Gold & Silver Stampede from West to East

News

|

Posted 14/10/2022

|

13586

Maybe one of the most enduring and oft used images when it comes to gold and the economic tug of war between east and west is that below…

We have written and spoken (in Gold Silver Standard Insights) at length about the so called US dollar wrecking ball. The irony is not lost on those who appreciate the true value of gold that the ‘money’ being printed at an unprecedented rate, the USD, is rocketing up in ‘value’, or more accurately price, whilst gold is generally tracking sideways. This irony or mispricing however hasn’t been lost on the ‘East’.

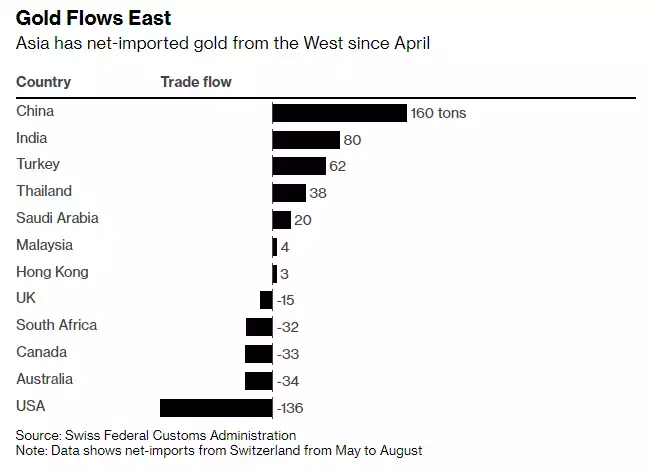

Bloomberg penned a great piece over the weekend titled “The Gold Market’s Great Migration Sends Bullion Rushing East”. As Wall Street and other Western financial markets position out of gold due to rising rates in isolation (or ignorance?) of the EFFECT of those rising rates and what promises to come, the price has softened and the East is snapping it up voraciously.

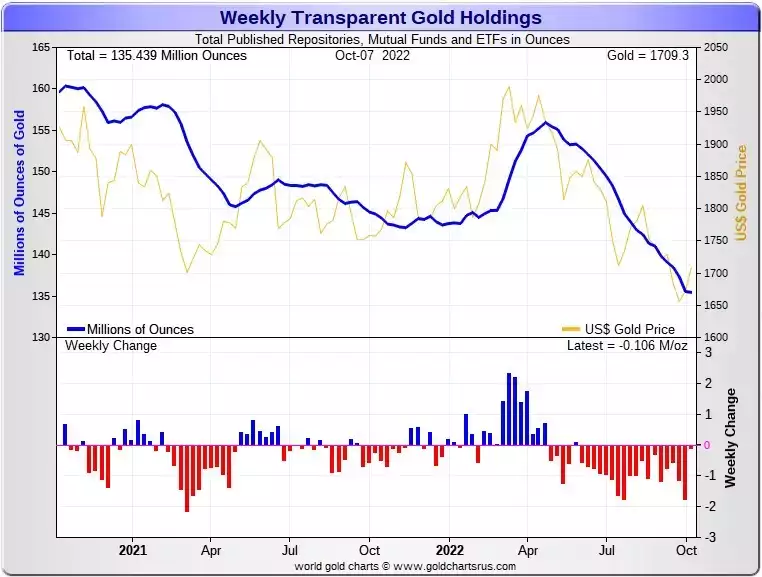

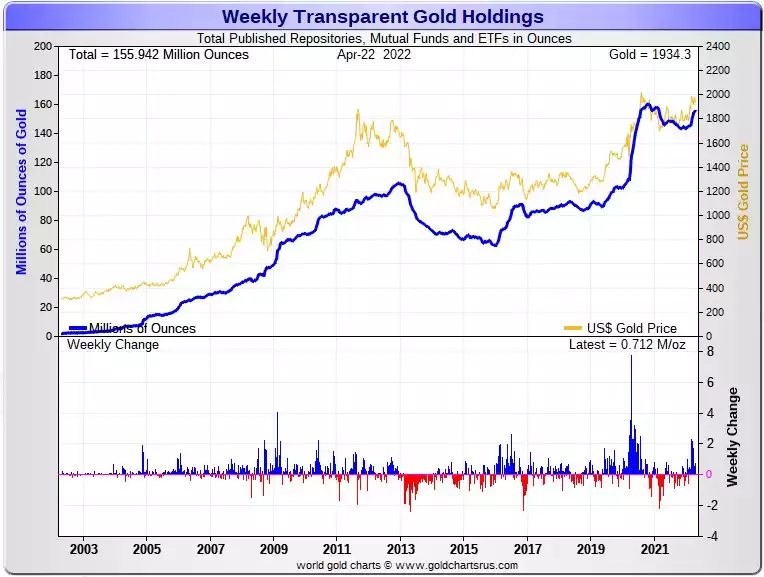

The chart below that we share on a regular basis shows all registered holdings in repositories such as COMEX, mutual funds and ETF’s.

As you can see the drawdown is indeed large. Zooming out though, you are reminded of the massive inflows in late 2020 when COVID hit.

From Bloomberg:

“In fact, it can’t move fast enough.

Logistical issues combined with quirks of the market are making it difficult for traders to get enough bullion where it’s wanted. As a result, gold and silver are selling at unusually large premiums over the global benchmark price in some Asian markets.”

“The rotation of metal around the world is part of a gold-market cycle that has repeated for decades: when investors retreat and prices drop, Asian buying picks up and precious metals flow east — helping to put a floor on the gold price during times of weakness.

Then, when gold eventually rallies again, much of it returns to sit in bank vaults beneath the streets of New York, London and Zurich.”

“While plenty of gold is heading east, it’s still not enough to meet demand. Gold in Dubai and Istanbul or on the Shanghai Gold Exchange has traded at multi-year premiums to the London benchmark in recent weeks, according to MKS PAMP — a sign that buying is outstripping imports.”

What Bloomberg fails to mention is the demand for physical bullion by investors in the West that don’t get captured by that ‘registered holdings’ report. The key word there is registered. All registered gold is essentially backing up paper promises, be that futures, ETF’s etc. Those that buy the physical bullion are not in that number as no one needs to know how much you own nor try and match that to what they owe in paper promises. There has been plenty written of late of wary investors pivoting from those synthetic futures and ETF platforms into physical bullion they control, removing all that counterparty risk. The pace of this in Australia for SMSF’s in particular has been astounding.

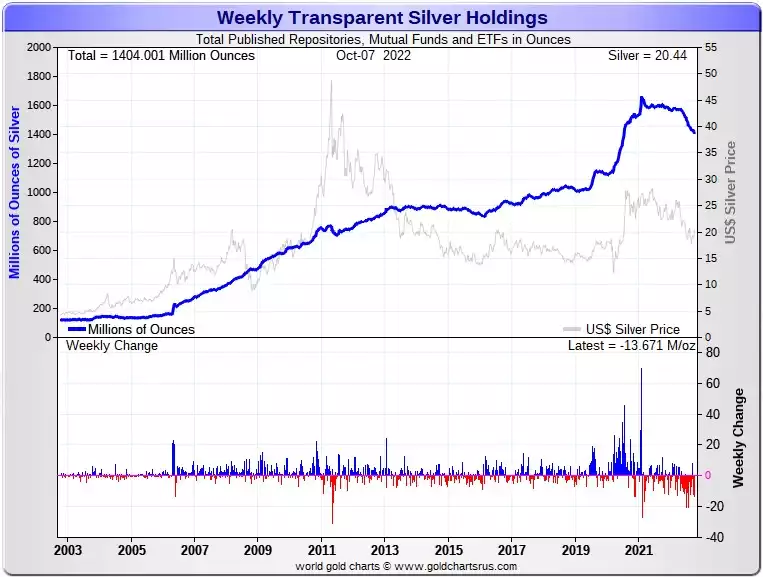

Anyone interested in this space on twitter or similar platforms has seen all the news about bullion dealers being drained of stock, particularly silver all around the world. Despite being one of the biggest in Australia, Ainslie too has succumb to the mismatch of massive demand and the logistics of keeping up silver supply. As Bloomberg state, its not just gold:

“In India, it is silver that is seeing big premiums. The differential has soared recently to $1, more than triple the usual level, according to consultancy Metals Focus Ltd.

“Right now the demand for silver is huge as traders restock,” said Chirag Sheth, the firm’s principal consultant in Mumbai. “Premiums could remain elevated during the festival season that concludes with Diwali.””

Also from Bloomberg:

“Traders say they are facing other logistical challenges as well, which are contributing to the high Asian premiums.

“Getting stuff on boats or on planes is a bit harder than it used to be,” said MKS PAMP’s Stefans. “It’s really just a classic example of demand far out-pacing supply.””

The Asian market is one with a much longer and deeper appreciation and affinity with gold and silver. The West is a more fickle market with a much higher appetite for and trust of financialised paper derivatives. The beauty of this dynamic is a solid floor in the pricing. Secondly, Asian buyers are generally more ‘sticky’, holding their gold for much longer, if not indefinitely. That means that such runs on supply like this tend to have a large element of removal of something already rare from the market in the long term.

************************************************************************************

GOT A QUESTION about today's news?

This afternoon, the Gold & Silver Standard Insights team will be breaking down the news and answering YOUR questions.

Submit your question to [email protected] and SUBSCRIBE to the YouTube Channel to be notified when the GSS Insights video is live.

**********************************************************************************