Gold Outlook 2022 pt2 – World Gold Council

News

|

Posted 17/01/2022

|

13137

On Friday we brought you part 1 of the latest World Gold Council Gold Outlook 2022 report. Today the second part talks to inflation, real interest rates, market volatility and gold drivers outside all of that.

Opinion is divided, but inflation may linger

Many central banks initially played down inflation concerns, and while some, such as the Fed, have acknowledged upside risks, there’s an underlying expectation that inflation will dissipate. Investors seem to be less sure, but opinions vary. Anecdotally, these views were echoed in a LinkedIn poll we conducted last December. While the vast majority expected inflation to remain high, more than one in four respondents thought it would cool down.

We believe there are multiple reasons why inflation will remain high, partly stemming from the unprecedented monetary and fiscal policies put in place to alleviate the effects of the COVID-19 pandemic. In particular:

- lingering supply-chain disruptions from the initial COVID wave and subsequent dislocations as new variants continue to emerge5

- tight labour markets, which, combined with COVID fatigue, have increased the number of people voluntarily looking for new, better-paid opportunities

- higher average savings from 2020, which have contributed to lofty valuations in various financial markets

- high commodity prices.

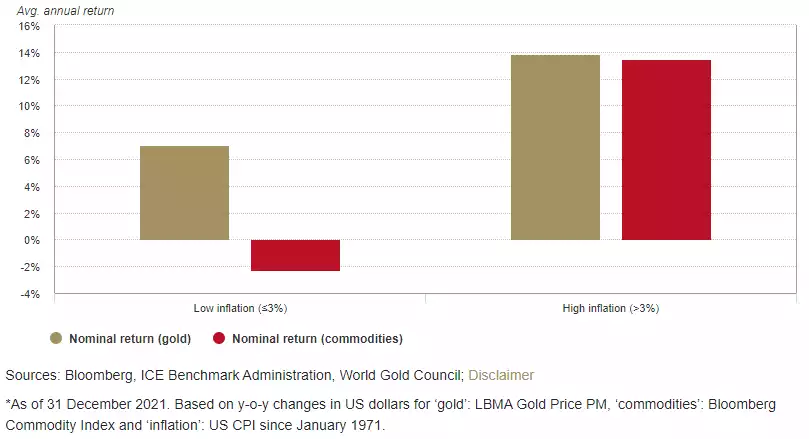

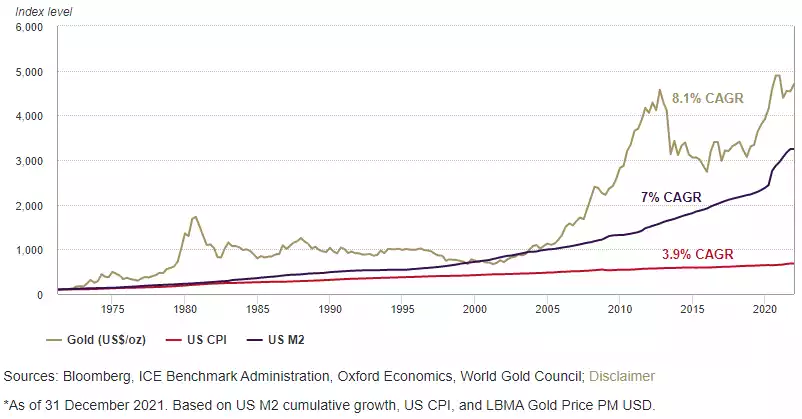

Gold has historically performed well amid high inflation. In years when inflation was higher than 3%, gold’s price increased 14% on average (Chart 4). Further, in the long run, gold has outpaced US inflation and moved closer in pace to money supply, which has significantly increased in recent years (Chart 5).

Chart 4: Gold historically performs well in periods of high inflation

Gold and commodity nominal returns in US dollars as a function of annual inflation*

Chart 5: Gold has kept up with money supply growth

Gold (US$/oz), US M2, US CPI indexed: Q1 1971 = 100*

Amid opposing forces, real rates will likely remain low

Despite potential rate hikes by some central banks, nominal rates will remain low from a historical perspective. Even more so, elevated inflation will likely keep real rates depressed (Chart 6). This is important for gold since gold’s short- and medium-term performance tends to often respond to real rates, which combine two important drivers of gold performance: “opportunity cost” and “risk and uncertainty”.

Further, low interest rates – both nominal and real – are shifting investment portfolios more towards risk-on assets. And this, in turn, as we discuss in one of our recent reports, increases the need for a high-quality liquid asset such as gold.

Chart 6: Both nominal and real interest rates are at or near historically low levels

US 10-year Treasury nominal and real yield*

Investors are ready to turn the page on COVID, but market pullbacks may persist

It’s been two years since the start of the pandemic and the world seems ready to move on: global stock markets have strongly rebounded from their 2020 lows, albeit at different rates. But “tail events” have also been on the rise (Chart 7).

Chart 7: Pullbacks have become more frequent

Kurtosis of S&P 500 returns*

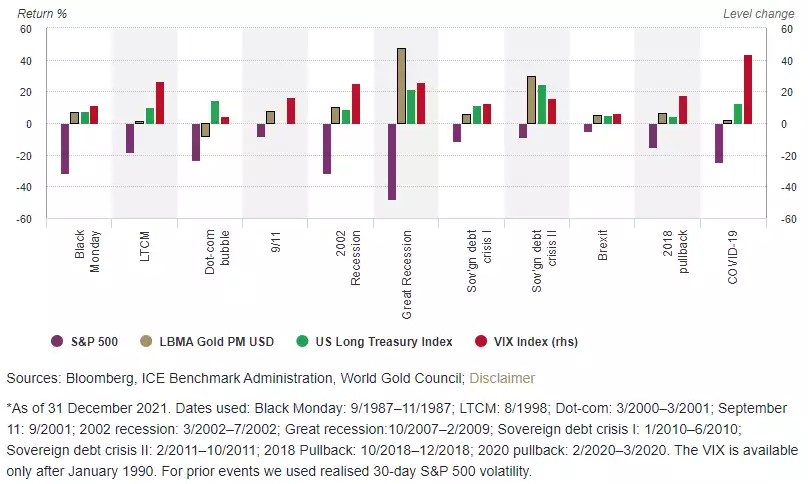

Pullbacks are likely to continue in the face of the seemingly endless stream of new variants, as well as simmering geopolitical tensions and overall buoyant equity valuations fuelled by a long-lasting ultra-low-rate environment. In this context, gold can be a valuable risk management tool in an investor’s arsenal. Gold has a proven historical record of mitigating the negative impact of equity market pullbacks in periods of systemic risk (Chart 8).

Chart 8: Gold tends to perform well in periods of significant market pullbacks

Performance of gold, US Treasuries and S&P 500 during VIX spikes*

Gold’s performance is not only linked to investment

It is often assumed that gold’s price behaviour is linked to investment demand, especially from financial instruments such as gold ETFs, over-the-counter contracts, or exchange-traded derivatives. This is only partly true. Shorter-term and more significant price movements do tend to respond to variables associated with these types of gold investments; for example, interest rates, inflation, exchange rates, and, more generally, flight-to-quality flows.

However, our analysis shows that gold’s performance is also linked to other components of demand, such as jewellery, technology, and central banks. While these do not typically result in the large price movements associated with investment, they help underpin gold price performance by either providing support, or creating headwinds.

We believe that gold can still receive positive – if modest – support in 2022 from key jewellery markets, such as India. However, there’s a chance that further Chinese economic slowdown may limit the contribution from local gold jewellery demand.

Finally, central bank gold demand, which rebounded in 2021, may remain an important source of demand. There are good reasons why central banks favour gold as part of their foreign reserves which, combined with the low interest rate environment, continue to make gold attractive. This was also evidenced by the fact that two developed market central banks last year joined the list of buyers which has been dominated by emerging market banks since 2010.

Gold’s behaviour will depend on which factors tip the scale

Gold will likely face two key headwinds during 2022:

- higher nominal interest rates

- a potentially stronger dollar.

However, the negative effect from these two drivers may be offset by other supporting factors, including:

- high, persistent inflation

- market volatility linked to COVID, geopolitics, etc.

- robust demand from other sectors such as central banks and jewellery.

Against this backdrop, gold’s performance during 2022 will ultimately be determined by which factors tip the scale. Yet, gold’s relevance as a risk hedge will be particularly relevant for investors this year.