Gold Demand Hits New High Amid Record Prices

News

|

Posted 06/11/2025

|

5775

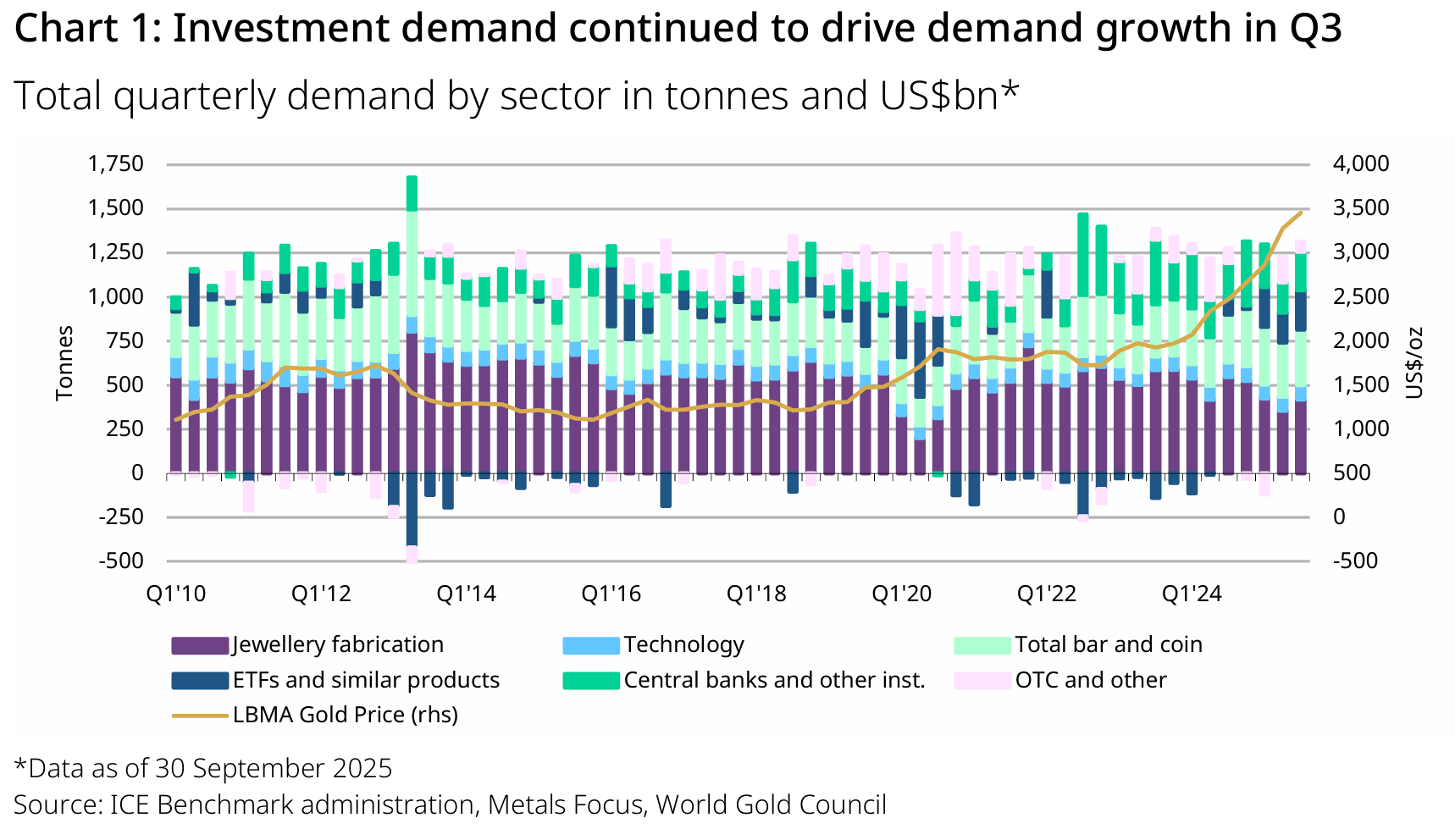

The World Gold Council’s latest Gold Demand Trends report shows global demand reached a record 1,313 tonnes in Q3 2025—up 3% year-on-year—despite pressure from record-high prices. The surge in demand was led by investors, particularly those funnelling into gold-backed ETFs, which added 222t in Q3. In value terms, demand soared 44% to US$146bn, driven by a 16% quarter-on-quarter price rally that lifted the average gold price to US$3,456/oz.

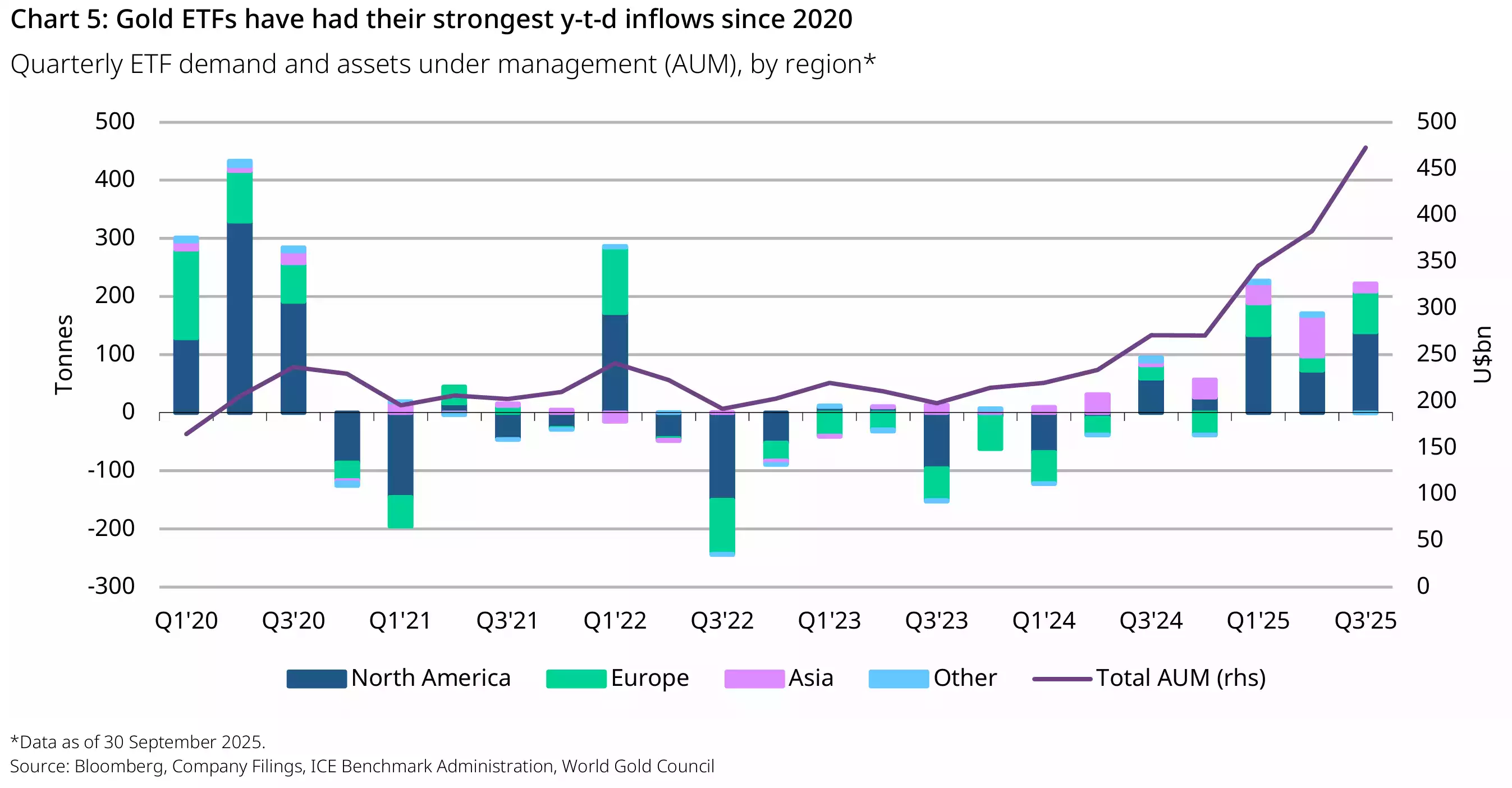

Investment the Primary Driver

The standout theme this quarter was investment. Total bar and coin demand held above 300t for the fourth straight quarter, with India and China leading gains. Fear-of-missing-out (FOMO) flows combined with safe-haven demand saw ETFs add more tonnes than any quarter since 2020, bringing global holdings within 2% of their all-time high. Retail demand was buoyed by rising prices, rather than deterred—a trend particularly visible in Asia.

Central Bank Buying Remains Resilient

Official sector demand also remained strong. Central banks purchased 220t in Q3, up 28% on Q2. While year-to-date buying lags 2022 and 2023 levels, it remains well above the long-term average. Notably, buying broadened in Q3, with Kazakhstan, Brazil and Guatemala among the more active purchasers. Central bank demand continues to reflect strategic diversification amid persistent macro uncertainty.

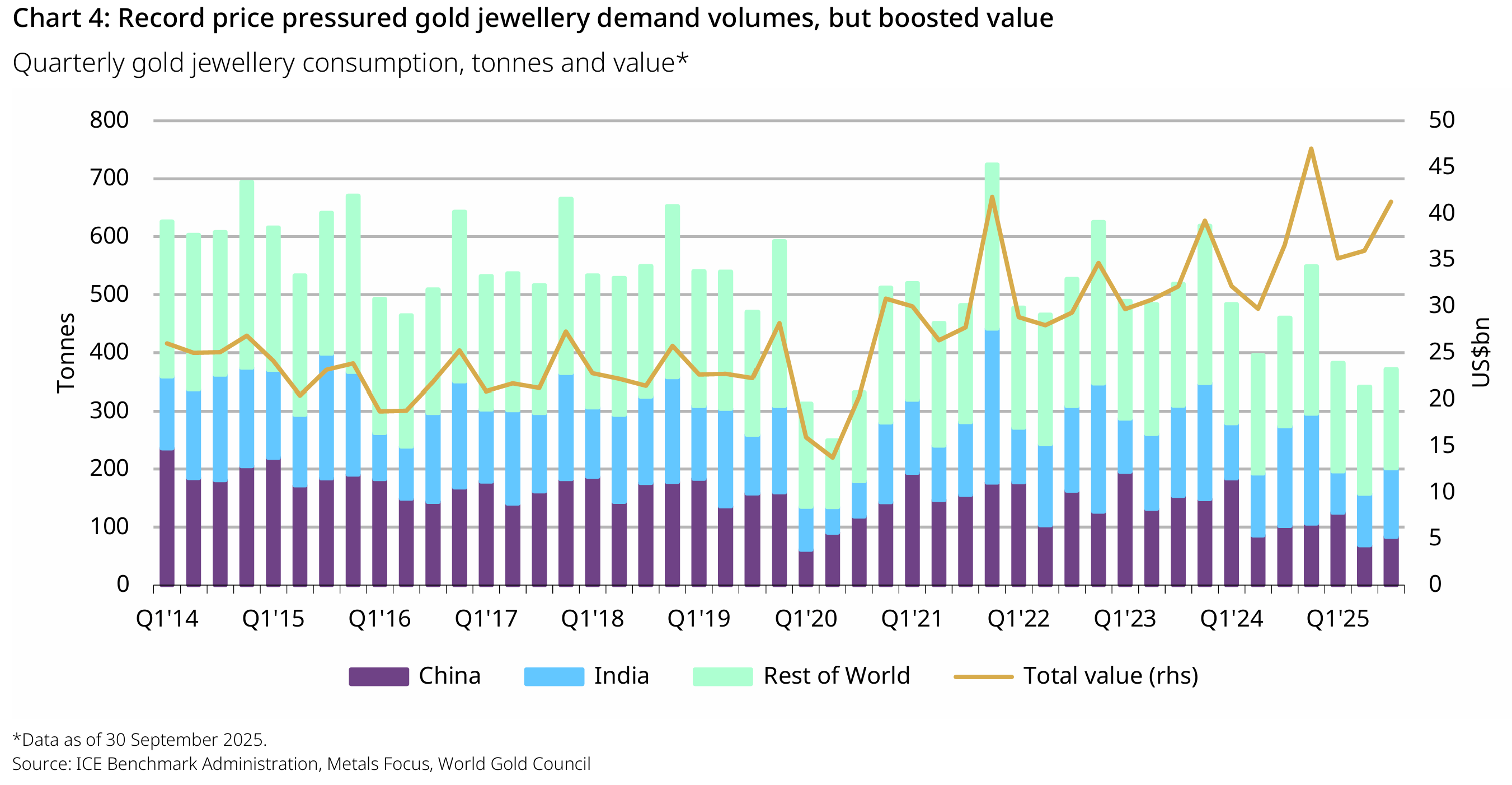

Jewellery Demand Weakens on Volume, Not Value

High prices weighed heavily on jewellery consumption, which fell 19% y/y to 371t—the weakest Q3 since 2020. Both China and India saw notable declines in volume, although value-based measures of demand rose as consumers spent more per item. In both markets, there are signs of substitution towards lighter or lower-carat pieces, and in some cases, bar and coin products replacing traditional jewellery.

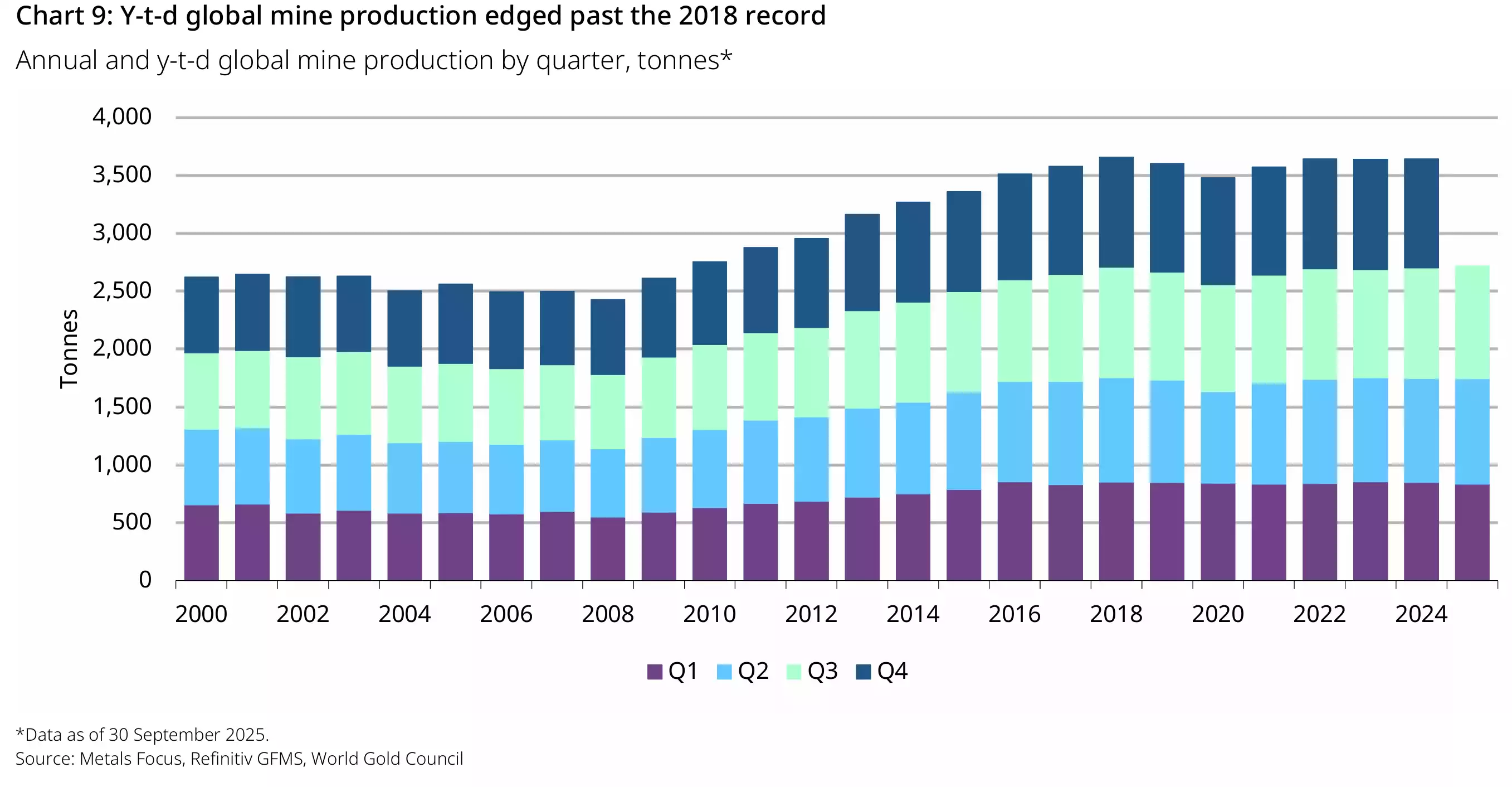

Supply Growth Lags Demand Momentum

Total supply rose 3% y/y to match demand at 1,313t, supported by seasonal gains in mine production (up 2% y/y) and continued high levels of recycling. Growth was led by new and expanding operations in Canada, Ghana and Australia. However, elevated gold prices have yet to trigger a notable increase in producer hedging or distress recycling—both indicators that market participants remain confident in the rally’s sustainability.

Looking ahead, the investment case for gold remains compelling as rate cut expectations, a weaker US dollar, and elevated geopolitical risk continue to drive inflows. With ETF holdings near record highs and bar and coin demand still strong, momentum appears firmly intact heading into year-end.