Gold Demand Trends Q1 2022 up 34%

News

|

Posted 25/05/2022

|

10974

The World Gold Council recently released their first quarter gold demand trends report for 2022. As usual we give you an expanded summary of this quarterly snapshot of global demand and supply.

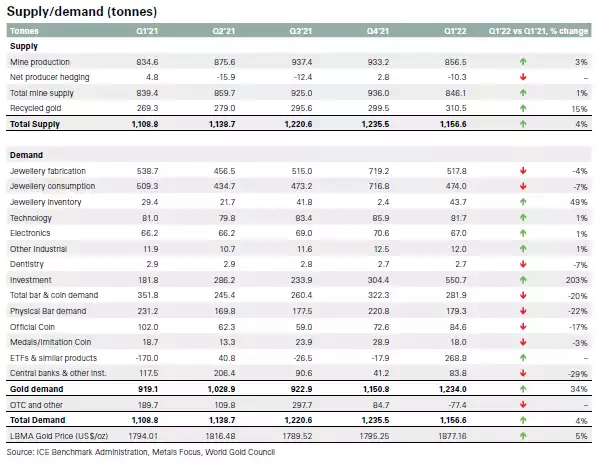

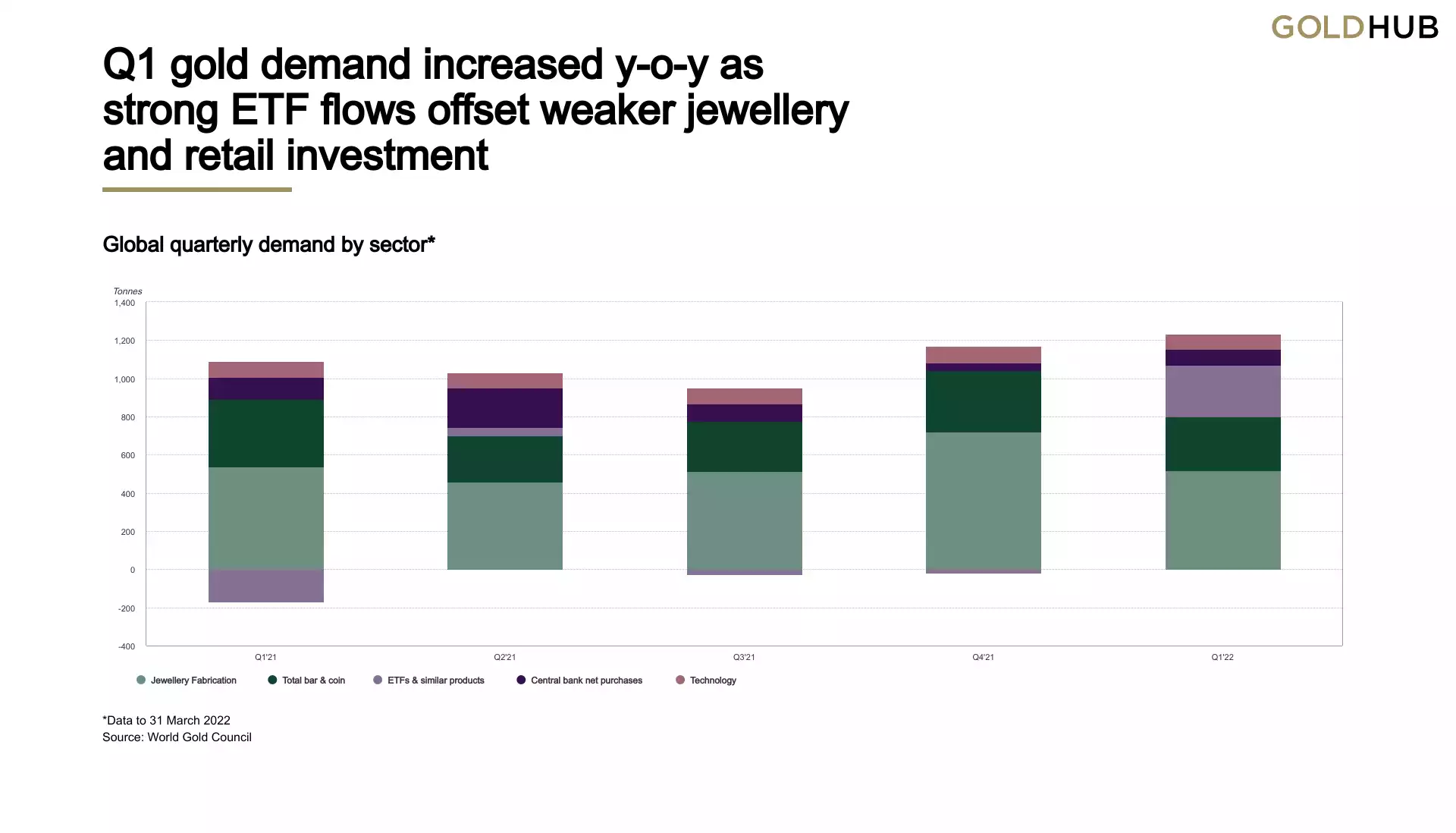

“In a quarter that saw the US dollar gold price rise by 8%, gold demand (excluding OTC) increased 34% y-o-y to 1,234t – the highest since Q4 2018 and 19% above the five-year average of 1,039t.

The Ukraine invasion and surging inflation were key factors driving both the gold price and demand.

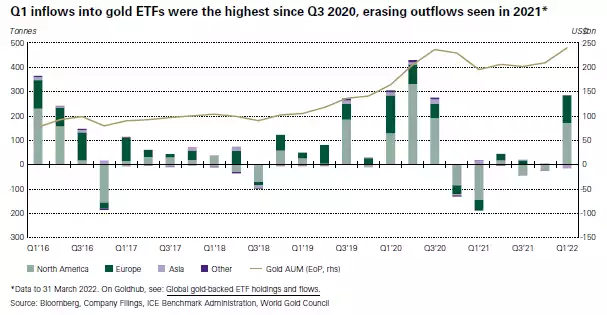

Gold ETFs had their strongest quarterly inflows since Q3 2020, fuelled by safe-haven demand. Holdings jumped by 269t, more than reversing the 174t annual net outflow from 2021.

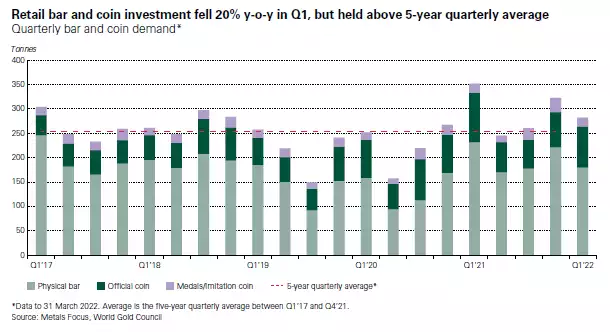

Bar and coin investment was 282t in Q1, 20% lower than the very strong Q1’21 but 11% above its five-year quarterly average. Renewed lockdowns in China and historically high local prices in Turkey were key contributors to the y-o-y decline.

Jewellery consumption lost momentum in Q1: demand was down 7% y-o-y at 474t. The drop was largely due to softer demand in China and India.

Central banks added 84t to global official gold reserves during the first quarter. Net buying more than doubled from the previous quarter but fell 29% short of Q1'21.

The technology sector had a steady start to the year: demand of 82t was the highest for a first quarter since 2018, driven by a modest uptick in gold used in electronics.

In more detail:

Jewellery

- Global gold jewellery consumption was 7% lower y-o-y at 474t, partly as a result of high gold prices

- However, much of the weakness came from China, which was affected by COVID-related lockdowns, and India, where there was a relative lack of auspicious days

- In value terms, Q1 demand was 3% weaker y-o-y at US$29bn.

Investment

- Global gold ETFs attracted 269t of inflows in Q1, more than reversing last year’s 174t annual net outflow

- Retail investment in gold was healthy compared with longer-term averages, but down 20% y-o-y, reflecting weakness in China, Turkey and Japan

- Overall investment demand more than trebled, from 182t in Q1’21, to 551t in Q1’22.

Central Banks

- Central bank gold demand in Q1 more than doubled q-o-q, but was 29% lower y-o-y

- Our survey findings show that central banks highly value gold’s performance during time of crisis

- At a country-level, both sizeable purchases and sales were seen during the quarter.

Technology

- Gold demand in the technology sector rose by 1% y-o-y to 82t during Q1, the highest total for a first quarter since 2018

- Demand in the electronics sector continued to recover, rising 1% y-o-y to 67t

- Other industrial applications also experienced a modest increase, rising 1% y-o-y to 12t, while dental demand continued to decline with a fall of 7% y-o-y to 3t.

Supply

- Q1 mine production increased 3% y-o-y to a record level for the first quarter

- Recycled gold supply jumped 15% y-o-y as the gold price increased

- Producer de-hedging of 20t was noted, continuing the full year 2020 and 2021 trend.

As our own sidenote, we have written in the past about various experts calling ‘peak gold’ in 2016 and the chart above needs the context of a catch up in mine supply from COVID lockdowns of 3% but the new peak being supported by the surge in recycled gold on higher prices.There is little evidence still that mine supply hasn’t peaked, and certainly investment in exploration and capex supports the case it has.

And so in summary: