Gold Shines Amid Disappointing Profits and Rising Job Losses

News

|

Posted 27/04/2023

|

11803

Earnings Season Uncovers Hidden Weaknesses

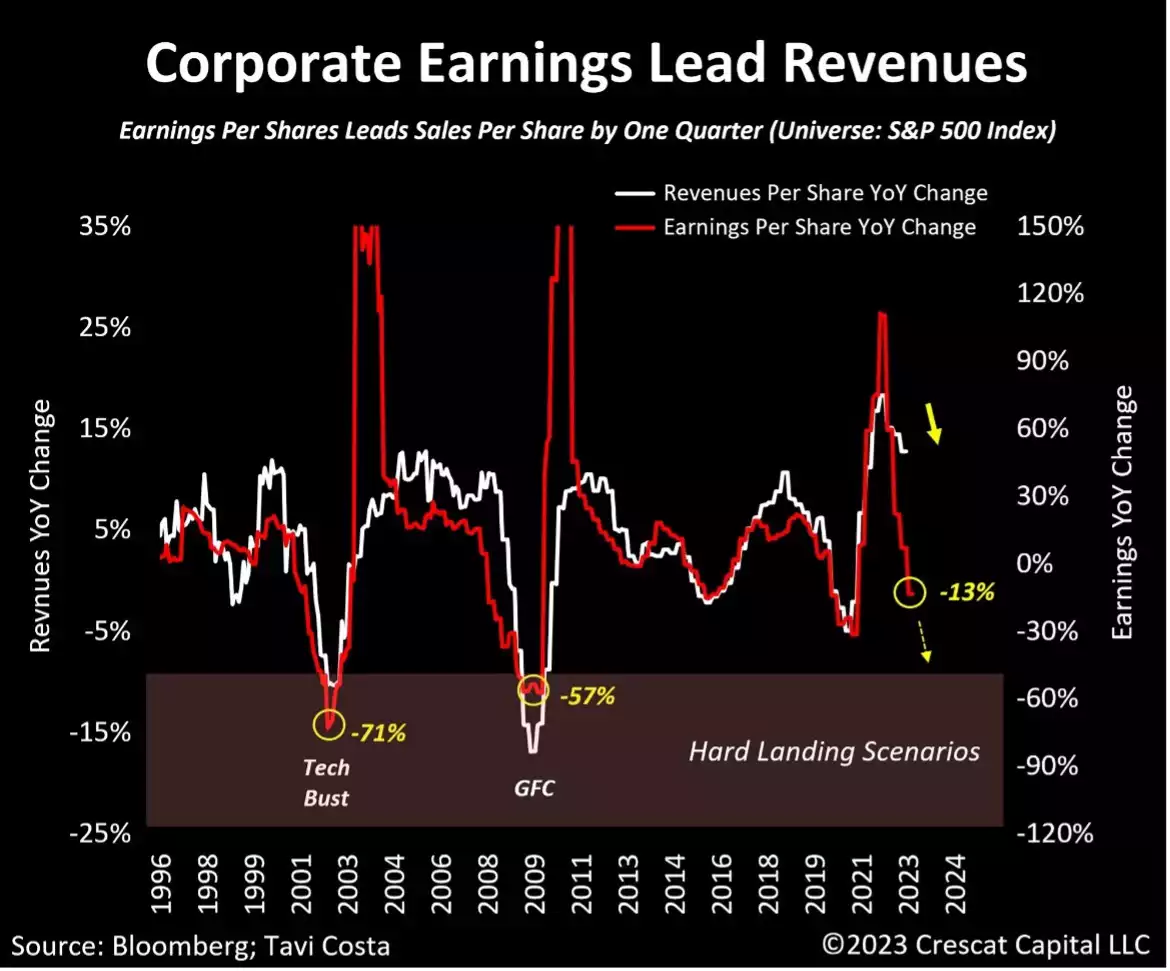

One of the key takeaways from the current earnings season is that profits have started to disappoint, even though revenues have remained resilient. This trend is often observed during downturns in the business cycle. Historical data suggests that changes in earnings per share (EPS) usually precede shifts in top-line growth by around one quarter. Recent reports reveal that corporate profits have fallen by a whopping 13%. When comparing this trend to past hard-landing scenarios, such as the Tech Bust and the Global Financial Crisis, earnings contracted by 71% and 54%, respectively. There is a reasonably high likelihood of a similar macroeconomic event happening now, and it's clear that the current valuation of the overall equity market does not yet account for this significant risk. The present downturn began with one of the most expensive stock markets in history – the reckless use of QE during the pandemic leading to unsustainable earnings growth. The looming question demonstrated below is: has earnings only just begun to feel the pain of this business cycle?

Unsustainable Earnings Growth and Market Complacency

Despite basic EPS being near all-time highs, there has been a significant contraction in diluted earnings. Corporate fundamentals, like the economy, experience short and long-term cycles, and we are likely witnessing the peak of another prolonged period of unsustainable earnings growth. Market participants often become complacent during times of sustained expansion, if the exceptional growth will continue indefinitely. However, history tells a different story.

The 2010s saw an unprecedented surge in earnings, like the developments that took place during the 1920s and 1990s. Both of those decades were characterised by exceptional economic growth, followed by significant contractions during the Great Depression and the Tech Bust, respectively. Today, the risk of a major decline in corporate fundamentals is likely due to mounting pressures from increasing labour and material costs, deglobalisation challenges, and significantly higher capital costs. Notably, the aggregate earnings per share for the S&P 500 index has been contained within a rising 70-year channel, with the upper range historically marking critical turning points. Currently, at peak levels, we are at another pivotal moment.

The Hidden Deterioration of the Labour Market

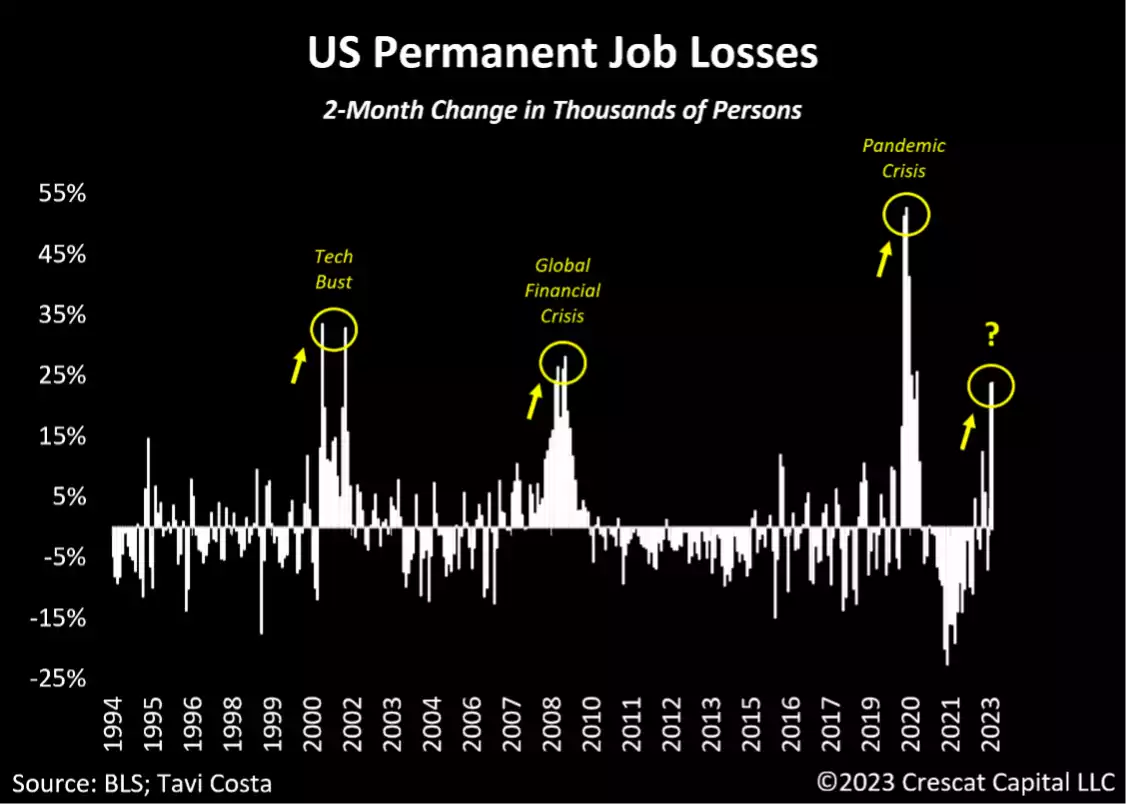

What’s the net result of these factors? Well, unemployment. While the unemployment rate remains below 4%, the number of permanent job losses has started to rise considerably. The recent two-month increase has been as steep as those observed during every recession over the past 30 years. Layoffs in higher-paying jobs have become more prevalent, leading to an increase in permanent job losses. As an illustration of this dynamic, consider that on Friday, Facebook let go of 4,000 employees, raising their total workforce reduction to 25,000 since November.

It's crucial to note that the current strength of the labour market is being masked by the ongoing demand for workers in lower-skilled positions. The overall labour market is not as healthy as it appears, with 1.55 million people now classified as permanent job losers – shown below.

With a significant economic downturn and job losses potentially on the horizon, gold could provide a sense of stability and security for investors aiming to safeguard their wealth. To offer some perspective, here's a reminder of gold's performance during previous economic downturns:

2008

ASX: -40.4%

Gold: +28.0%

1987

ASX: -3.9%

Gold: +28.9%

1974

ASX: -26.9%

Gold: +87.0%

1973

ASX: -23.3%

Gold: +49.0%