Friday’s ‘Everything’ Falls

News

|

Posted 05/02/2018

|

7605

Friday night saw big drops across nearly every single asset leaving Aussie investors on tenterhooks today with futures markets indicating the pain is headed our way today. The Dow Jones saw its biggest point drop since the GFC (an ‘ominous’ 666 points) and capped off its worst week since January 2016, down 1000 points. The traditional safe havens of US Treasuries and precious metals got hit as well, indeed UST’s crashing was potentially the catalyst for it all. UST’s finished their worst week in over 2 years and Gold was smacked $16 and silver down 63c, finishing off its worst week since July 2017. Crypto’s too got hit again, seeing Bitcoin have its worst week since January 2015. This wasn’t a US thing either, with similar falls in Europe and Asia. Indeed the only things up were of course the VIX (volatility index – highest since Brexit) and the US dollar up the most in a year.

The catalyst for all of this? The US non farm payrolls came out with a higher than expected 200,000 new jobs (but with 24,000 downward revision to the last 2 months) and, more importantly, wage growth increased to 2.9%. But that’s good yeah? Well that is the ‘problem’ as in theory the implied inflation supports more rate hikes from the Fed. Rate hikes mean higher interest servicing costs, and as we shared last week the market has never had more debt through margin lending invested in it.

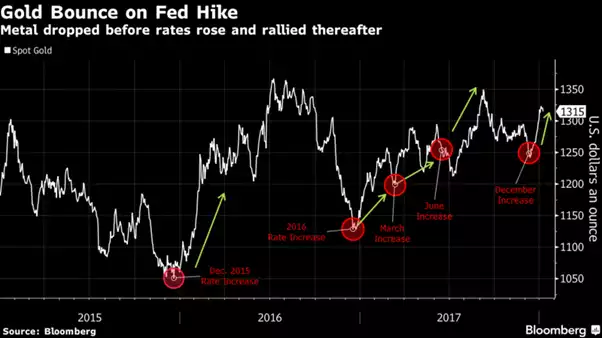

Where we go from here is the million dollar question. Gold and silver often get ‘hit’ on growing expectations of rates hikes. We recently shared the following chart that shows this and what normally happens afterwards…

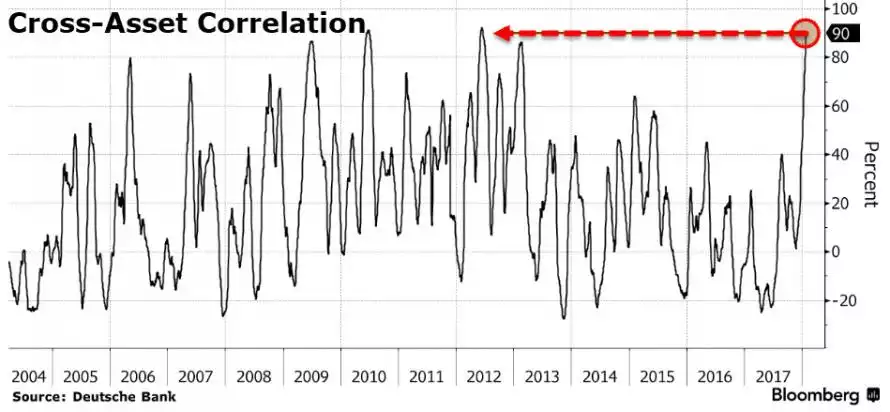

However the context this time is a global ‘hiccup’ across all financial assets. The danger now is the very high level of cross asset correlation leading to fears of contagion…

History still tells us gold and silver are the safest havens when ‘everything’ tanks….