Ethereum's Stabilised Market and the Optimism Ahead

News

|

Posted 11/04/2023

|

6942

Embracing the Calm Before the Upgrade

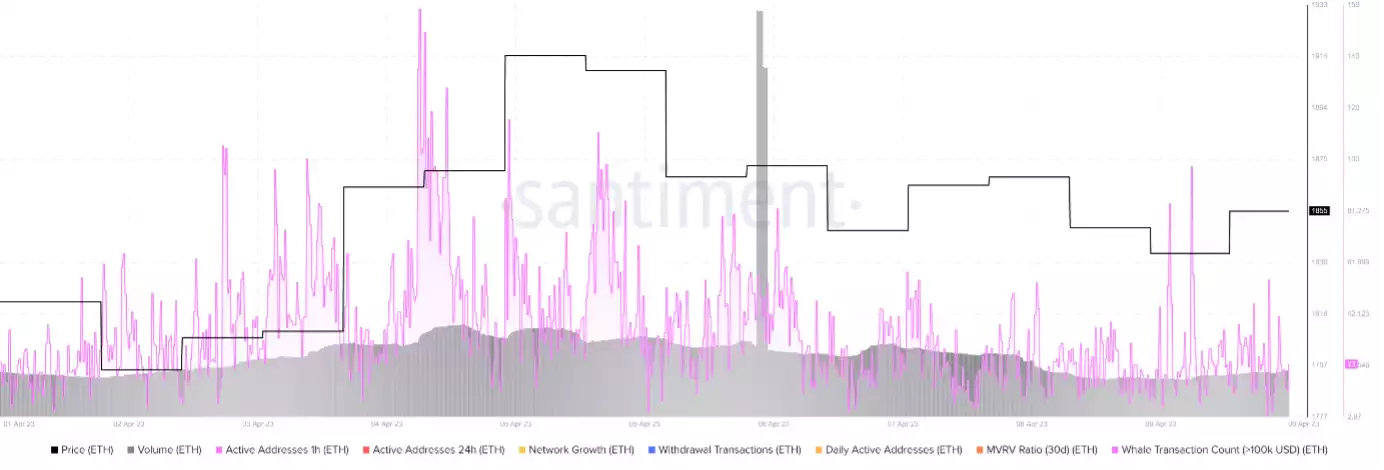

Over the last week, the Ethereum price has been stuck in the US$1,800 to $1,900 range – and appears to be attempting to break out higher at the time of writing. This price stagnation is due to a decline in whale activity and flat exchange balances, hinting at cautious ETH traders. Ethereum faces challenges in surpassing the $2,000 resistance, and Ether whales' scepticism has contributed to the price stagnation. With decreased coin supply on exchanges, it suggests potential short-term profit booking. Sentiment data shows a significant drop in Ether transactions over $100,000, and this Ethereum price stagnation is linked to the Shanghai/Capella upgrade countdown.

Anticipating the Impact of the Shanghai Upgrade

The Ethereum Shanghai upgrade, scheduled for April 12, 2023, enables ETH withdrawals for stakers since December 2020. According to Dune analytics data, over 16.3 million tokens are staked on the Ethereum network. The Shapella upgrade reduces the risk of holding staked Ethereum variants. Some investors may cash out staking positions, but many will maintain staking balance for yields.

Stakers cannot withdraw all ETH at once, limiting selling pressure. With $1.03 million ETH ($1.8 billion) available for direct withdrawal, it is negligible compared to the daily volume of $8-10 billion. The 50,400 ETH per day withdrawal limit further reduces selling pressure. Buying pressure is expected to increase due to reduced validators, higher staking rewards, and the deflationary nature of ETH. Ethereum's price may rise as supply decreases and buying pressure increases.

Reading the Whale Activity

ETH whale transaction count declined 84% in a month, from 14,655 transactions on March 11 to 2,346 transactions on April 10. Whale activity is a key indicator of market sentiment. The reduced transactions could imply that whales are consolidating their positions, anticipating positive developments in the near future. A stable Ether supply on exchanges might indicate a more balanced market, reducing the likelihood of sudden price fluctuations. The price uptick in late March, which led to tokens being moved out of exchanges, could be a sign that investors are increasingly optimistic about Ethereum's long-term potential, holding onto their assets for future gains.

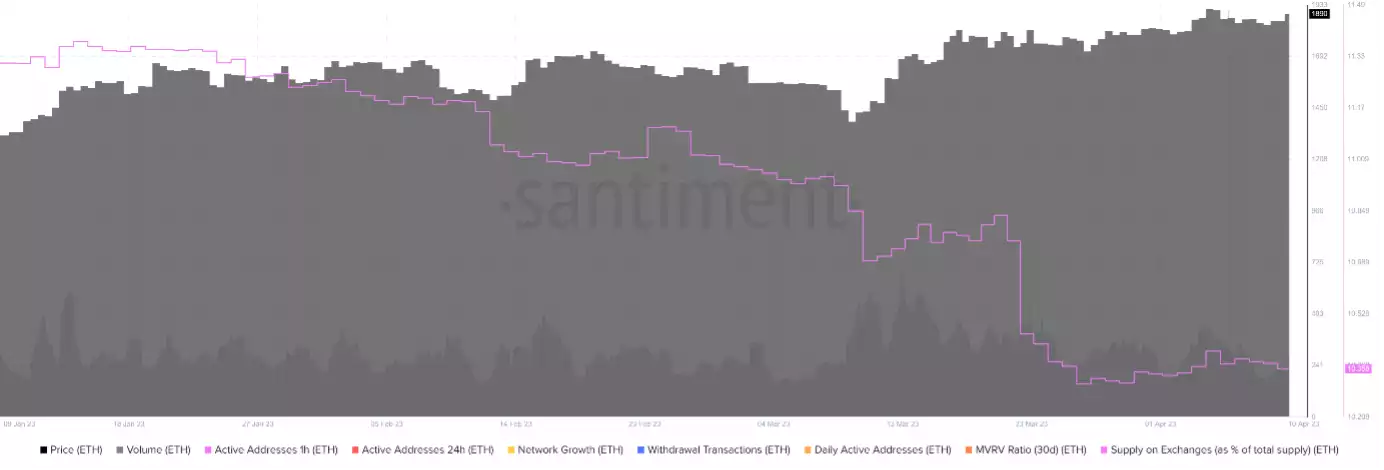

Examining the Steady Supply and Trading Volume

Ethereum outflows flatten in April, with the ETH Supply on Exchanges remaining stable at 12.49 million coins (March 31 - April 10). Investors are holding ETH on exchanges for short-term trading opportunities. Cold wallets are not being utilised as much for long-term gains. A drop in whale transactions and steady supply hamper Ethereum's price explosion. Trading volume has increased 30% to $7.76 billion, and major resistance levels are faced by Ethereum's price as shown by on-chain data. To validate a strong bullish outlook, we need to see a shift to traders moving ETH to cold wallets for long-term holding. This is an important aspect to keep a close eye on, as it could signify a more optimistic market sentiment and further upward momentum.

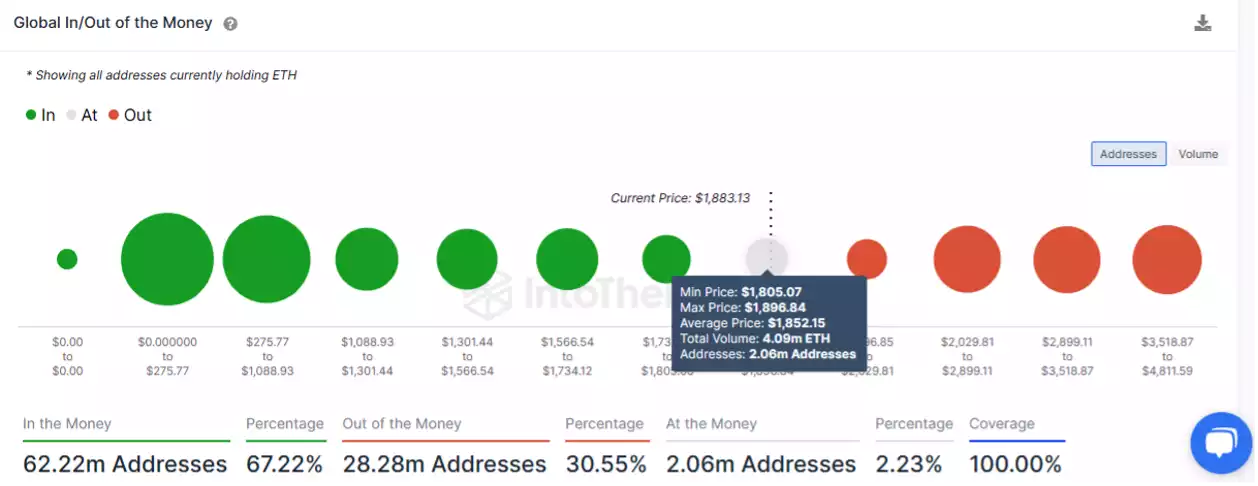

Potential Price Movements and Future Outlook

Global in/out of the money (GIOMAP) data suggests Ethereum's price is vulnerable below the $1,835 support level. Bears may take control if bulls show reluctance. 2.06 million addresses with 4.09 million ETH provide support between $1,805 to $1,896. Failure to hold support could result in a drop to $1,753. Ethereum's price could surpass $2,000 if sidelined investors enter the market. 1.7 million addresses may sell 1.84 million ETH after breaking even under $2,000. In highly bullish scenarios, Ethereum's price could reach the $2,500 resistance level.

In conclusion, despite the current Ethereum price stagnation, there is cautious optimism for the future, as the upcoming Shanghai and Capella upgrades could potentially transform the Ethereum market. While a shift in traders moving ETH to cold wallets for long-term holding is necessary for a strong bullish outlook, the underlying fundamentals of the network and the impact of the upgrades are expected to bring positive changes. As the market evolves, it's essential to stay informed and make well-considered decisions. Ainslie is here to make the process of buying and selling crypto as easy as possible. Our consultants are available to guide you through the entire process, providing comprehensive support for buying, selling, and securely storing your cryptocurrency.