Financial Time Bomb: Soaring Debts and Devaluation

News

|

Posted 04/05/2023

|

9903

Raoul Pal, one of our favourite prominent finance experts, recently tweeted about the over-leveraged economy, and GDP growth being insufficient to cover interest payments on government and private sector debt. Raoul argues that, consequently, interest payments are shifted to the Federal Reserve's balance sheet and seemingly never need to be paid back.

He notes that monetisation of interest payments is a trend seen in the United States, European Union, United Kingdom, Japan, and other regions. It contributes to the growth of central bank balance sheets. Occasionally, something "blows up" in the financial system, like the 2008 banking crisis, the 2012 EU crisis, the 2020 pandemic, and the current 2023 banking issues.

In normal circumstances, these events would lead to complete equity and debt wipe-outs. However, due to excessive financial interconnections and collateral chains, these losses are now socialised through QE. This process devalues fiat currencies (denominator), as the money printer conceals problems under the rug.

As governments cannot collect enough taxes to cover the debt burden, government debt interest payments are also shared among the population using the same mechanism. This results in debt compounding due to interest payments and non-payment of the actual principal debt.

The majority of the population (99%) bears the brunt of these debt payments and bailouts, while the top 1% of asset holders see their assets appreciate due to the falling denominator (fiat currency value). Incomes and revenues don't keep up with this process, causing people who don't invest to become poorer.

Only a few assets consistently outperform this debasement: gold and silver. These assets have the highest beta (sensitivity) to global central bank balance sheets. Traditional investments such as real estate, S&P 500, bond yields, emerging market equities, and credit either perform in line with or underperform compared to central bank balance sheets. Individuals can opt out of this insidious debt mutualisation by investing in gold and silver.

Sticking to old investment strategies or doing nothing makes you pay for the system's losses. Since 2012, the G4 central bank balance sheet has grown at a rate of 10% per annum. If your chosen assets don't earn at least 10% per annum over time, you are effectively becoming poorer every year.

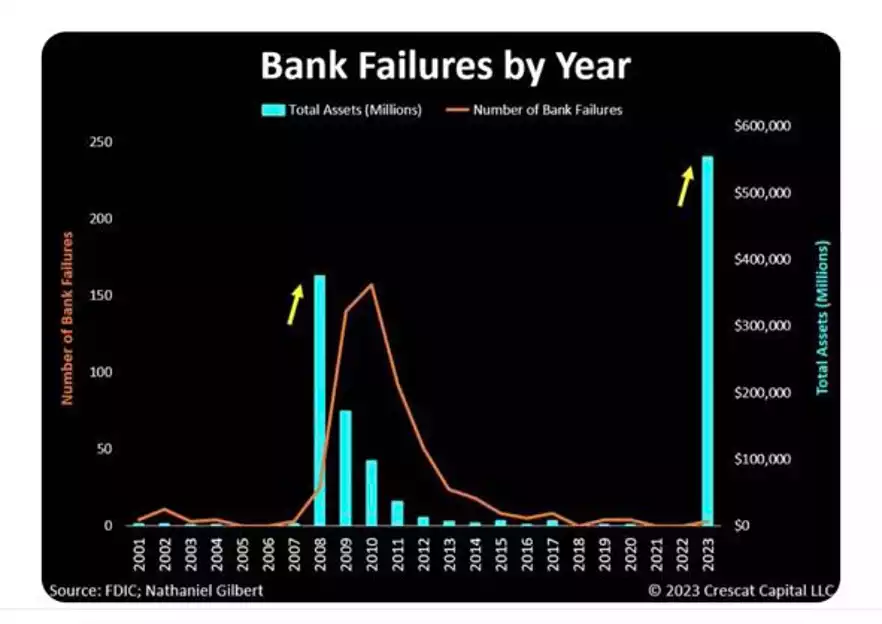

The world's financial system now, as we’ve argued, revolves around liquidity and the debasement of fiat currencies. To avoid paying for the system's losses and becoming poorer, it's essential to invest in assets like precious metals that consistently outperform this debasement. It's important to remember that during the GFC, over 150 banks went out of business. In today's context, just four bank failures account for nearly the same amount of assets that financial institutions held during the 2008-2009 crisis. If you're wondering whether the Federal Reserve will permit a similar systemic issue to develop now, pay attention to gold prices, which are beginning to reflect the potential need for liquidity injections to maintain financial stability.

This morning, gold reached a new all-time high in AUD, with a spot rate of $3,095/oz at the time of writing. This surge coincides with growing concerns about a potential Fed default by the end of the month. Janet Yellen confirmed on Monday that, due to the current US debt ceiling, the government may be unable to service its debt as early as June 1st.

Raoul shared his perspective on this issue earlier today via Twitter, stating “Feels like the FDIC, the Treasury and the Fed are going to have a lot more work to do this weekend. I'll be surprised if we don't lose a few banks on the weekend and finally a larger policy response to try to stem the flow of failures.”

To provide a clear and concise overview of the current economic situation:

- Over-leveraged economy with insufficient GDP growth to cover interest payments on debt

- Growing central bank balance sheets due to monetisation of interest payments

- Devaluation of fiat currencies as losses are socialised through QE

- Majority of the population bearing the brunt of debt payments and bailouts

- Potential for more bank failures, exacerbating financial instability.

- Possibility of a Fed default due to the current US debt ceiling.

Do we have to repeat ourselves any further? Balance your wealth in an unbalanced world.