FOMC Summary and Takeaways

News

|

Posted 06/07/2023

|

7524

The FOMC meeting minutes were released this morning and it appears that there is still tough-talk in regard to inflation. Below are a few key quotes.

"Participants agreed that inflation was unacceptably high and noted that the data, including the CPI for May, indicated that declines in inflation had been slower than they had expected."

"Almost all participants noted that in their economic projections that they judged that additional increases in the target federal funds rate during 2023 would be appropriate."

"The U.S. banking system is sound and resilient."

Notice that the participants appear very heavy-handed on inflation, yet they chose to pause. It's no surprise that equity indices have moved little after the release of the minutes, which shows that investors are trying to call the Fed's bluff, or simply wait for non-farm payroll data this Friday. Calling a bluff would not be surprising as readers may remember after the 2020 crash when members of the Fed and other central banks were calling inflation transitory and knocking back rumours of rate hikes. It's not yet 2024 and we have already potentially completed, or nearly completed a rate hike cycle.

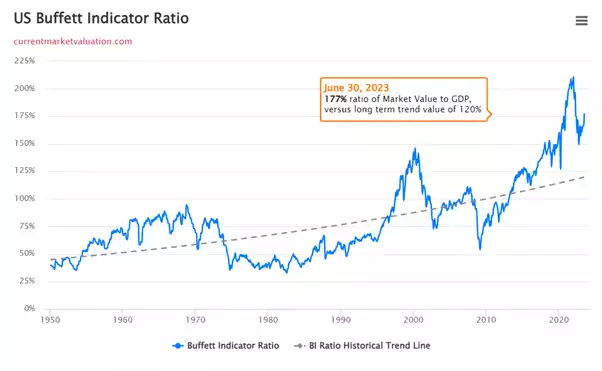

In contrast, the Warren Buffet Indicator (US stock market value divided by GDP) is currently around 177%. This indicates that the stock market is significantly overvalued and sitting 47.99% above its trendline.

Highlights from the Federal Reserve meeting minutes:

Financial Markets:

- Policy-sensitive rates increased, indicating continued economic resilience.

- The shift in policy expectations led to higher Treasury yields.

- Broad equity prices rose, mostly due to large-cap companies.

- Cyclical sectors performed better, suggesting reduced investor concern about downside risks.

- Investor sentiment about the banking sector improved (notably regional banks, which were a subject of fear earlier).

Open Market Operations:

- Respondents expected no rate change at the meeting, but a clear probability of additional tightening at future meetings.

- Uncertainty about the policy rate path derived from options remained high but decreased slightly.

- Respondents still anticipated a recession, but forecasted it to be slightly later due to strong economic indicators.

- Projections for quarterly core inflation were revised higher for the rest of the year.

Money Market Developments and Policy Implementation:

- Expectations for the three-month bill yield to increase slightly relative to the overnight index swap rate.

- Replenishment of the Treasury General Account (TGA) and balance sheet runoff were likely to subtract from reserves.

- Mixed messages about the abundance of reserves by the end of the year.

Staff Review of the Economic Situation:

- Real GDP was expanding at a modest pace in the second quarter.

- Labor market conditions remained tight, with robust job gains and a low unemployment rate.

- Consumer price inflation (core and total) remained higher.

- Wage growth remained higher (although lower than previous levels).

- Global economic growth rebounded in the first quarter but was expected to slow down in the second quarter.

Staff Review of the Financial Situation:

- Market participants justified future tightening based on current economic strength.

- Treasury yields and expected future policy rates shifted upward.

- Equities are being led by strong tech-related stocks.

- Credit availability is healthy, despite restrictive monetary policy.

Staff Economic Outlook:

- Tightening in credit and financial conditions will lead to a "mild" recession later in the year.

- Real GDP is projected to decelerate and pivot to a decline near the end of the year

- The unemployment rate is forecasted to increase this year through to next year.

- Core inflation is forecasted to slow next year but still remain below the 2% target.

- Both total and core PCE price inflation are expected to be close to 2 percent in 2025.

Participants' Views on Current Conditions and the Economic Outlook:

- Economic activity has continued to expand.

- Inflation remains elevated.

- Real GDP growth is expected to stay suppressed due to interest rates.

- Consumer spending has been stronger than expected, but there are signs of depleted savings.

- Business sector reports are mixed.

- GDP readings have been strong, but the momentum is questionable.

- Inflation is unacceptably high, and have not been tackled.

The data in the minutes is very concise, but it still rests on the back of what the policymakers theorise their next actions should be. Some standout discrepancies are:

- The staff claim to be unsure if past interest rate hikes have finished having an effect. This makes the prospect of any future hike look like trying to find the glass ceiling by jumping into it.

- GDP and unemployment will become worse according to them, yet they almost unanimously agree on tighter policy.

- Investors have been challenging, not the Fed's actions, but their statements this year and that reveals a reduction in credibility. From past statements, such as "inflation is transitory", to hiking much earlier than expected, it's not surprising.

Here is a throwback to our own central bank in July 2021: