Gold Holds Firm Amid USD Strength

News

|

Posted 23/01/2025

|

1615

In a recent report published by Oanda, the markets showed that precious metals had mixed results over the last month, with gold prices rising marginally by 0.1%, closing at US$2,600/oz. This follows a year of strong gains, with prices up 31.1% year-on-year. Platinum also posted gains of 1.5%, while silver saw a dip of 5.2%.

Gold Weathers U.S. Rate Pressures

The U.S. continues to put pressure on gold, with rising interest rates and a stronger U.S. dollar driving market conditions. The US dollar index is up 6% since September, making gold more expensive in USD terms. However, for Australian investors, the weakening Australian dollar has amplified gold’s strength, with prices rising even more sharply in AUD terms. Central banks and long-term investor demand keep demand strong.

China’s Role in the Market

China remains a key player in the gold market, with the report showing that in 2024, Chinese gold-backed ETF holdings rose an incredible 53.3 tonnes (+86.7% year-on-year), driven by low domestic savings rates and the appeal of gold as a hedge against inflation and currency risks. This trend is expected to grow, with projections suggesting the ETFs could triple in size by 2030, reshaping global gold demand.

Jewellery Demand Eases as Investors Step Up

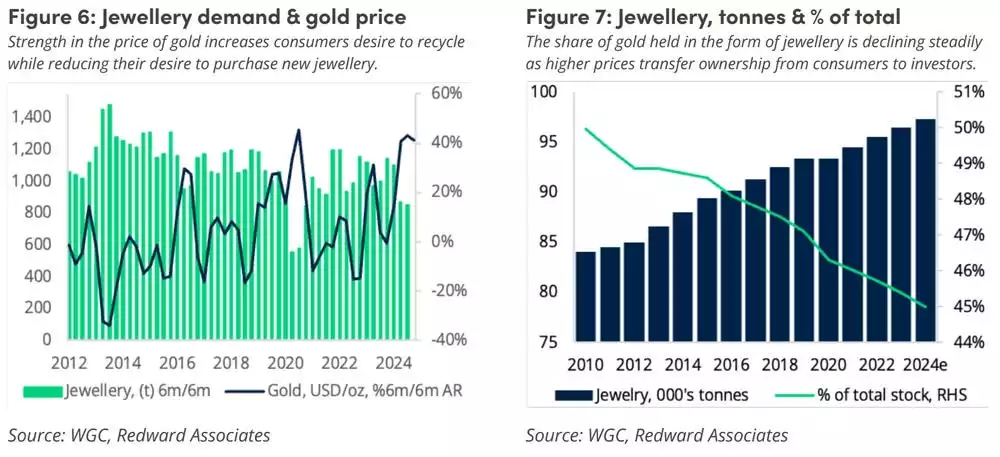

High gold prices are starting to take the shine off jewellery demand, particularly in China where people are becoming more conscious of rising costs. In India, there was a brief uptick after customs duties on gold were cut, but that surge is expected to cool down next year. Globally, jewellery now makes up about 39% of total gold demand, down from 50% a decade ago. Highlighting a significant shift as gold moves away from being purely a luxury purchase to an investment option for both central banks and private investors.

Gold Outlook

Gold’s current consolidation phase shows stability, with prices well above the 200-day moving average of US$2,494/oz. With volatility on the lower side, technical indicators point to a promising trend for the remainder of the year. Central bank buying remains strong, and gold-backed ETFs continue to draw investor interest, further reinforcing the metal’s long-term strength.