“Gold, The Simple Math” - Hathaway

News

|

Posted 21/10/2020

|

13857

John Hathaway needs little introduction to long term gold participants. He is a highly regarded analyst who until this year penned excellent analysis of gold markets for Tocqueville Asset Management. He is now with Sprott Asset Management and recently penned “Gold, The Simple Math”. Below are some key excerpts from this excellent summary of the compelling reason to be buying gold right now.

“The current pullback in the precious metals sector is a buying opportunity. Since trading at a closing high of $2,064 an ounce on August 6, gold bullion has declined 8.34% as of this writing. Gold mining shares have followed suit, declining 9.26% since the August high. It is possible that gold and related mining shares could continue to chop sideways to lower until the U.S. presidential election results are known and even into yearend as the implications are sorted out. Whatever the electoral outcome, the path towards monetary debasement is bipartisan. It is crucial for investors to focus on the long-term trend and to avoid the distractions of short-term timing considerations.

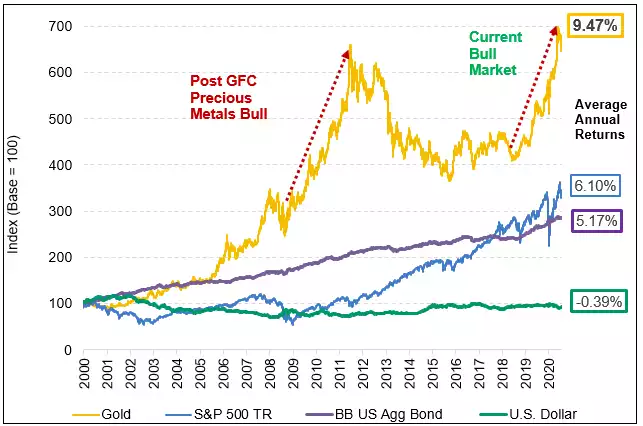

The very strong investment fundamentals for gold and gold mining shares are based on what has been a slow irreversible drift towards significant U.S. dollar (USD) devaluation. Paper assets, including equities, bonds and currencies, have underperformed the dollar gold-price since 2000, the dawn of radical monetary experimentation by central bankers. Until recently, gold's strength has attracted little notice from mainstream investors. Widespread disinterest can perhaps be ascribed to the stealthy, long-term character of gold's outperformance. In addition, the absolute performance of equities and bonds has been positive over the past two decades, so there has been little incentive to look elsewhere.”

Figure 1. Gold vs. Stocks, Bonds and USD

Relative Returns for Period from 12/31/1999-9/30/2020

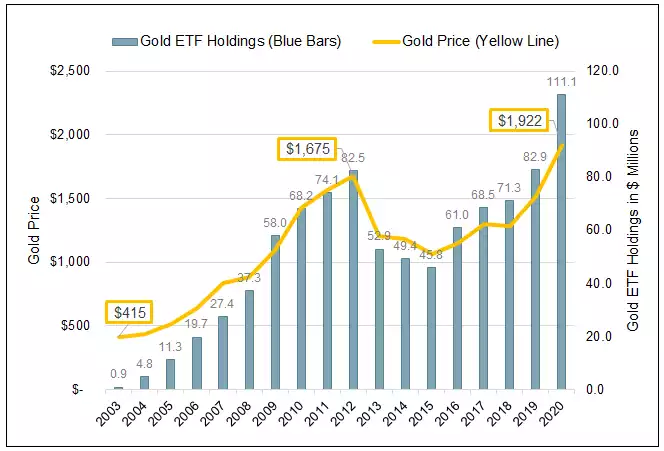

“In simple mathematical terms, the gold market could not clear at current prices if 1% of the $100 trillion or so of institutional assets under management were to move into the physical metal. Record year-to-date inflows into gold-backed ETFs have exceeded any previous year. But in dollar terms, this amounts to a paltry $51.2 billion requiring the acquisition of 936.2 metric tonnes of gold (according to Meridian Macro Research). By contrast, a $1 trillion inflow into gold bullion would require 18,000-19,000 tonnes, equal to roughly six years of annual world gold production. A shift of this magnitude by asset allocators would require a bullion price of $5,000-$10,000 an ounce.

Figure 2. Gold-Backed ETF Flows Have Reach Record Levels in 2020 (2003-2020)

“The time frame for a hypothetical $1 trillion inflow could range from a few years to a decade. As the supply of paper money accelerates, a $1 trillion inflow could prove conservative. What is inescapable is that the future increase in the supply of U.S. dollars is likely to far outstrip the 1-2% annual growth in gold supply. Monetary regime change, not cyclical or episodic (COVID) related factors, explains the steepening slope in the supply of paper currency versus gold.

On September 16, Federal Reserve ("Fed") Chairman Powell announced a new QE (quantitative easing) program that is twice the size of earlier QE programs in terms of monthly credit expansion. Under the current program, the Fed will purchase $80 billion of U.S. Treasuries and $40 billion of mortgage-backed securities per month net. This will lead to a 21% increase in the Fed balance sheet over the next twelve months. Powell stated:

"Effectively, we're saying that pace will remain highly accommodative until the economy is far along in its recovery.... We do have the flexibility to adjust that tool and the rate tool and other tools, as well."

Sustainable V-Shaped Recovery is Highly Unlikely

Implied in Powell's comment is the expectation that the U.S. economy will recover to pre-COVID levels and that further Fed support will be unnecessary. His thinking assumes that business cycle factors plus cures for COVID-19 will restore normality, which will allow the Fed to withdraw support for financial markets. We believe that Powell, his Fed colleagues and consensus economic thinking do not comprehend that the highly indebted U.S. and world economy are incapable of a sustainable V-shaped recovery. More likely is a continuation of sub-par economic performance that will be viewed as unacceptable by the next and future presidential administrations.

Highly indebted economies are destined to underperform their potential. Productive resources must be diverted to debt service and principal repayments to meet credit obligations. Monetary policy is handcuffed because any tightening, including interest rate hikes, will increase the risk of credit defaults and economic instability. Lenders become reluctant to extend credit at sub-economic rates when borrowers are swimming in debt. Therefore, future monetary and fiscal interventions are likely to increase in scale and frequency. Extraordinary measures will become routine.

Before the onset of the COVID economic shutdown, U.S. consumer, business and government debt totaled $64 trillion or more than three times the U.S. gross domestic product. That ratio is most assuredly greater today and, with continuing government and corporate debt issuance, will continue to grow. High debt drives a vicious cycle of money creation that cannot be reversed without an extended period of austerity.

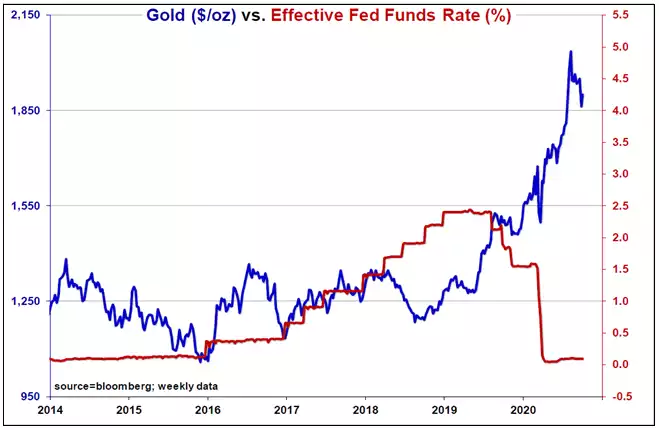

Excessive indebtedness practically guarantees that interest rates will remain tethered to the zero bound. As of September, the blended interest rate on U.S. debt was 1.77%, a record low. The fiscal year (FY) 2020 interest expense was $522 billion through September and will approximate $560 billion for the full fiscal year ending October 31. A 1% increase would add over $300 billion in interest expense. As noted by FFTT (Forest for the Trees, 9/24/2020) authored by Luke Gromen, on a year-to-date basis, interest expense plus entitlement spending equaled 97% of tax receipts. Taking defense spending into account, spending on automatic pilot is $1.4 trillion. Assuming interest rates do not increase, we estimate the growth of embedded non-discretionary spending to be 5-10% annualized.

Figure 3. Interest Rates are Zero Bound

“Toss in additional stimulus and other ongoing government programs, and one can easily picture routine deficits of $2-3 trillion and annual growth in U.S. Treasury debt of 15-20%, well in excess of gross domestic product (GDP) growth. As noted by Gromen, with federal spending accounting for 45% of GDP, any attempts to cut outlays "will effectively amount to a cut in GDP." Proposed tax increases would likely trigger a new recession. The U.S. no longer has fiscal choices.

Monetary policy is also trapped. The Fed is morphing into an arm of the U.S. Treasury, as former Fed Governor Kevin Warsh observes in a September 7 Wall Street Journal Op-Ed:

"If the economy does well in the coming quarters, I expect the Fed will expand significantly the scale, scope and duration of its asset purchases. If the economy weakens or financial markets fall, the Fed will do even more. This is what political scientists call path dependency. When an institution sticks to a path for so long, it finds its options limited, detours difficult and exits infeasible.

"The Fed is on a one-way path to a larger role in our economy and government. On the current trajectory, the Bank of Japan might be the model for Fed policy: a large buyer of public stocks and an indistinguishable partner with fiscal authorities. The unimaginable can become the inevitable."

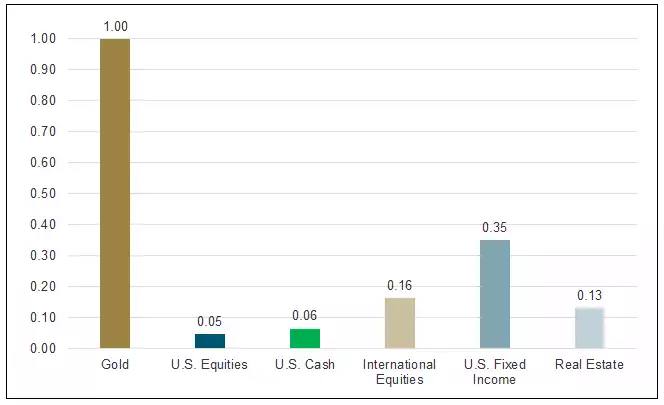

Bonds and Equities Have Become Positively Correlated

The emasculation of the Fed means that bonds can no longer protect conservative, balanced portfolios against equity risk. Bonds and equities have become highly correlated. The inverse equity/debt correlation assumes a normal business cycle in which bonds and equities would travel in opposite directions during recessions and recoveries.

At the zero bound, bonds offer only return-free risk. Upside potential seems entirely dependent on appreciation linked to crossover into negative nominal territory, certainly a possibility but only speculation for the sophisticated investor. Downside risk would be considerable if the U.S. dollar weakened, inflation returned or if the yield curve steepened. If bonds have reached a dead end, asset allocators must look elsewhere. Gold will fill a large part of the void vacated by bonds to help balance equity risk.

Figure 4. Correlation of Spot Gold to Traditional Financial Assets

Are Markets Priced for "Destruction"?

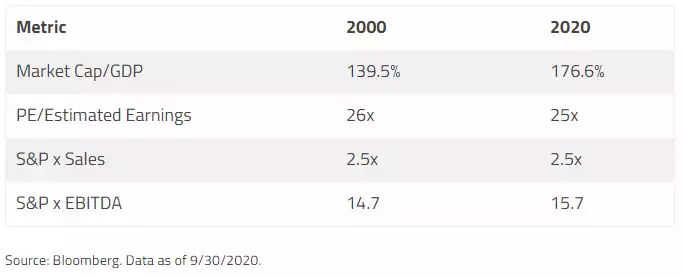

On the other hand, the downside risk in mainstream equity portfolios is considerable and, in our opinion, requires more protection than ever. By almost any benchmark, the stock market (measured by the S&P 500 Index) is equal to or more overvalued than at its 2000 peak.

As hedge fund manager Michael Solomon of Marlin Sams Fund, L.P. summed up on October 3:

"The markets are priced for destruction... Investors ignore the fact that real corporate after-tax profits (US Bureau of Economic Analysis) have been flat since 2010... Since 2008, the markets have crashed/cracked four times (including the bond market's taper tantrum)…The mass delusion is that the Federal Reserve can save the day. We believe that as the Fed gets further in, it will find itself trapped in a position from which it cannot get out. Investors believe things are good, but they are not. The illusion has been supported only by the reckless, extreme, and irresponsible actions of the Fed."

High financial asset valuations are addicted to Fed support. In our opinion, there is little risk that Fed support would or could be withdrawn. Fiscal stimulus is likely to continue as well. As argued in Mr. Solomon's synopsis above, the consensus illusion of well-being is dependent on ever greater money creation.

In our view, new episodes of money creation, market intervention, or price rigging add to systemic instability. Conditions caused by the next financial accident mirroring the GFC (great financial crisis) or black swan event echoing the COVID-19 pandemic could render monetary and fiscal countermeasures ineffectual. A substantial devaluation of the U.S. dollar would take place.

Layer in Gold Exposure

Ray Dalio noted in his study, The Changing World Order, "most people don't pay enough attention to their currency risks." He recently reiterated his earlier prediction of a 30% decline in the U.S. dollar within the next few years. Most investors assume the dollar will retain constant value. We believe that is wrong. Dalio points out that all paper currencies have been devalued or died. No exceptions.

We believe that now is the time to start layering in gold exposure, not when the rest of the world tries to do so.

A cursory inspection of the U.S. fiscal situation suggests that the U.S. dollar deserves to rank high on the endangered species list. There are many ways that a dollar devaluation could transpire. Inflation, pronounced loss of value against other currencies, or a deflationary credit meltdown are all possibilities. In any of these scenarios, the dollar price of gold would rise.

The four-year rise in gold from $1,100 at yearend 2015 to $1,900 in 2020 is an early signal of a failing currency regime. We believe that potential exists for the dollar price of gold to rise more than 5-10 fold when that failure becomes plain for all to see. It is a matter of simple math. Timing remains uncertain but the outcome seems inevitable.”