Fed holds & prints, OECD warns, Minack maps solution

News

|

Posted 11/06/2020

|

20001

It was a mixed bag on markets last night as we had the Fed meeting and sobering warning from the OECD. Gold was up again by 1.4% and silver up 3.3% (0.9% and 2.7% in AUD terms) whilst the S&P500 and Dow fell but the every bubbly NASDAQ up yet again. The USD continued its extraordinary streak of declines.

Sharemarkets aren’t making any sense of late so it’s hard to explain the falls. The Fed’s tone was very dovish on the back of poor forward estimates which ordinarily would see the ‘pure stimulus driven’ sharemarket rally on the promise of more stimulus, but maybe, just maybe when combined with dire warnings from OECD, share traders paused and realised how bad things are… maybe. The message was clear for precious metals, bonds and the dollar though – more easy money for longer on anything but a V shaped recovery. From Bloomberg:

“Federal Reserve Chairman Jerome Powell sent a powerful message Wednesday that the central bank will keep pumping stimulus into the U.S. economy until its traumatized labor market has healed from the harm of the coronavirus pandemic.

“We’re not even thinking about thinking about raising rates,” he told a video press conference after the Federal Open Market Committee held its policy benchmark near zero and almost all officials forecast keeping it there through 2022.

“We are strongly committed to using our tools to do whatever we can for as long as it takes,” Powell said.”

‘Whatever it takes’ sees them continuing with rates on hold at 0-0.25% (and keeping it there for 2.5 years) and a continuation of QE indefinitely “at least at the current pace” of which a continuation sees $80 billion of US Treasury purchases and $40 billion of mortgage backed securities per month, or $1.44 trillion annualised. Yesterday we explained Yield Curve Control on speculation they might employ that this round. When asked about YCC, Powell said they had received a briefing and would discuss it over the coming meetings.

The Fed didn’t even bother giving its usual quarterly economic forecast in March given it was mid pandemic chaos and they were busy cranking up the printers. And so last night Powell gave the first update since December now that the dust has settled somewhat.

“The economy faces “considerable risks” over the medium term, the Fed said in its statement, reiterating language from the last FOMC meeting in late April.

Officials forecast the U.S. unemployment rate would fall to 9.3% in the final three months of the year from 13.3% in May, according to median estimates, and to decline to 6.5% in 2021. U.S. GDP was projected to contract by 6.5% this year before rebounding 5% next year. Inflation was forecast to remain below the Fed’s 2% target through 2022.”

The market’s reaction was telling:

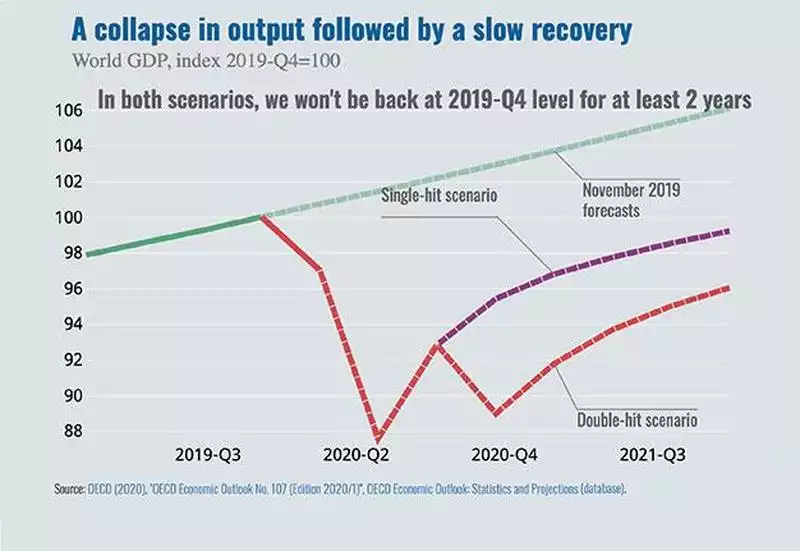

As mentioned, the OECD released its latest global economic forecast and it deviated from its normal practice by giving a two scenario forecast as they contemplate the 2nd wave of the pandemic to occur in the 2nd half of this year. On the basis of no second wave they are forecasting the world economy will contract 6% this year and if we get the 2nd wave it will fall 7.6%. As important, they are not forecasting a return to 2019 levels for at least 2 years. OECD chief economist Laurence Boone wrote in the report:

"Both scenarios are sobering, as the economic activity does not and cannot return to normal under these circumstances,"

"Most people see a V-shaped recovery, but we think it's going to stop halfway. By the end of 2021, the loss of income exceeds that of any previous recession over the last 100 years outside wartime, with dire and long-lasting consequences for people, firms, and governments."

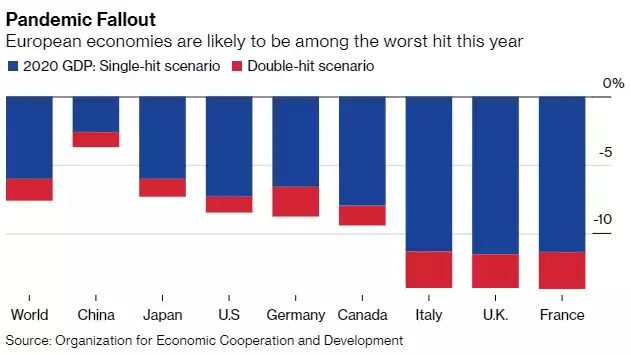

Breaking it down, they had a more dire view on the US than the Fed, predicting a 7.3% plunge this year and just 4.1% next year. Should the 2nd wave hit, they become 8.5% and 1.9% respectively. That is a massive difference to the more optimistic Fed.

Europe is even worse with 9.1% decline in 2020 followed by 6.5% the next or 11.5% and 3.5% on the 2nd wave scenario.

By country it looks like this:

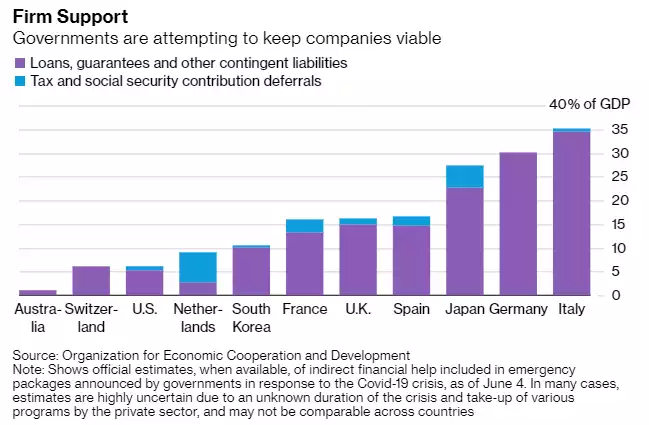

We discussed the US central bank response above and the OECD also speak to the government fiscal stimulus side of things. From Bloomberg:

“It’s an unprecedented challenge for governments, who’ve already spent billions to keep businesses afloat and workers in jobs until their economies reopen. The OECD said support must now be adapted to help companies in ailing industries restructure, and workers retrain. But such transitions take time, and many more businesses may fail in the meantime, which means greater job losses.

The OECD said policy makers will have to walk a “tightrope” between continuing to provide exceptional -- and costly -- safety nets and not being trapped into upholding activity for a long period.

“Policies need to mitigate inequalities being worsened by the crisis,” OECD Secretary General Angel Gurria said. “We know many of the worst off and most vulnerable are being hit hardest by the pandemic.””

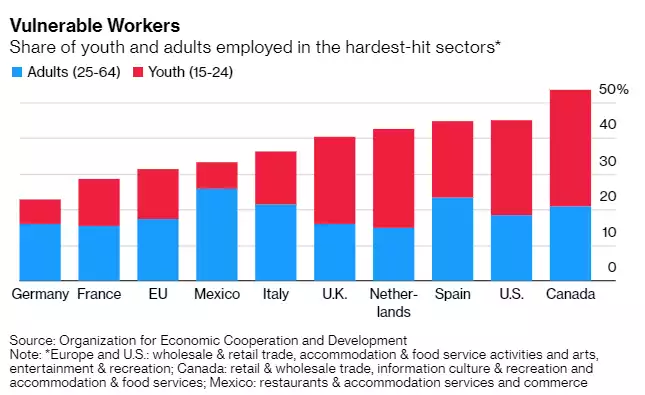

“Governments must pay particular attention to the most vulnerable, according to the report. The young and low-paid are make up a larger share of the workforce in the sectors most exposed to job losses and health risks, while highly qualified workers have more often been able to work at home.”

One thing is certain in all of this, and that is this is far from over and stimulus is the key outcome. Topically, Real Vision’s Raoul Pal interviewed Australia’s own Gerard Minack, the author of the one report Raoul never misses reading. After a long interview on the macro economic set up, here’s what Minack had to say in response to Pal asking ‘so how do you trade this situation’:

“Looking at options strategies that seemed sensible, looking at what's the most vulnerable to pull back and I'd rate, some of the commodities, iron ore, Aussie dollar are in that group, and then be very selective about what you might pick out for the longer term inflation risk. The only thing I think that really is fast and solid enough to be responding to that longer term prospect of inflation is gold. I think that's partly because gold has what by my reckoning is an almost unique characteristic which is it's the only thing I know of that protects against both tail risks, both inflation and deflation, gold does well. That may be the one thing that you'd want to focus on if you're worried about that longer term inflation risk and yeah, full disclosure, I am long gold and long gold companies.”

Pal goes on to note:

“As am I, but the problem is quite a few of us are long gold, but I've never heard a better case for gold in my life. Now, maybe we're all deluding ourselves and we get through some muddle through world of 1%, 2% GDP growth, then gold's not going to do great, but from everything that you've laid out, I don't see how there's not going to be more stimulus. I don't see how they're not going to try and fight the slow growth environment. It's clear it's going to be more fiscal and they'll end up being monetary, so it seems that gold makes sense to me.”

Minack:

“Yes. Look, I think the reality is it is a tiny, tiny asset class. The value of global equities outstanding last time I looked is $70 trillion or $80 trillion, global sovereign bonds is $60 trillion and obviously going up, the value of gold outstanding particularly if you exclude the gold that's in the back of your grandmother's molars, so the investable gold is only $2 trillion or $3 trillion. You don't need big accounts, big real money, people saying, that should you hedge against the tail risk and just click 1% or 2% from our equity holdings and stick them into gold, might make much difference to equities, but it's a huge inflow into the gold market.

That's before you consider things like the weaponization of the US dollar, which quite understandably makes a lot of people go, well, do I really want that to be the bedrock of my FX reserves? Why don't we revert to gold? It's been okay for 5000 years, so let's put a few more in there. I think it's a good story. Obviously, it's going to have its setbacks along the way. That's particularly true if we do enter this disinflationary thing. In other words, we don't go direct from where we are to where inflation's a risk, but if it slips back next year, we'd just add more.”