Gold And Silver Long Term Price Targets – Measured via US Government Debt

News

|

Posted 11/02/2026

|

3549

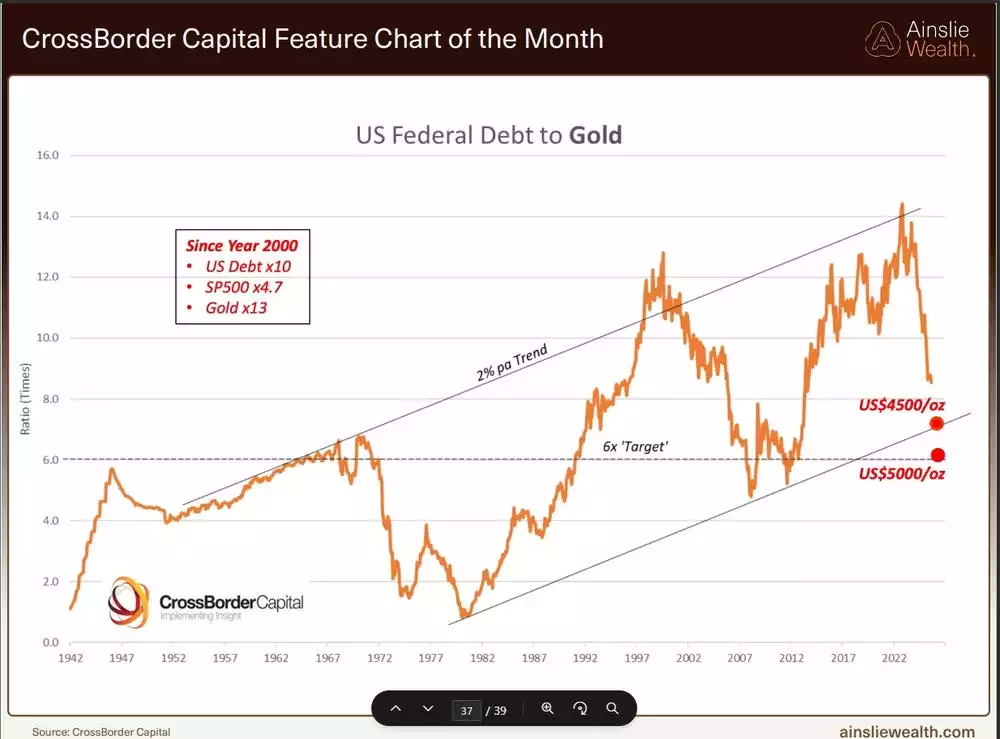

With US government debt alone now sitting around US$37 trillion and set to continue rising, US dollar debasement is effectively baked into the system if that debt is to remain serviceable.

With the previously referenced US$5,000/oz gold target, approximately A$7,067/oz, now achieved, projecting US government debt forward ten years using the same metrics suggests a gold price closer to US$25,000/oz, or roughly A$37,000/oz.

Gold has therefore acted as a barometer for US government debt. As debt levels rise, so too does the gold price. This relationship stems from the inverse correlation between US dollar strength and government debt levels. The greater the debt burden that must be serviced, the more US dollars are required to be introduced into circulation. As gold is globally priced in US dollars, rising debt pressure tends to weaken the currency and push the gold price higher.

Despite ongoing rhetoric, inflation is therefore not something governments are likely to seriously combat. Rather, it becomes a necessary policy outcome to help manage and service excessive debt burdens, making inflation a deeply regressive and largely hidden tax.

With gold targeting A$37,000/oz over the next decade, the gold to silver ratio provides a useful framework for estimating silver’s potential price. The 100 year average ratio sits near 50, which would imply a silver price above A$700/oz within the same timeframe.

The current pullback in both metals aligns with expectations under the broader eight-year macro cycle from 2022 to 2030, with a mid-cycle correction anticipated around 2026. Longer term, however, this appears to be only the early stages, as US debt continues to grow at an accelerating pace, positioning hard assets for what could resemble sharply rising inflation profiles.

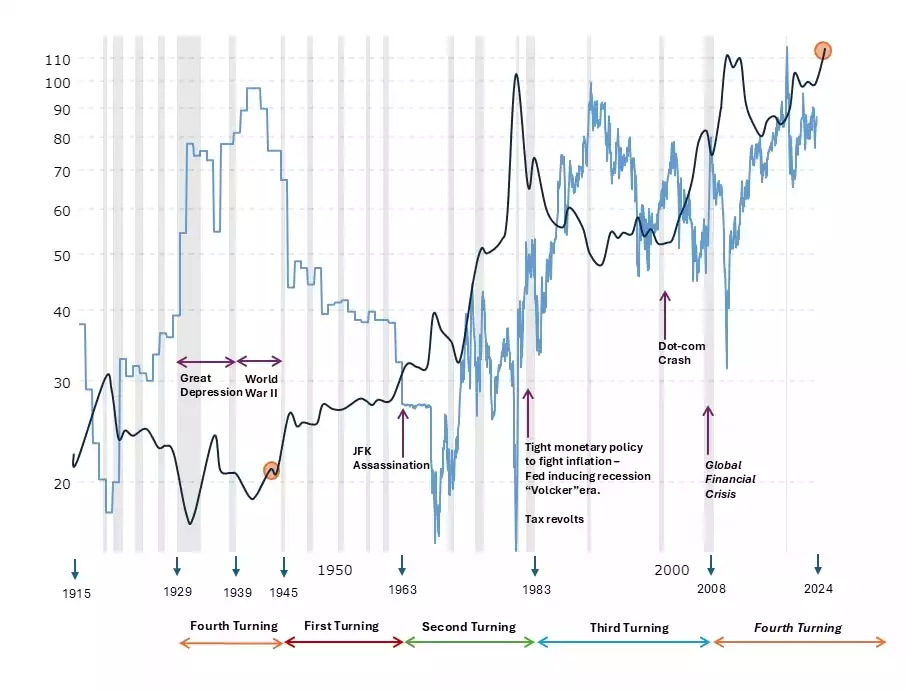

While the eight-year cycle continues to unfold largely as expected, the larger 80-year socioeconomic cycle also remains on track. As we transition into the next phase of this cycle, often referred to as the four turnings, historical behaviour offers useful context. During previous cycles, the gold to silver ratio tended to fall well below its long-term average during the first turning and remained suppressed through the second.

Against this backdrop, if gold reaches A$37,000/oz over the coming decade and the gold to silver ratio ultimately trends lower than its historical average, the A$700/oz silver target may represent only an early milestone in a broader, multi decade bull market, similar to what was observed during the first 40 years of the current four turning cycle.

Looking ahead to the next eight-year cycle beginning in 2030, this period coincides with the early phase of a new 80-year socioeconomic regime, when global financial frameworks are often reshaped. The last such transition gave rise to the gold standard, the World Bank and the IMF. This coming cycle may therefore prove to be only a preview of more profound changes ahead.

While many investors remain focused on short term price movements, a longer-term perspective suggests that, for both gold and silver, the move may still be in its early stages.

As global systems evolve and one human designed framework gives way to another, history shows that enduring assets such as gold and silver have consistently provided stability, serving as reliable stores of value through periods of monetary change for thousands of years.