Fresh Inflation Data Finally Gives Aussies Some Hope

News

|

Posted 01/08/2024

|

1437

Following a series of unexpectedly strong monthly inflation reports, the much-anticipated June quarter Consumer Price Index (CPI) data likely prevented an increase in the Reserve Bank’s current cash rate of 4.35%, giving borrowers a small sigh of relief.

Following the announcement, financial markets considered another rate increase improbable, leading to a drop in the Australian dollar by about 0.4 U.S. cents to 64.9 U.S. cents. Meanwhile, the stock market saw a boost of roughly half a percentage point, continuing its morning gains and closing the day nearly 1.1% higher.

Ideally, the Reserve Bank’s goal to bring inflation back to target levels should have been paving the way for interest rate cuts by now, which the government had hoped to highlight in its re-election campaign.

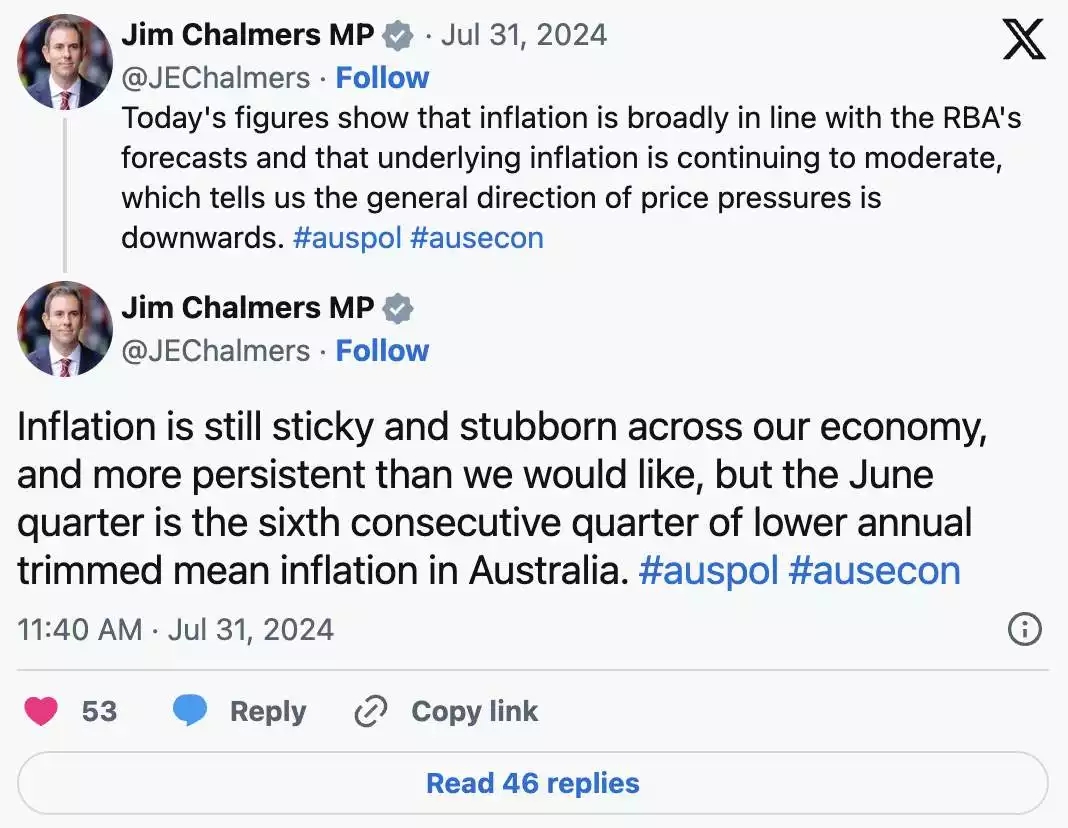

Treasurer Jim Chalmers has emphasised Labor’s commitment to fighting inflation. However, due to the Reserve Bank's delayed action in raising the cash rate and keeping it lower than other central banks, Australia is now dealing with higher interest rates for an extended period to address a more persistent inflation issue compared to the rest of the world.

This comparison to the rest of the developed world was on clear display this morning, where the Federal Reserve announced that a September Rate Cut is “on the table,” given that their inflation rate has been cooling off. Meanwhile in Australia, we are celebrating the fact that we probably won’t have a rate rise next week!

Additionally, as a result of the Fed announcement, Gold climbed 1.2% to US$2,437.39 per oz, and logged its largest monthly rise since March (over 4%).

Last week, at an event co-hosted by The Australian Financial Review, Governor Michele Bullock mentioned that “aggregate demand in the economy is probably still outstripping the ability of the economy to supply those goods and services.”

With little chance of a significant increase in capacity through higher business investments, aggregate demand is still fuelled by the cheap money and significant budget stimulus from the pandemic. At the same time, supply chains disrupted by the pandemic are still being repaired.

This situation is maintaining price pressures even as economic growth slowed to just 0.1% real growth in the first quarter of 2024.

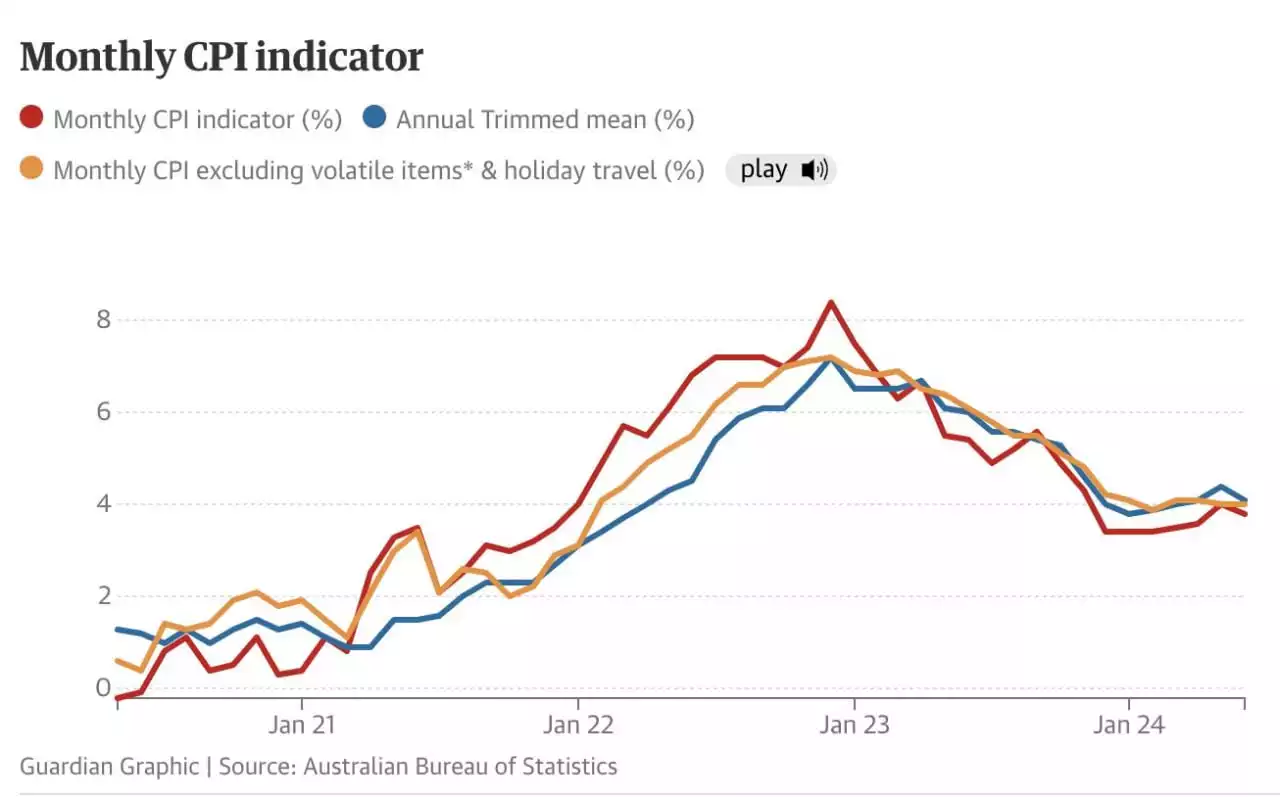

Therefore, it’s not surprising that quarterly consumer price inflation remained steady at 1% in the three months to June, with annual headline inflation rising to 3.8% from 3.6%.

The Reserve Bank’s preferred measure of underlying inflation was 3.9%, slightly above the official forecast of 3.8% but a bit lower than market expectations. Before this CPI result, Australia was the only advanced economy, aside from Japan, where a possible rate hike was anticipated.

Now, at last markets are predicting the next move will be a rate cut, fully priced in by February. We can only hope that Australia will start catching up to the rest of the world and start providing much needed relief to their citizens amid this cost-of-living crisis.