Global Debt to GDP Rising – No Feasible Solution

News

|

Posted 22/05/2024

|

1788

Yesterday we discussed inflation and its role in how the world deals with the unprecedented US$315 trillion of debt. Today let’s dig a little deeper into the ‘paying it off’ scenario. No, but seriously, hear us out…

As we said yesterday:

“there are only three ways to reduce that debt.

- Pay it off with growth income exceeding additional debt (that hasn’t happened in a very long time and shows NO sign of changing).

- ‘Forgive’ it / wipe slate clean / ‘Debt Jubilee’ (virtually impossible now in a multi polar world with widespread geopolitical disunity).

- Inflate it away. i.e. reduce the effective size of it by deflating its value by inflating the currency.”

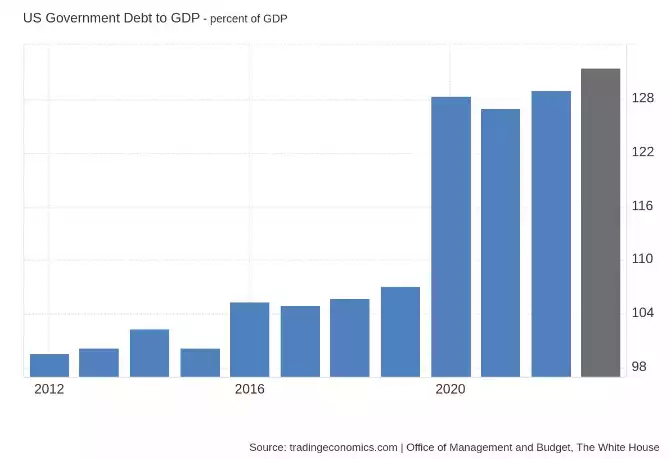

Let’s talk about option 1. An easy metric to sanity check this is to measure the Government Debt to GDP figure. Once upon a (normal) time anything over 100% was considered fatal. That is now in the rear vision mirror for the U.S. The U.S.’s government debt alone compared to its GDP – its entire economy - now stands at 130%.

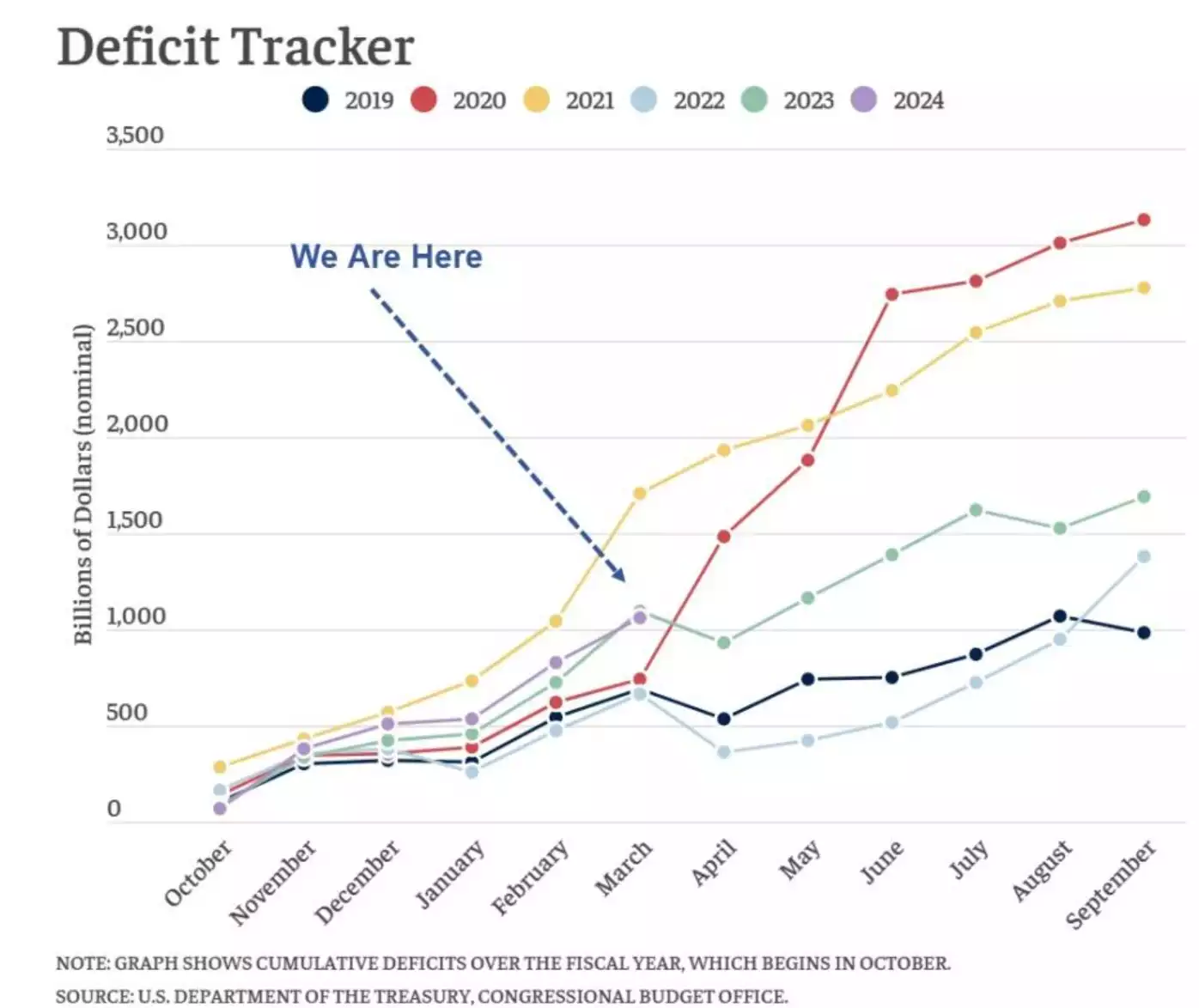

How? Continual deficit spending which by definition is funded by, you guessed it, more debt.

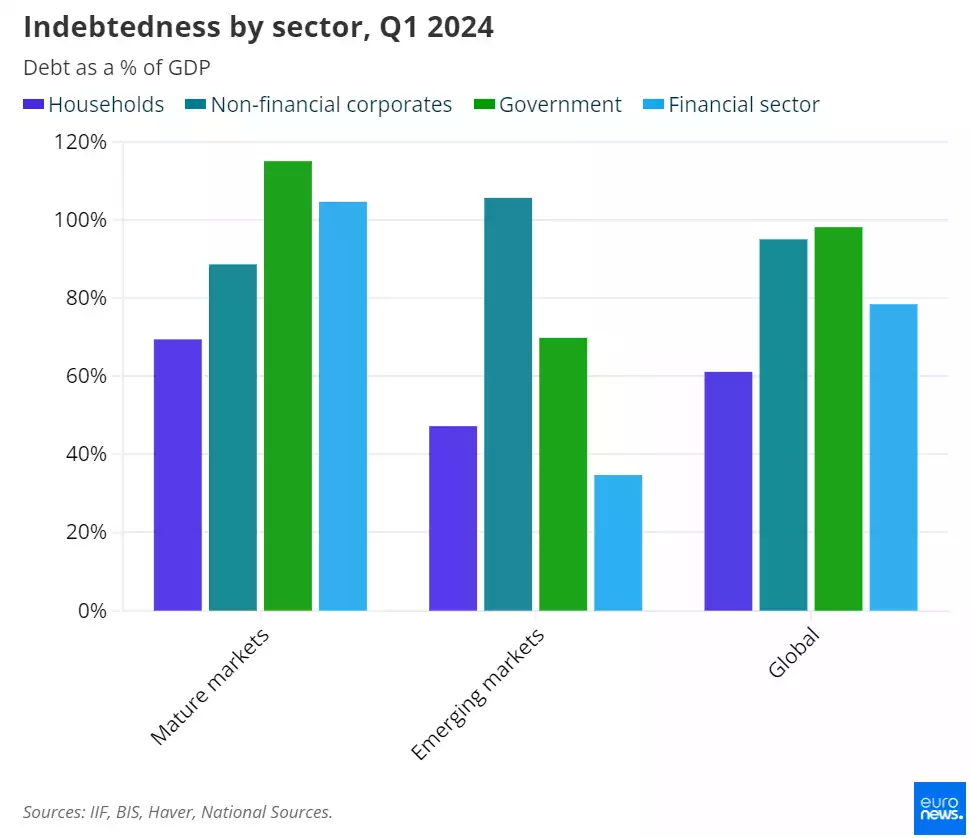

But that is just the U.S., globally it’s a little better but Developed/Mature Markets are still over 100% for all debt and nearly 120% for Government alone. Topically (on yesterday’s article), the metric improved a little last year on the back of inflation driving up GDP a little.

This is how things sit according to the Institute of International Finance (IIF). Global debt rose by around US$1.3 trillion in the first quarter of this year, reaching a new record high of US$315 trillion after the aforementioned three quarters of decline (coinciding with falling inflation of course). So, we are back to climbing debt to GDP and according to the IIF, Emerging markets are driving the trend with the biggest increases coming from China, India, and Mexico.

But that is all in the context of history. What about going forward? It can be argued that GDP can be expanded by increased productivity, increased debt, or improving demographics (younger, more productive, and higher consuming), whether through one factor alone or a combination of these factors.

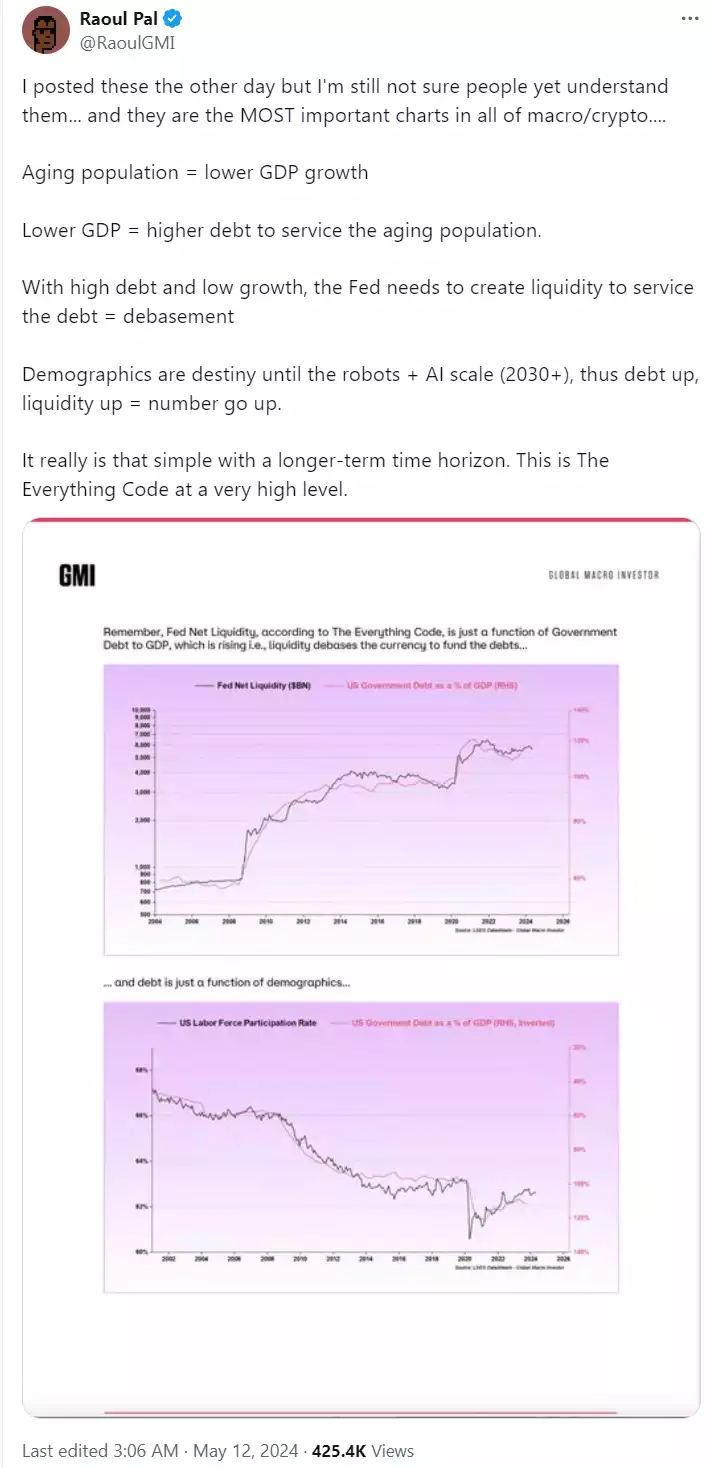

We have before us the outlook of debt saturation (literally too expensive to expand – remembering the U.S. is already paying US$1.2 trillion per year in interest alone – more than defence), an aging demographic and the big unknown of the effects of AI on productivity and when. Global Macro Investor’s Raoul Pal recently made a telling Tweet, stating the following –

And so in essence, when you have assets such as gold, silver and Bitcoin that so perfectly follow the global liquidity growth Pal refers to, and gold in particular, a proven record of protection against economic crises, you get a clear understanding on why all three are rallying right now and why they are arguably only just getting started.