"Gold Has Immunity To The Virus" – Goldman Sachs

News

|

Posted 09/03/2020

|

14565

As the reality of the seriousness of Coronavirus is setting in on numbers coming out of Italy overnight to name but one, we are seeing more and more people moving to protect their wealth from the ramifications. Yesterday Dr Richard Hatchett, who sat on the White House Homeland Security Council in 2005 - 2006 and was a principal author of the US’s National Strategy for Pandemic Influenza Implementation Plan gave a very grave warning:

"This is the most frightening disease I've ever encountered in my career, and that includes Ebola, it includes MERS, it includes SARS. And it's frightening because of the combination of infectiousness and a lethality that appears to be manyfold higher than flu."

The virus may or may not get worse and last longer than some believe but the economic implications are likely already beyond repair and hence the sharemakets cratering again Friday night and why gold and silver just jumped another 2% this morning on opening. As we have been warning for some time the global economy is a bubble awaiting a prick. No one really knew what that prick would be and to be fair few ever do. These Black Swan events can come out of left field but it is the strung out, over inflated, interconnected and debt laden financial system that is the root cause, not the catalyst. Coronavirus is just a catalyst but it is unleashing, and is almost certainly going to continue to unleash, pandemonium on financial markets.

Safe haven assets thrive in times of volatility and the VIX (Volatility Index) just hit a post GFC high on Friday night:

In addition to the falls on Wall Street on Friday the futures market is currently showing another 4% loss tonight. The Aussie sharemarket is looking to be brutal today as well dropping 3.9% on open.

We routinely share Bank of America’s ‘Asset Quilt’ below and it should be no surprise that gold is the best performing asset this year as its lack of correlation with financial assets comes to the fore again:

Goldman Sachs pointed out the obvious over the weekend:

“While so much about the current environment remains unclear, there's one thing that isn’t: gold, which—unlike people and our economies—is immune to the virus. It is the currency of last resort and avoids the concern that paper currencies could be a medium of transfer for the virus. As a result, gold has outperformed other safe haven assets like the Japanese Yen or Swiss Franc, a trend we see continuing as long as uncertainty around the full impact of COVID-19 remains.”

However whilst the performance has been solid this year it is way too early to talk of it peaking. From Barrons:

““The flows into gold are just getting started,” says Peter Grosskopf, chief executive of Sprott, a Toronto asset manager focused on precious metals. “Gold is now being seen as mandatory portfolio insurance and not a fringe asset.” He says that ownership of gold among institutional and retail investors remains low, with few even having Sprott’s recommended asset allocation of 5%.”

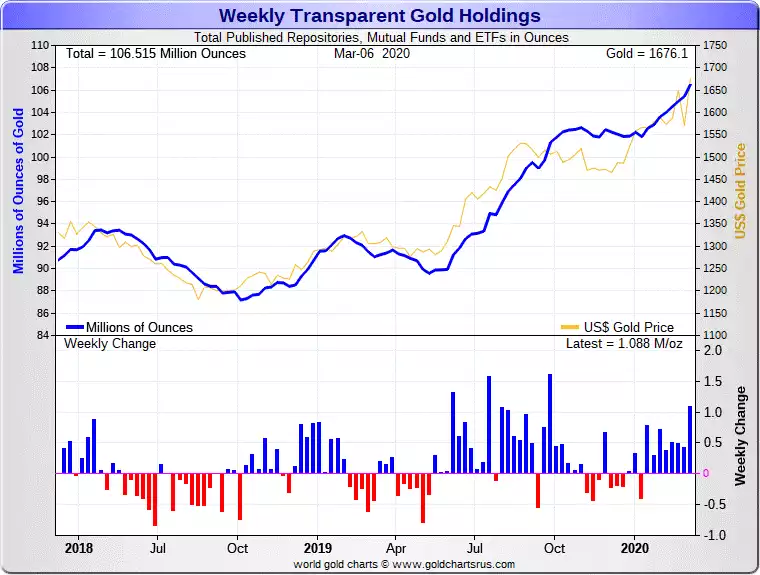

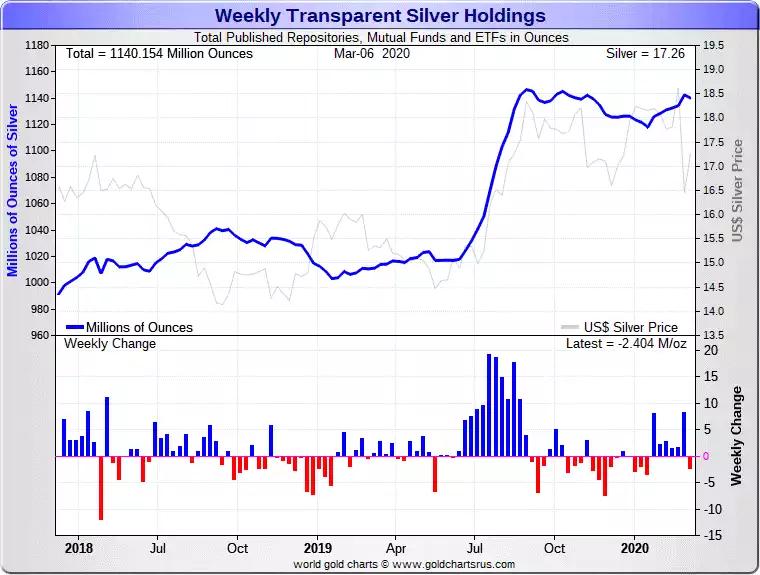

The charts below show all holdings of gold and silver by mutual funds and ETF’s. You can see the strong inflows we’ve reported recently from WGC updates. You can see too the disconnect at present between the silver price and these holdings which might be seen as a bullish signal for the silver price.

Whilst these ETF vehicles are the preference for the managed funds reallocating into gold, they don’t make a lot of sense for your personal or super investment. GLD, the biggest ETF, not only has the counterparty risk of that opaque derivative vehicle (as we have outlined here) but also a 0.4% annual charge. If you store your bullion at Reserve Vault or in a storage account with us you are paying a similar or lower rate but without any counterparty risk. Store it at home and you have no costs. Either way you have real bullion secured independently of a digitally based financial system subject to whatever comes our way with this pandemic.

Our trademark is “Balance your wealth in an unbalanced world” and we’d respectfully suggest the wheels right now are getting pretty wobbly. Are you prepared?