FED Interest Rate Hikes Could Finally be Starting to Slow Down

News

|

Posted 01/12/2022

|

12070

Early this morning, Chair of the US Central Bank Jerome Powell inspired extraordinary bullish public sentiment by announcing that the 0.75% interest rate hikes that we have seen the past 2 months could start to dwindle back down to 0.5% as early as December.

“My Colleagues and I do not want to overtighten,” Powell said during the Q & A session after his speech at the Brookings Institution in Washington DC.

“The time for moderating the pace of rate increases may come as soon as the December meeting.”

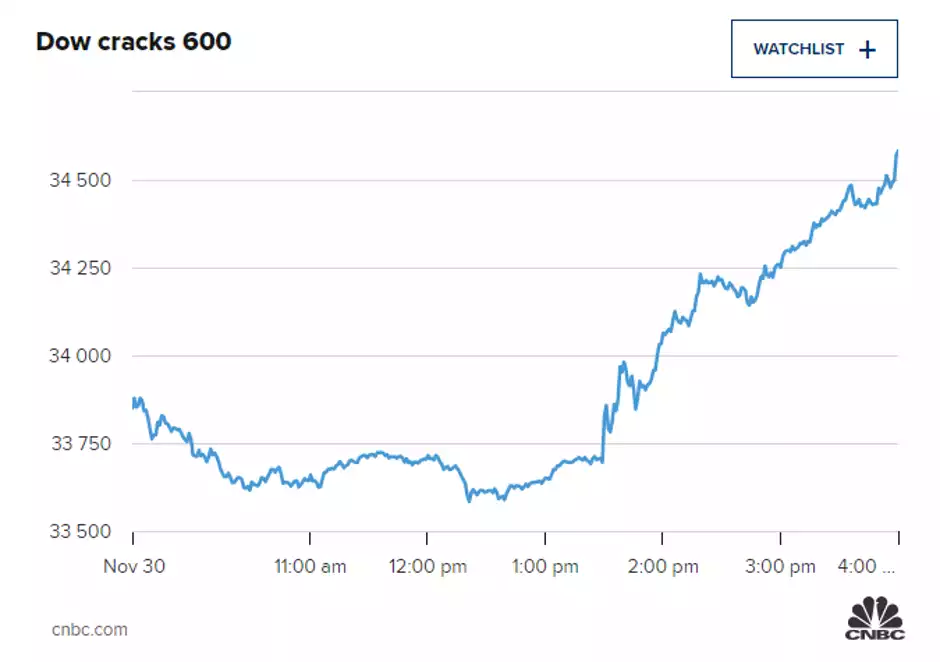

To no surprise, the market responded extremely positively, with both the Dow and S&P 500 rising to session highs after the speech. Treasury bonds, which typically move with interest rates, fell slightly.

The S&P 500 in particular had an extremely strong end to the day, closing at highs, and more interestingly, closing on a level of hourly volume that effectively doubles any amount we saw throughout November.

Powell’s bullish announcement also comes on the heels of the most recent Eurozone inflation data, which showed inflation in Europe decreasing from 10.6% last month to only 10% in November.

Powell did however go on to warn the public of the dangers of lowering the interest rate rises too quickly, a clear statement that the job of curbing inflation to a more manageable level is nowhere near done, and also leaving the door open for further increases in the future.

“History cautions strongly against prematurely loosening policy. We will stay the course until the job is done.”

“The truth is that the path ahead for inflation remains highly uncertain.”

The main challenges that the FED are currently facing surround a very strong labor market. More specifically, that the current level of hefty wage rises is fighting against the FED’s tightening economic policy.

Powell went on to admit that a ‘sustained period of below trend growth’ in the labor market will be required to fully curb inflation.

Even with the challenges ahead, clearly today’s announcement was a positive sign and step in the right direction. However, with a 0.5% rise now clearly priced in, if on the off-chance Powell were to announce a continuation of the 0.75% basis point increase, it is likely all the positive momentum in the markets we saw this morning will be reversed – and then some.

************************************************************************************

GOT A QUESTION about today's news?

This afternoon, the Gold & Silver Standard Insights team will be breaking down the news and answering YOUR questions.

Submit your question to [email protected] and SUBSCRIBE to the YouTube Channel to be notified when the GSS Insights video is live.

**********************************************************************************