Gold Charges Toward US$3,000 As Futures Markets Light Up

News

|

Posted 11/02/2025

|

1991

The economic uncertainty gripping the world, inflamed by President Trump’s tariff spree, is causing big moves in the gold market. This week, Trump announced a new 25% tariff on all steel and aluminium imports to go with tariffs already announced on imports from Mexico, Canada and China. The party might not end there, with the Disruptor In Chief stating that he would apply tariffs to all countries that match the current tariff rates levied by each country on the USA.

The tariff plans are broadly viewed as inflationary and capable of sparking trade wars, thereby increasing the demand for safe-haven assets like bullion, traditionally regarded as a hedge against geopolitical instability.

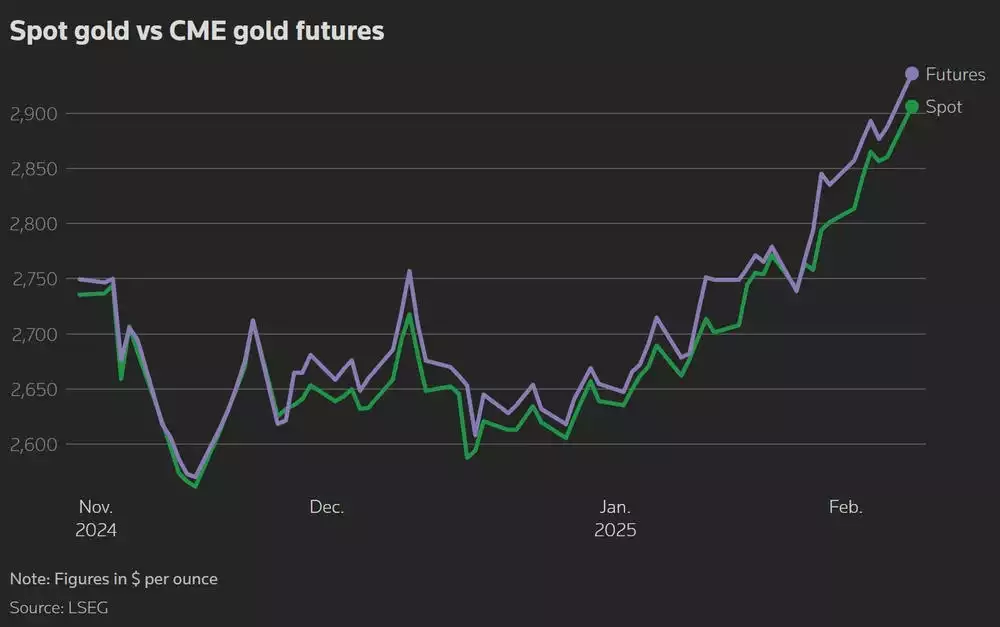

The recent surge in demand for gold is highlighted in the gold futures prices, which are trading at a premium to the spot price. If there is a shortage of registered physical gold in New York’s COMEX vaults but strong demand for deliverable futures, futures prices often rise relative to spot prices. These premiums have driven bullion banks to move gold from London, Dubai and Hong Kong trading hubs to New York to capitalise on the arbitrage opportunity. As we wrote about yesterday, the waiting period to withdraw gold has blown out due to the outflows from London.

If there is a shortage of registered gold in New York’s COMEX vaults, but there is strong demand for deliverable futures, futures prices can rise relative to spot prices.

After a cooling off in price following the U.S. election in November, gold’s rally has powered on, fuelled again by strong central bank buying. The World Gold Council reported a 54% increase in demand from central banks year-on-year in Q4 2024. The price has already gained 11.7% this year against the U.S. dollar and the major psychological level of US$3,000 is in sight.