Gold & Silver About to “Skyrocket”

News

|

Posted 29/11/2019

|

22257

Elliot Wave technical analyst Avi Gilburt has a very strong following, earned from getting it right more than most. Whilst a subscription based service he occasionally shares his views and his latest is calling the bottom in (or nearly so) on this correction in gold and silver since September after that very strong mid year rally. He called that rally and he called that correction, so his latest advice titled “Sentiment Speaks: Metals Getting Ready To Skyrocket Again” may be well worth listening too.

“Back in May, I was suggesting to my subscribers that we are likely bottoming and getting ready for the next rally in the metals complex. Then, in early June, I penned a public article entitled "Strap Yourselves In - Gold May Take Off Like A Rocketship."

Then, in mid-August, I was looking for one more extension to be seen in the complex (which turned out to be a bit shorter than I initially expected). However, my expectation also outlined that once that next push higher completed, we would likely see a multi-week to multi-month pullback/consolidation in the metals market.

As we now know, the metals began a strong rally just as I was suggesting to my subscribers to buy back into the complex, with the follow-through to the upside seen at the time of my public article. Then, in early September, the metals began a 3-month pullback/consolidation as we expected.

At this point in time, I am seeing the potential for the market to be bottoming out again. But, please also recognize that we still run a risk of one more spike lower before this pullback completes. However, we seem to be coming to the conclusion of this pullback/consolidation we expected back at the end of August.

What is most interesting is that one of my subscribers pointed out that gold exchange-traded fund investors were selling off their holdings. In fact, recently, over $620 million was withdrawn from State Street's SPDR Gold Shares, the most since October 2016. This is often a sign that the metals are bottoming out.”

Gilburt only quantifies where he sees gold shares taking off to on the GDX VanEck Gold Miners ETF where he sees it going from the current US$26.6 to US$43/45, i.e nearly doubling! One would expect a similar performance of the real thing, gold and silver.

Gilburt is not alone amongst analysts. Highly acclaimed (literally ranked #1 in the Motley Fool® CAPS stock picking contest during parts of 2008 and 2009, out of 60,000+ portfolios) Paul Franke just published the following this week. First he talks to seasonality and then technical analysis:

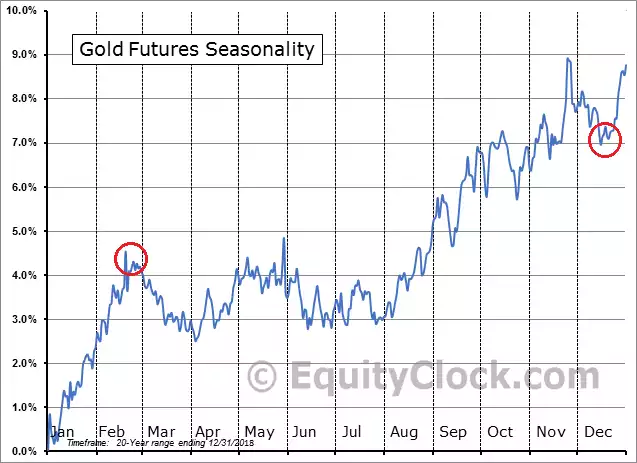

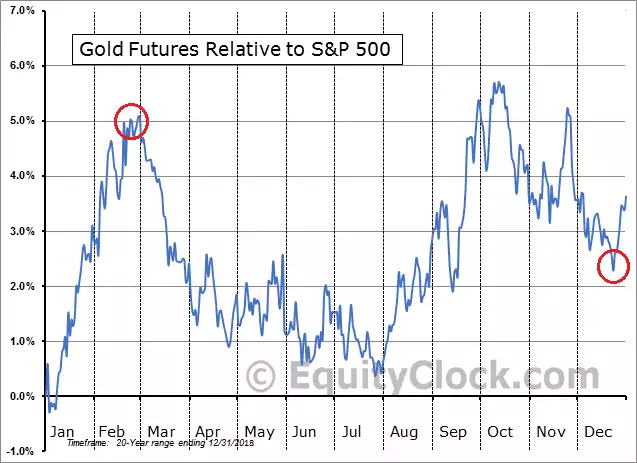

“Based on my personal trading and tracking of gold/silver prices over the decades, the absolute best time to own gold and silver seasonally is mid-December to late February. During the past 5 years, gold and particularly silver have had some great upside runs over this 10-12 week span. You can review a long-term 20-year seasonal gold chart below from Equity Clock. In a nutshell, the “average” gain in gold priced in U.S. Dollar has been +6.5% over 3 months starting in December. Additionally, gold has actually “outperformed” the S&P 500 by about +6% over the same period. I have marked the beginning and end points with red circles.

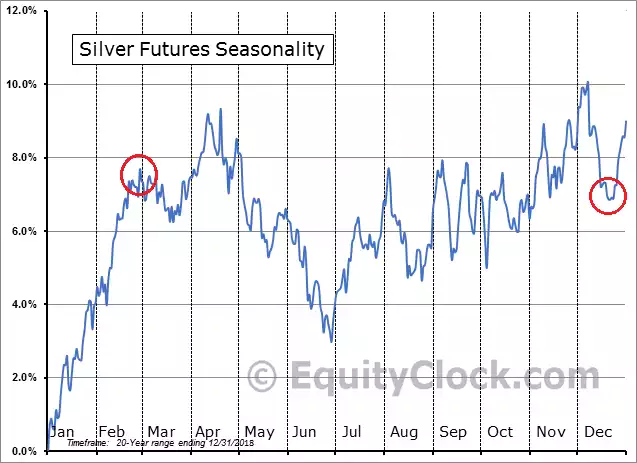

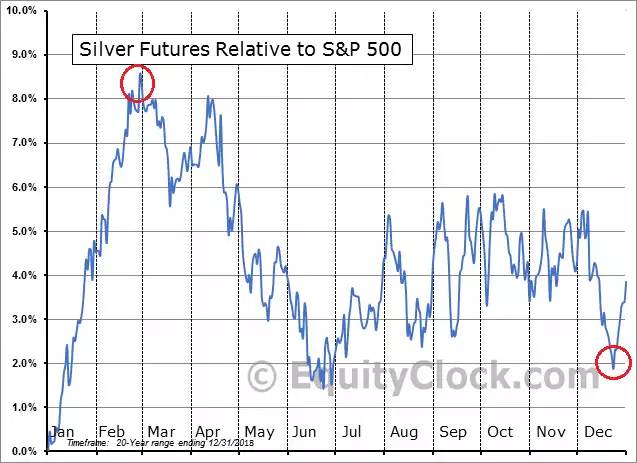

“Silver has performed even better measured from December to the end of February. Gains of closer to +10% have been the norm the last 20 years. In fact, if you had owned silver during this 3-month span only, each year the past two decades, an investor would have achieved about the same return as holding silver the entire year, all 20 years! Please review the seasonal silver charts below.

“I am posting 5-year charts for gold and silver prices below. You can view for yourself plenty of important bottoms in the month of December.

We should note that both Gilbert and Franke believe we could see further weakness in the next fortnight before it takes off, however history tells us no one picks bottoms, except of course monkeys….