Ethereum Gets Volatile

News

|

Posted 27/01/2021

|

19674

The second-largest cryptocurrency by market capitalisation has been on a tear in 2021, almost doubling its price since the 1st of January.

On Monday, ETH broke its previous all-time high set in the 2017 bull market, reaching $1900 per ETH. This means that ETH is the first significant altcoin to break through the 2017 all-time highs. Other tokens such as LTC, XRP and BCH still require significant gains to breach through the top.

Today, we are seeing ETH trading hands up 75% on a year-to date basis. Much like the recent BTC rally, this ETH rally is believed to have been fuelled by players with deep pockets moving into the market. Small investors looked to have participated in the rally, too. Both the number of non-zero addresses and addresses holding at least 0.1 ETH have risen to record highs.

Additionally, on-chain data shows that Ether is leaving centralised exchanges, possibly creating a supply shortage and facilitating a stronger bullish move.

The number of coins held on exchanges fell to just over 15 million over, the lowest level since October 2019. The exchange balance has been declining by roughly 250,000 ETH per day.

ETH leaving exchanges is extremely bullish as it’s a signal that more market participants plan on HODLing and also creates a supply crisis – which could lead to the price being squeezed higher.

Some traders could be depositing ETH to DEX’s and liquidity pools, while others could be “staking” coins to earn passive income. Staking refers to locking up cryptocurrency to receive rewards for participating in transaction validation on a proof-of-stake blockchain. Ethereum, which is shifting over to a fundamental upgrade, launched its Beacon Chain for that purpose in December.

Additionally, the increased utilisation of the Ethereum blockchain has lead to increased network fees. Participants on the ETH blockchain are having to pay hefty fees at the moment, with some interactions with complex smart contracts costing more than $100 per transaction. DeFi is becoming a VERY expensive practice, and because ETH is needed to fuel all transactions, participants are having to increase the gas on transactions just to ensure they're processed promptly.

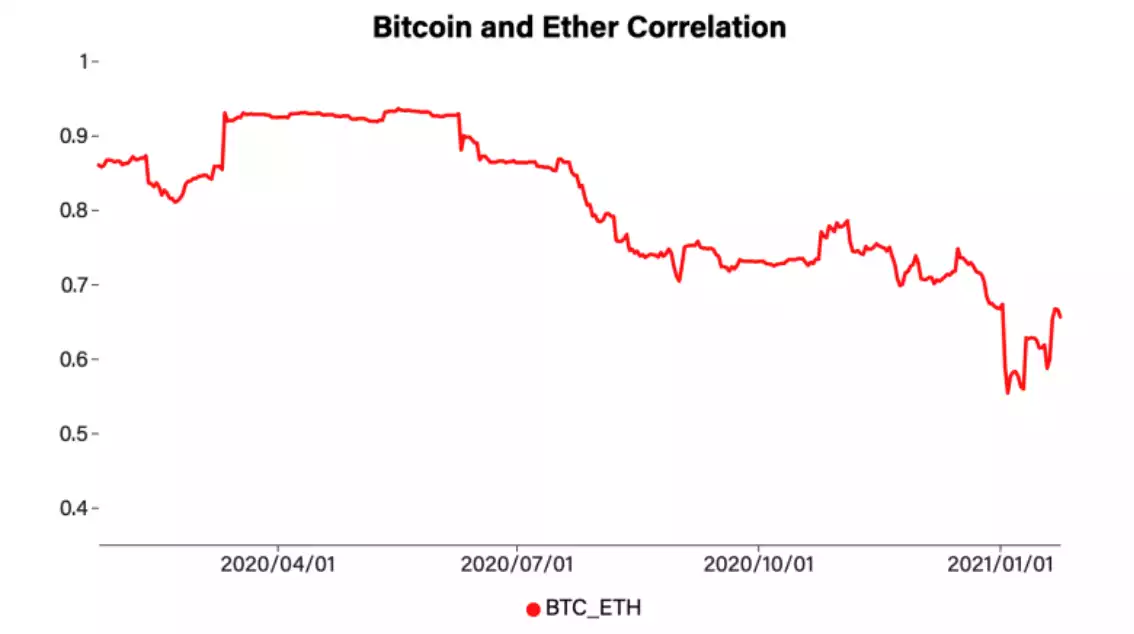

Something to keep an eye on is Ether's decoupling from the price of bitcoin. This decoupling could be what straps ETH holders onto a Rocketship, no longer shadowing BTC prices. Over the past year, the correlation between BTC and ETH has been slipping:

On Jan. 24, 2020, the 90-day correlation was at 0.86. A 90-day correlation of 1 means highly correlated. On Sunday, Jan. 24, 2021, that figure was at 0.66. So while it is still considered a relatively strong correlation, it is certainly trending away from simply following BTC price action.

Ether priced in bitcoin has also broken a yearlong price resistance. Ether’s price gains could be parabolic when factoring that the currency will be increasing in value against BTC and BTC could also be seeing further gains. If that scenario plays out, analysts have predicted ETH prices to multiply by up to 19 times.

Both Bitcoin and Ether are showing signs that they will see higher highs but as we saw in the previous bull run when bitcoin cools off, the spotlight moves to ether and when BTC & ETH are cooled down, we start to see altcoins shine. That could be the scenario we are seeing playing out right now with ETH.