Fallout from the FTX Saga May Be Only Just Beginning

News

|

Posted 17/11/2022

|

11627

As we saw with the Investment Bank Lehman Brothers in 2008, who imploded after overleveraging their capital on subprime mortgages no one would accept as collateral, once a large economic player falls there are typically many more dominoes to follow. Many other large investment banks also got wiped out thanks to the Lehman collapse, a situation we are starting to see now with FTX.

The bank run on crypto exchanges following the FTX collapse is well underway. In the last 24 hours alone, we have seen multiple large scale crypto brokers and lenders with strong ties to the now infamous exchange halt withdrawals, with one even filing for bankruptcy.

We have been discussing this FTX debacle all week, including on Tuesday where we looked at the on-chain analytics. Today we will be further dissecting the fallout, with a specific focus on the companies that have suffered contagion effects from the 2nd largest crypto exchange in the world going bust.

Starting with crypto broker Gensis, who recently halted withdrawals due to significant FTX exposure, as they had $175 million in assets locked on the exchange.

Derar Islam, interim CEO of Genesis, claimed its trading and custody arm Gemini would remain unaffected. When would a CEO ever promise that its subsidiary company would remain solvent?

FTX US declared bankruptcy just a few days later.

Closer to home, Digital Surge (Australia’s 3rd largest cryptocurrency exchange) also began halting withdrawals yesterday, citing the ‘Impact of FTX Australia administration.’

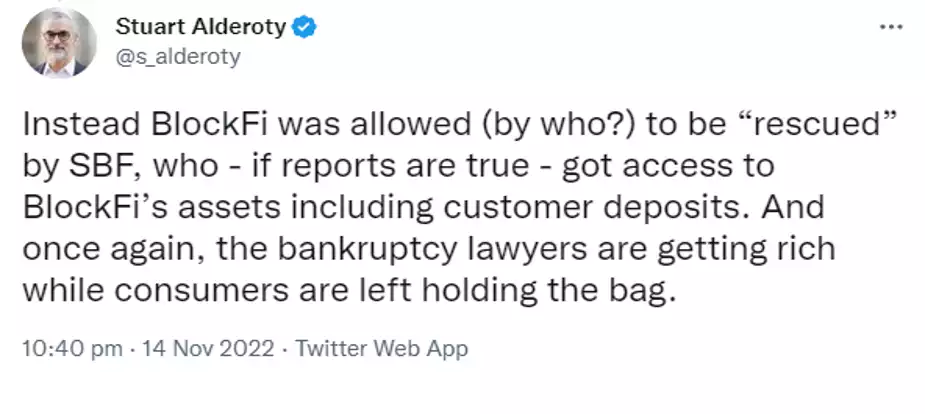

The most interesting case is BlockFi, a crypto broker/lender who received a $250 million liquidity injection from FTX back in June this year when they were on the verge of collapse. Why would CEO Sam Bankman-Fried choose to do that? Well, if the rumors are true, than it was purely to move Blockfi’s customer deposits onto their platform in order to overleverage them for yield.

BlockFi has announced they plan to file for bankruptcy in the coming days.

The commonality between all three of these case studies is that they would leverage customer deposits for their own benefit, or at the very least had a low regard for consumer deposit safety.

As highlighted during Insights on Monday, and again worth repeating here, there are a range of custody solutions available to people wanting to get into crypto. For example, we have seen cold wallet storage options skyrocket in demand as a consequence of the fallout, including the demand for Trezors which has risen by 300% this past week.

It is clear that the contagion impacts of the FTX debacle will likely continue on until every overleveraged and reckless organization with strong ties to FTX has been wiped out.

And let it serve as a reminder for all of us that there is no safer way to prevent ourselves from feeling the negative consequences derived from this recklessness than by storing our digital assets ourselves or with a safe custodian who does not touch their customer’s funds.

************************************************************************************

GOT A QUESTION about today's news?

This afternoon, the Gold & Silver Standard Insights team will be breaking down the news and answering YOUR questions.

Submit your question to [email protected] and SUBSCRIBE to the YouTube Channel to be notified when the GSS Insights video is live.

**********************************************************************************