fourth Turning, the last of which culminated in the Great Depression and World War II. It then falls during the First Turning and spends much of the Second Turning well below 50, before rising again in the Third Turning. Each phase spans roughly 20 years.

During the First and Second Turnings, silver experienced a 40-year bull market. Today, we are again in a Fourth Turning, the final 20 years of the current 80-year cycle. Looking ahead to the First Turning of the next cycle, when new financial systems are typically established, it would be reasonable to expect a similar outcome for precious metals. Historically, these periods have seen multi-decade bull markets in both gold and silver, with silver outperforming and the GSR spending extended periods below 50.