Gold & Silver Investment Demand Before & After the GFC

News

|

Posted 27/03/2019

|

9160

Last year was the strongest year of central bank gold demand since we left the gold standard in 1971, some 651 tonne net buying. We’ve written in the past of the reverse in net selling that occurred from 1971 to the GFC. The GFC marked the ‘oh sh!t’ moment’ for central banks when they saw a glimpse of the ramifications of the world’s biggest ever credit bubble since they left the discipline of the gold standard. They were reminded of the need to hold gold and since then have been strong net buyers every single year.

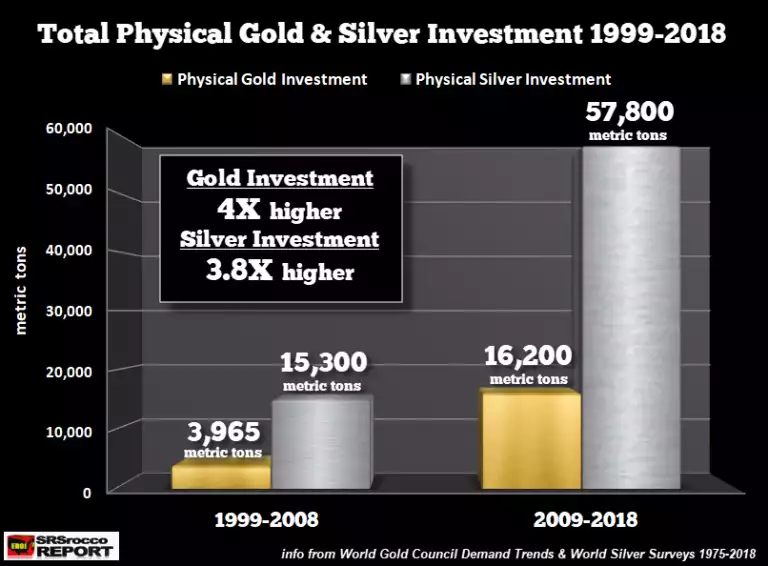

But it is not just central banks who have been big buyers since the GFC. The chart below shows the investment (bars and coins) demand for gold and silver over the last decade since the GFC and compares it to the decade before. It is self explanatory showing a quadrupling of demand for both metals.

The chart above is notable however for a couple of reasons beyond the obvious. The advent of ETF’s, now a massive component of demand only came into being mid way through that previous decade and is not represented in that chart. Gold demand is via World Gold Council which a number of specialised gold analysts believe woefully underestimates Chinese demand (better estimated through SGE consumption and often by a factor of 2).

Now let’s look at that 4x ratio in further context. Over that period mine supply has increased just 1.7 times (approx. 17,000 tonne to 27,000 tonne) and the gold:silver ratio has gone from being in the 50’s to now in the 80’s, and yet as demand has expanded about the same for both metals at around 4x, further reinforcing how nonsensical that sky high GSR really is.

As we started, the GFC was the first real reality check of the inescapable ramifications of endless debt, derivatives, and monetary stimulus. Since then both central banks and investors have been quietly positioning into precious metals at a rate over double mine production. When we have that day of reckoning with what, in theory, should be a crash to make the GFC look like a picnic, one can only imagine the demand into this relatively tiny market. Just remember we having around $300 trillion in financial assets, a lot of which might try and get into that $1.5 trillion gold market.