Falling Mortgage Rates Have Resulted in a Stunning Surge in U.S. Home Refinancing

News

|

Posted 15/08/2024

|

1469

Over the past two weeks the U.S. refinancing index has seen a substantial rise of 55%, an increase of this magnitude signals greater economic activity, with many individuals capitalising on the opportunity to reduce their previously high monthly repayments.

Over the past 2.5 years mortgage lenders have faced the challenges due to continuous interest rate hikes by the Fed, leading to a drastic decline in refinancing applications, plummeting to the lowest levels in decades. Those who survived this period of record-low applications and avoided mass layoffs amid industry consolidations are now seeing a significant uptick in activity as the rates start to fall amid growing recession fears.

As of the week ending August 9, the Mortgage Bankers Association refinancing index reached a two-year high of 889.3, climbing a substantial 34.5%.

This past week in the refinancing index marks saw the largest increase since early March 2020, a period when the Federal Reserve slashed interest rates in response to COVID-19. Mortgage applications for home purchases rose by 2.8%, the biggest jump since early June.

Mark Palim, Fannie Mae’s deputy chief economist, noted the rise in refinance activity, suggesting its increase is due to the recent drop in mortgage rates.

“With mortgage rates on the decline, refinance activity increased by over 32% last week, as measured by our Refinance Application-Level Index, after rising by 21% in the prior week,” Palim said.

“In fact, last week, total refinance activity hit a level not seen since August 2022, when mortgage rates were closer to 5%.”

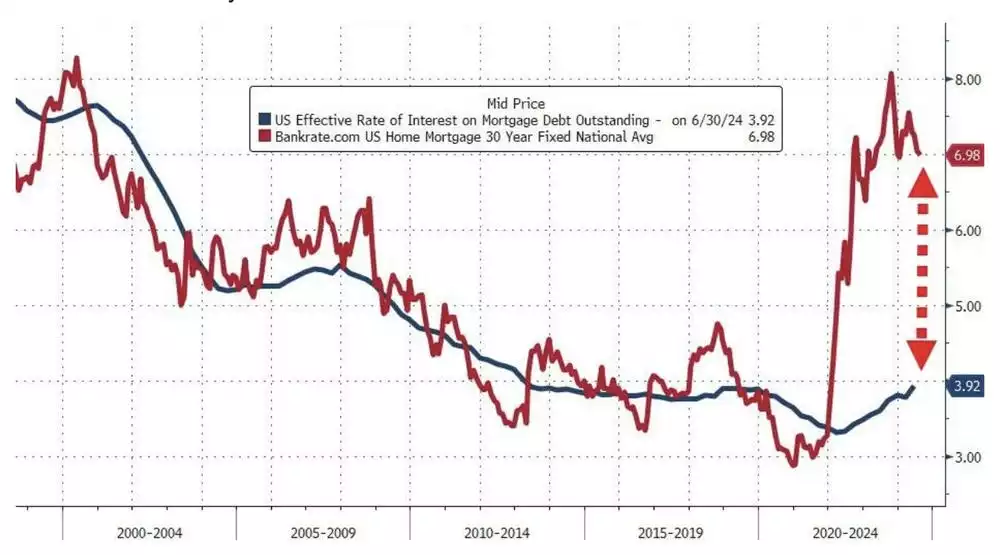

Data from Freddie Mac shows that the average 30-year fixed mortgage rate has dropped to around 6.47%, the lowest since May 2023. While this is a substantial drop from the October 2023 peak of 7.79%, it remains significantly higher than the rates seen during the pandemic, which were as low as 2.68%.

Despite this decline in mortgage rates, the overall cost of homeownership is still much higher than the average current mortgage cost. Until this gap narrows further, many Americans will find it difficult to afford a home.

Mortgage rates generally move in line with U.S. government bond yields, and the yield on the 10-year Treasury note has dropped below 4% due to increasing concerns about a potential recession and a downturn in consumer spending.

Goldman Sachs is now forecasting three 25-basis point rate cuts this year and four more in 2025. If these rate cuts occur, there could be more growth in the refinancing index and mortgage applications.

"We've experienced several head fakes regarding potential rate cuts during the Fed's hiking cycle, as reflected in interest rate swaps over the last few years. But this time, it seems more concrete as recession risks build," said Lewis Sogge, a senior loan officer at Freedom Mortgage Corporation

Effectively, those who have managed to weather this interest rate storm the past few years look like they may have finally made it to the other side. If one thing is for sure, the housing/mortgage industry is still highly cyclical and unpredictable.