Gold & Silver Prospects in 6 Charts

News

|

Posted 06/06/2022

|

12379

Its Monday morning so lets keep the words to a minimum and check out some compelling charts for gold and silver.

First, that cup & handle formation we keep banging on about just gets better and better…

On Friday night we saw more red on the S&P500, down another 1.6% tellingly because the NFP payrolls, whilst weaker, was better than expected. Beware a market falling on good news because it is pricing in a Fed pause on tightening… The setup now of gold v S&P500 is incredibly bullish…

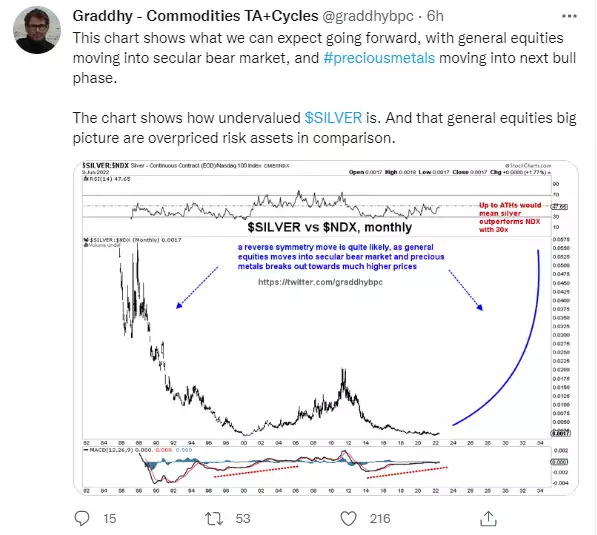

But for as overpriced as the S&P500 is, it pales against the tech heavy NASDAQ (NDX - which fell another 2.5% Friday night) and the picture there of silver against it is epic:

Tying the 2 charts above it is important to look at the USD. The chart below talks to the expanding wedge but it is clearly looking like the dreaded ‘triple top’ mark as well. That ordinarily sees capitulation which is normally constructive for gold when that denominator is the USD…

Now lets tie the last 2 charts together. The S&P500 and NASDAQ have been inflated through the decimation of the denominator through unprecedented money printing. That same campaign of debasing the USD could precipitate that fall after this triple top. The USD has held strong because everything is relative in FX and the basket of currencies against which the USD is ordinarily measured have been as debased at the US itself and often more. Many will argue that M2, currency supply, is only a fraction of the impact of QE and zero rates and hence the position is understated. Regardless, the picture below is clear and the prospect for precious metals in general and silver in particular looks tantalising.

Kind of feels like one giant silver coiled spring doesn’t it?

And finally, zooming right back for further context. On Friday we presented the big movers in central banks buying up gold. 2nd place was Turkey in terms of gold held in reserves. Remembering gold preserves wealth against debased currencies and in the face of the accompanying inflation that makes a whole lot of sense when you see Turkey is currently seeing 73.5% CPI, and their PPI last week printing an incredible 132% PPI (inflation at the producer end)!

If you were in Turkey and held gold, you’ve seen it rise lock stop against the Lira losing literally half its value, i.e double.

There is no substitution for real monetary assets in this period of reckoning of reckless currency debasement.