Gold - Biggest Dip Since Last Year

News

|

Posted 27/05/2024

|

2006

The gold price took a heavy hit last week. The price touched the record high of US$2,449.89 at the start of the week, then pulled back by over US$100. That makes it the largest weekly dip since last year. This temporary decline is primarily due to uncertainty surrounding the Federal Reserve's interest rate policies.

What Happened?

The recent sell-off in gold was potentially compounded by profit-taking after gold hit its all-time high. The main factor was likely the hawkish signals from the Federal Reserve’s latest policy meeting. Speakers said that achieving their 2% inflation target might take longer than expected. Several Fed officials expressed hesitance to cut rates in the near term, which led to a stronger U.S. Dollar and a dip in gold.

The Long-Term Outlook: Stability and Growth

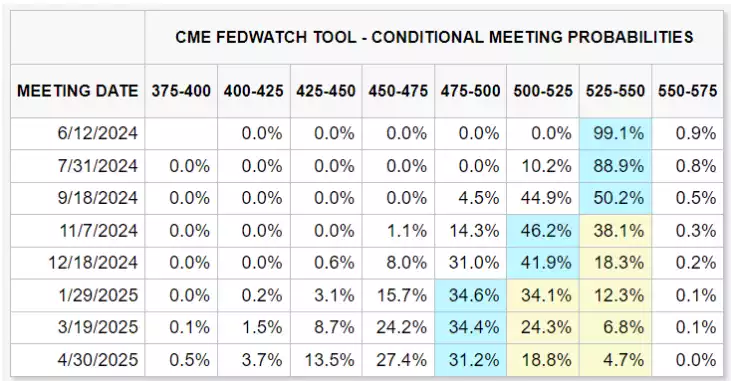

Higher interest rates might increase the opportunity cost of holding gold, but the Federal Reserve's current stance is not set in stone. Market expectations show a 63% chance of a rate cut by November, suggesting that the landscape could shift favourably for gold investors in the near future.

*Note the date format: Month/Day/Year

Source: CME.

Global Demand

Gold prices have already seen a 17% gain this year driven by demand from China and ongoing geopolitical uncertainties. There is a possibility that Chinese retail demand may slow in the second half of the year. This could be the result of the Chinese government trying to excite the population back into the stock market and reinflating major companies with easy money. That would be a major test to see if the retail market in China can be led astray from the multi-thousand-year-old safe haven. Any potential dip in Chinese demand could possibly be offset by renewed interest from Western investors, particularly if the Fed’s policy evolves and given China’s looser monetary policy drives up global liquidity.

Market Reactions: Short-term vs Medium-term

Recent market movements have highlighted the volatility and the opportunity in gold investments. While traders are adjusting to the Fed’s signals, long-term investors can capitalise on the current lower prices. Fed officials have suggested a stable rate environment for now, providing a window of opportunity to invest in gold before potential rate cuts drive prices higher again.