Equitable Treatment – An Impossible Communist Dream

News

|

Posted 21/08/2024

|

1635

As South America slowly moves back to the Centre-Right of politics after decades of left-failing policies, North America is on the opposite trajectory. Kamala Harris is proposing several socialist-style taxes and agendas to achieve ‘equitable treatment’. Many commentators are describing the term ‘equitable treatment’ as a form of communism, and with the tax agenda currently being set out, this may be a fair assessment. Price controls, hiking capital gains (including on unrealised assets) and increasing corporate tax. These taxes are needed to ensure an impossible utopian target of ‘equitable treatment’ – but what will they do to the U.S. economy?

Price Controls

Inflation in the U.S. (and the world) is the cause of a lot of discontent. But, just like in Australia, where the government continues to spend and ignore their impact on inflation, the U.S. has spent even more prolifically. Due to this, rampant inflation has plagued the world for the last two years, with food prices in the U.S. up around 20%. To deal with this inflation, Kamala Harris has proposed price caps on certain items.

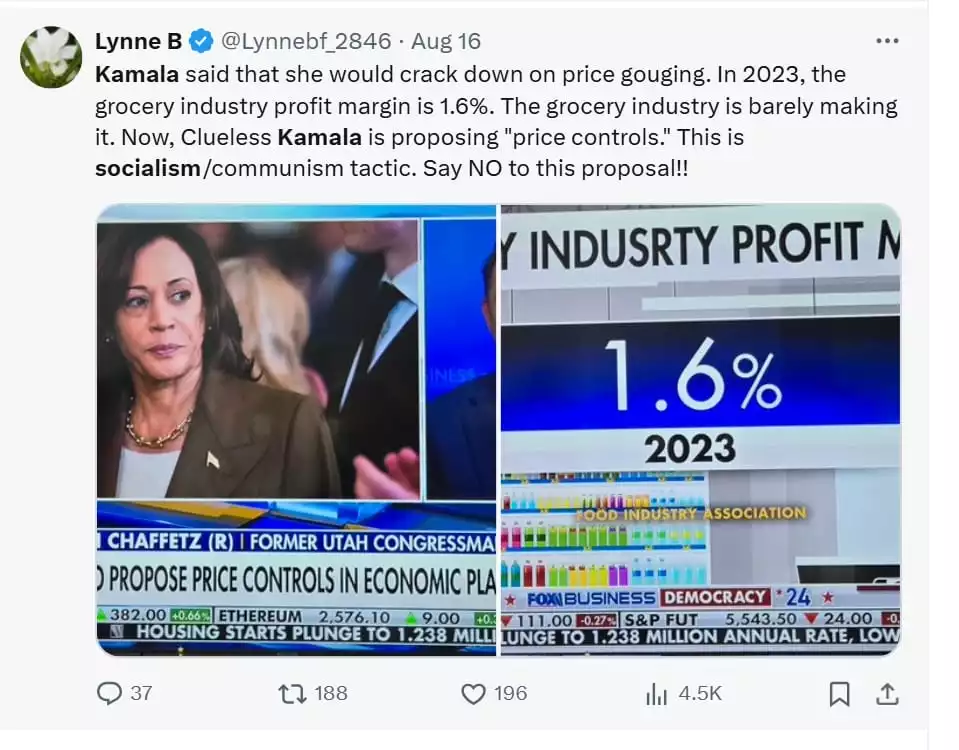

Price controls do not work, especially in open markets like the U.S., unlike Australia’s price-gouging duopolies and monopolies, the U.S. has a highly competitive market. In the grocery market, the 2023 grocery margin was 1.6%. With falling retail buying, this is likely to fall even further in 2024. So, if I sell a loaf of bread for $1, I make 1.6c. Let's say 50% of the cost of a loaf of bread is wages, those wages go up with inflation by 3% per year, and within a year this makes the loaf of bread an item that is only is breaking even. Within two years I’m losing money, so I can either substitute quality goods for cheap substitutes or choose to shut down. In the past, these outcomes have inevitably led to food shortages and poor-quality goods in price-controlled countries.

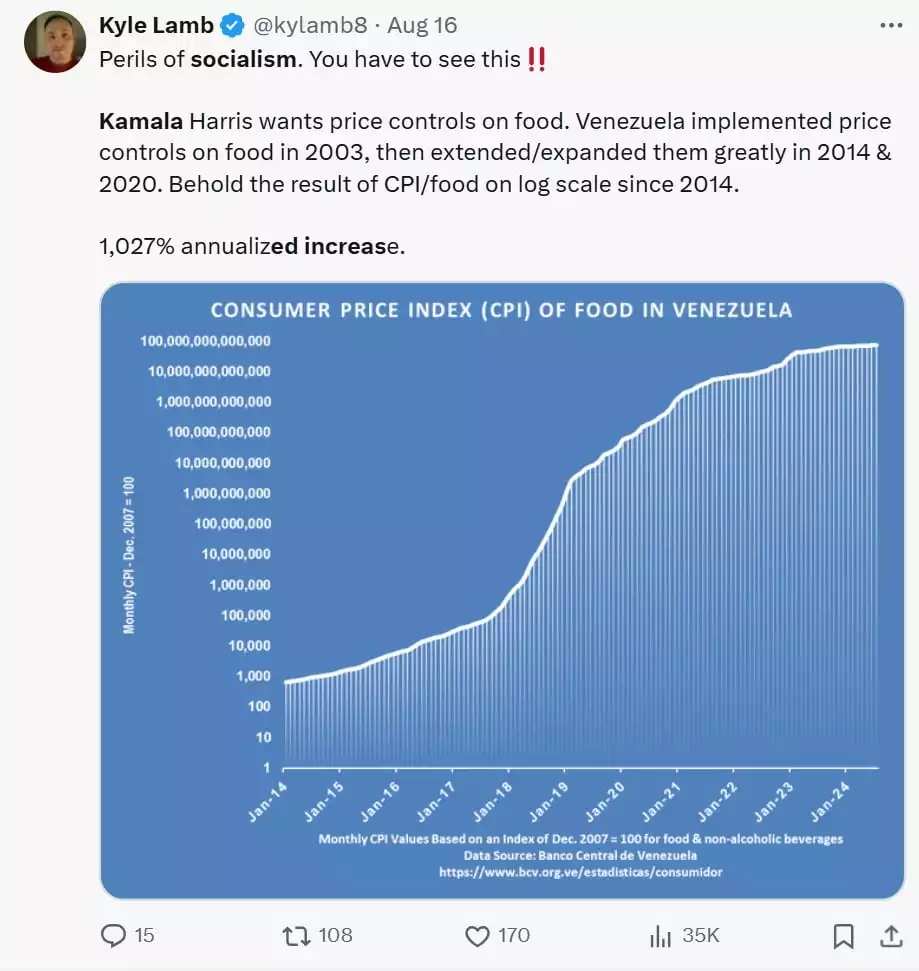

Price controls have been used in history and seemingly were always unwound due to their failure. In 2003, Venezuela put price controls on goods and kept extending these controls. According to The Guardian, ‘price controls created a scarcity of basic goods and made black markets flourish under President Maduro’.

As the government continued to spend and create money, inflation became rampant and eventually flowed into basic goods, so something that cost $1 in 2014 ended up costing $100,000,000,000 in 2024.

Capital Gains on Unrealised Assets

The wealth gap keeps widening with increased government spending and increased government debt. One of the major reasons this occurs is that the top 1% captures large amounts of this liquidity through stock market increases. On top of this, unless a stock is sold, there is no realised capital gain, so instead of selling stocks, most individuals borrow against their shares from banks, hence raising income as a tax-deductible interest-paying (and therefore deductible) source of funds. This drives bank profits. As these loans are the best option, a lack of selling in stocks occurs as individuals and companies are better off not realising the gains. This drives the stock market higher, makes banks more profitable and the wealth gap continues to increase.

Now, let’s look at what happens to the stock market if this tax is applied. It only applies to people with a wealth of $100 million or more so what impact could it have? Take Elon Musk who currently holds 20% of Tesla stock. If the ‘unrealised asset’ tax occurs, Elon Musk will be forced to raise 25% against his shares and as this will affect share price, it is unlikely he will receive a loan against these shares from a bank. So, he is forced to sell these shares - 5% of Tesla stock liquidated from 1 individual. This in turn will drop the price of the share, meaning the unrealised gain was now ‘overtaxed’. Due to the decrease in stock price thousands of individuals will lose money on the stock, including retirement funds. This happens across multiple stocks in the U.S. stock market, causing a stock market crash, reducing wealth for millions and taxes for the U.S. government.

An alternate way of doing this would be to ban loans against shares. This would force high net worth individuals to sell their shares to raise their income, but in an orderly fashion as they require the funds, rather than leading to a collapse of the stock market, which is currently at giddying PE heights again.

What is Equitable Treatment?

Equitable Treatment is a utopia everyone hopes for, with sunshine and rainbows every day. In Kamala’s words, ‘Equitable treatment means we all end up at the same place’. This means you have to give people, including dole bludgers, a leg up in life through taxes, free money, student loan gifts and healthcare, to ensure they end up in the same place as people like Elon Musk who works a huge amount of hours a week, not only to get ahead for themselves but also for humanity.

As several people on X have started pointing out:

‘Equal outcome is an impossible goal that requires massive social engineering that always fails because we differ in drive, intelligence, creativity, interests, etc. Equal opportunities.'

What, happened to equality – where everyone is treated the same – but allowed to strive to their own advantage through work or intelligence? With equal outcomes for everyone, isn’t equitable treatment just communism?

So as the U.S. looks to move to the Venezuelan socialist/communist utopia. What will this do for you as an individual, as the wealthy, successful businesses are taxed more to ensure an equitable outcome? Will they work harder or give up? As history has shown time and time again – they give up. Think about what this will do to the USD and monetary asset prices like gold and Bitcoin.

Equitable treatment means we all end up in the same place.