Fed Pivot and Bond Prices

News

|

Posted 16/01/2025

|

1396

The fall of currencies to the strength of the U.S. dollar, is driving the Aussie dollar to multi year lows – as gold holds in USD terms making the Aussie gold reach all-time highs (again). But will this trend stop or is this the start of a repricing of risk that is long overdue?

Government-bond yields have surged across the globe, lifting the USD, kneecapping equities and putting the USD inflation fears of 2023 back in the spotlight for the rest of the world. As inflation began to fall central banks around the world started dropping interest rates in August 2024 – in hopes of relieving pressure on highly indebted young families. Whilst these Central Banks dropped rates the rest of the world has finally cottoned on to the fact that the more governments spend, the higher the risk of recovering bond money into the future.

Large volumes of bond issuance around the world, coupled with a reduction in demand from central banks around the world have seen bond rates lifting and bond prices collapsing. Who would have thought that maxing out the credit card would cause so many issues, don’t you just get a new credit card? This trick has worked in the past but when the lending options are thin the rates go up.

Term Premium Finally Being Priced In

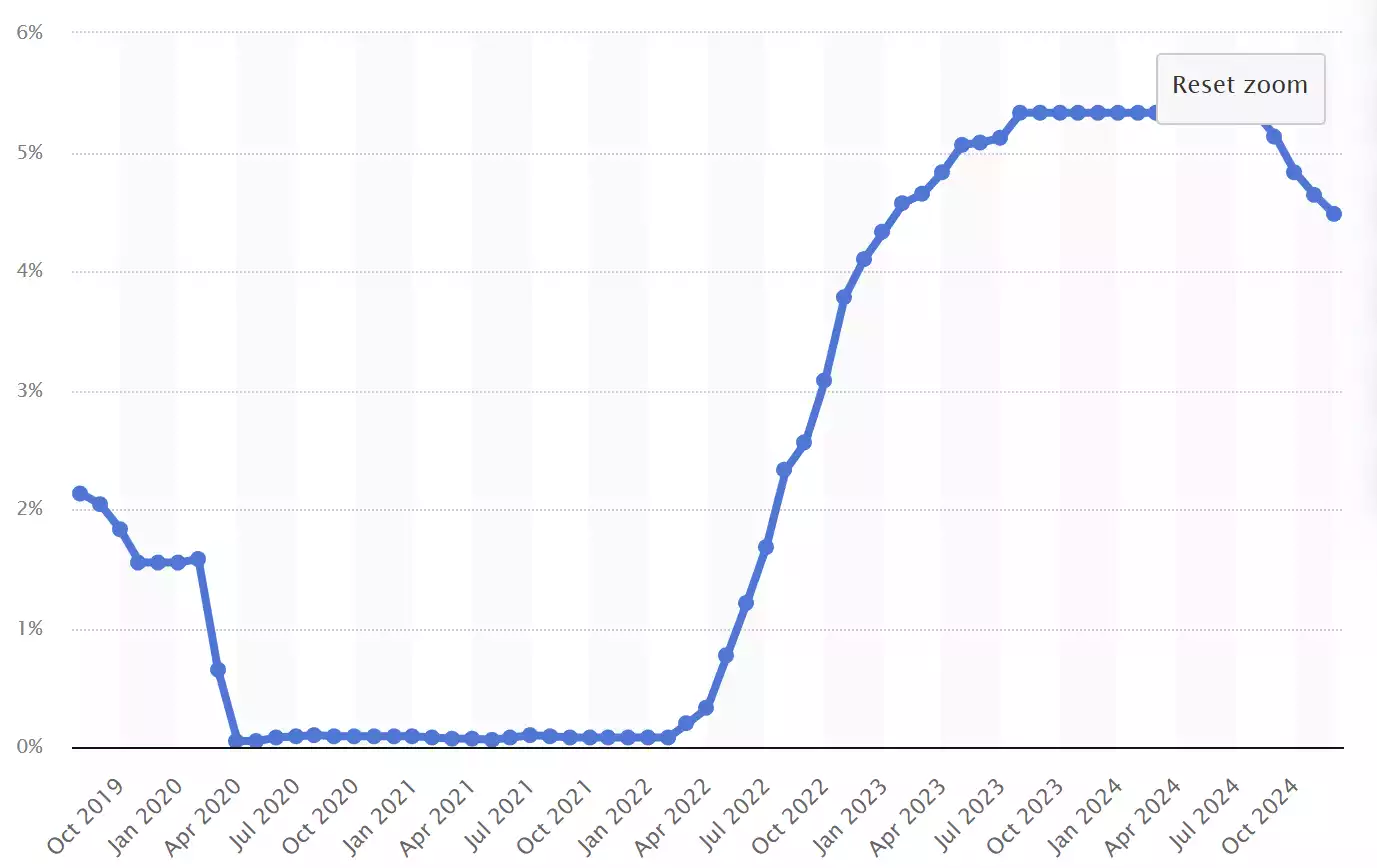

So how could bond yields be rising when all central banks (except for Australia) are raising interest rates? Put simply it’s the term premium, investors are selling bonds off in huge numbers as more and more bonds are issued to sustain the government debt monsters, and this has raised the required rate to hold. In September when the Fed started dropping rates the 10-year bond yield was sitting around 3.6%, with the spot rate at 5.33%. Since they started dropping in December the spot rate sits at 4.5% and the 10-year at 4.79%.

As most mortgages are based on long-term rates, this means that the Fed has dropped rates and increased mortgage rates inflicting more pain on young homeowners, businesses and banks.

So how could rates drop and 10-year yields rise so much, Chip Hughey, managing director of fixed income at Truist Advisory Services in Richmond, Virginia recently pinpointed the term premium increase attributes to "85% of the rise in yields that we have seen since mid-September is accounted for by the term premium,"

So what has increased the term premium, in the U.S. the uncertainty around the deficits and fiscal policy uncertainty can be related to the new administration soon to be sworn in, but the rest of the world is similarly facing these increased term premiums.

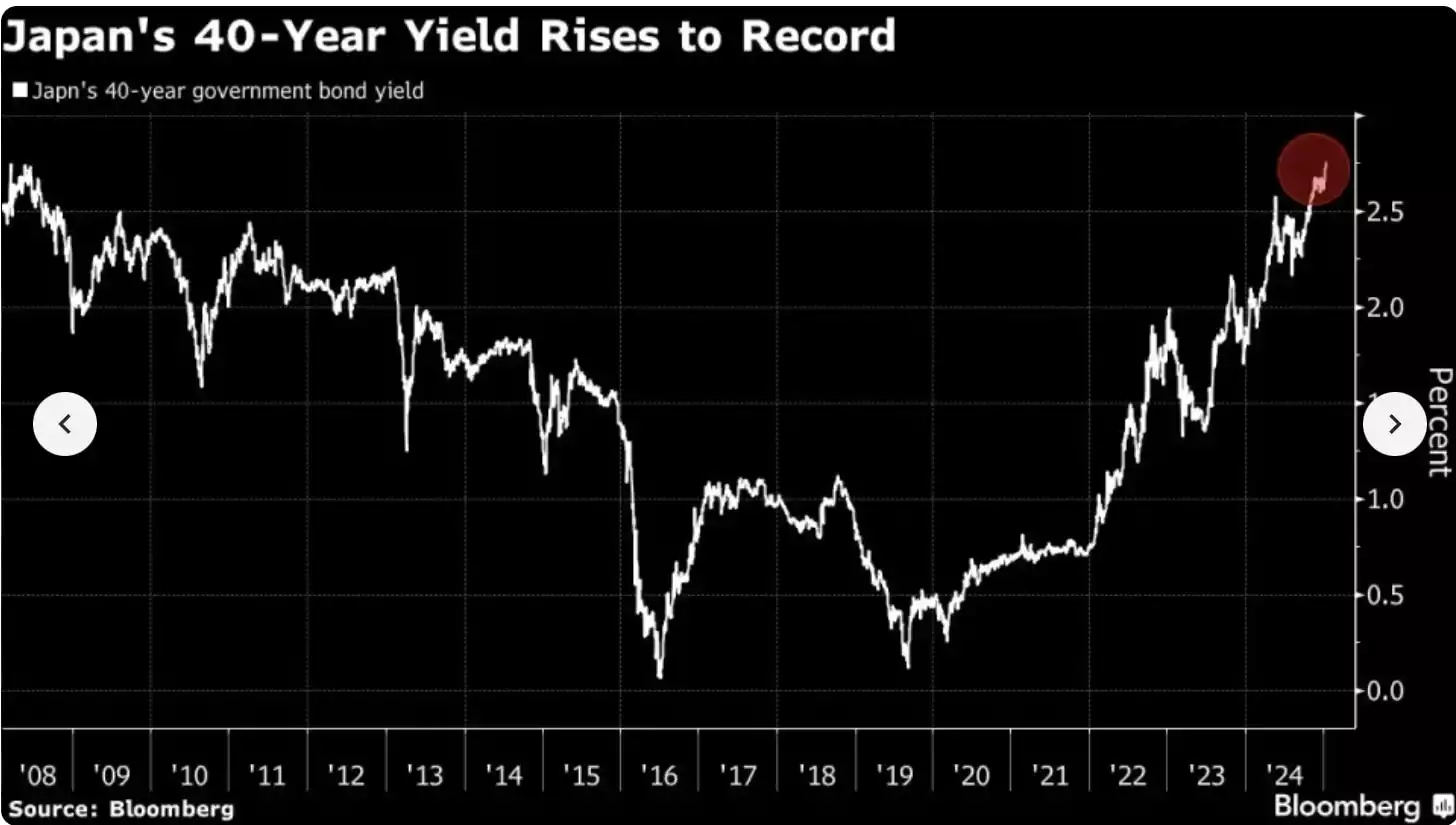

Germany has seen 10-year yields rise by 0.6% from 2-2.6% from September to January and Japan’s 40-year yield has also increased at its fastest rate in years, moving from around 2.2% to 2.7% over the same period. These countries are not facing the same political changes as the U.S., and still, their term premium has been on the move in the last 4 months. The likely culprit is investors have finally woken up to the government debt Ponzi scheme and will continue to punish governments who spend beyond their means.

In the UK, the 30-year Gilt has risen to its highest yield in 30 years.

So has the penny finally dropped? Will investors start demanding more returns from governments who have been emboldened to spend their children’s money away? One thing that is known is if this bond rout continues there will be stress in the financial markets, equities traditionally drop as bonds give a better return, banks' balance sheets will creak as their safe as houses bond investments rapidly lose value with interest rates climbing and the USD will continue to rise crushing highly indebted nations in its wake.

What is different about this time is how dramatically inverse interest rates set by the central banks have been to long-term bonds. As California burns, with estimates of $150 billion in damage insurance companies are going to need higher returns in government bond markets to manage risks as highly indebted, incompetent governments focus more on spending on the management of emotions of every different divisible category of human (noting we are all different and divisible down to our individuality) and not the inherent growing risks of highly populated megacities and their potential environmental risks.

If the Central banks are running from bonds into gold – maybe it's time you should too.

Watch the Ainslie Insights video discussion of this article here: https://www.youtube.com/watch?v=9YU3flZ0LV0