Gold Thwarts Western Influence - Potential Upside Breakout

News

|

Posted 31/08/2023

|

2408

The gold market has continued to draw interest as well as criticism as it holds above the $1900 (USD) mark and hitting AUD3000 again this morning, showing a potential to break higher. A shocking narrative has started to emerge that suggests the West's control over gold prices may be fading quickly, and that central banks are preparing to be leaders in the gold arena.

Challenging the Status Quo

A report published by Jan Nieuwenhuijs unveils that Western institutions' traditional reliance on Treasury Inflation-Protected Securities (TIPS) to predict real interest rates and gauge gold demand is facing trouble. Despite a historical correlation between gold prices and TIPS yield over the past 16 years, they have begun to diverge.

Falling inflation and rising interest rates have appeared to push TIPS to a real yield of 1.5%, which historically should send gold prices lower. This has not happened, which shows gold's increasing independence from Western markets.

Central Banks Amplify Demand

Jan also mentions the evolving role of central banks in the gold market. While Western players have reportedly been shedding gold holdings to align with rising TIPS yields, the report suggests that central banks are embracing the opposite strategy. We previously covered the fact that central banks have been on a gold buying spree, and now it seems to be overpowering the actions of institutional traders.

A Breakout is Potentially Looming

tradingview

Gold's price trajectory has been trapped in a prolonged consolidation phase, lasting over 44 months. The $2090 level, which has been tested three times before, remains as a critical resistance to overcome. Compare this to something like the S&P500 and one can see the clear difference: The S&P500 has had a fairly easy series of breaks higher meanwhile gold has been capped. What happens if (or when) this cap breaks?

There is a technical analysis saying that there is ‘no such thing as a triple top’. The chart above shows exactly that, and history tells us it will break higher and decisively from this 3rdtop. Of course technical analysis is not perfect the 4 most expensive words in investing are often “this time is different”.

Gold has had a clear breakaway from traditional Western influences, and an increasing central bank concentration on gold. One of the worst nightmares for fiat currencies is losing ground to gold, which reveals to the common person that cash is not king. Banks have historically worked with governments to try and cap assets like gold from 'rising' against fiat money, and the cap has eventually broken.

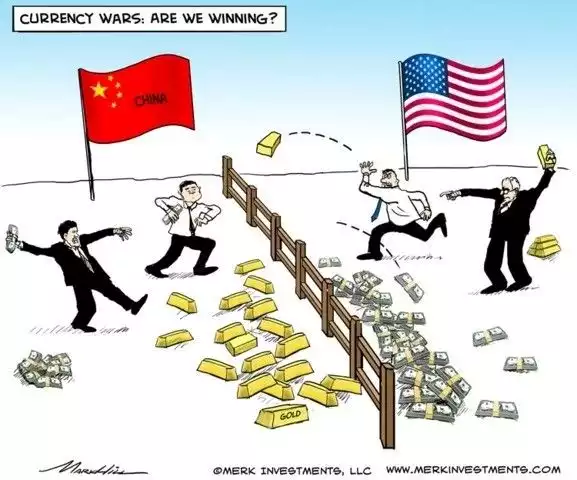

Again we must share this oft used meme…