Ending 2018 with a Bang! Wall St Flops, Gold Pops, What’s Ahead?

News

|

Posted 21/12/2018

|

9368

Talk about ending the year with a bang. Last night Wall Street fell heavily yet again, the Dow down 2%, the NASDAQ now joining the Russell 2000 officially in a bear market (>20% fall from peak) and the S&P500 (after dropping another 1.6% last night) just 3% off joining them and ending the longest bull market in history.

Gold jumped 1.4% and silver and platinum likewise up 1.2% as money sought safety (you have until 4pm today here to do likewise…).

The scene now is one of many ominous threats for global markets.

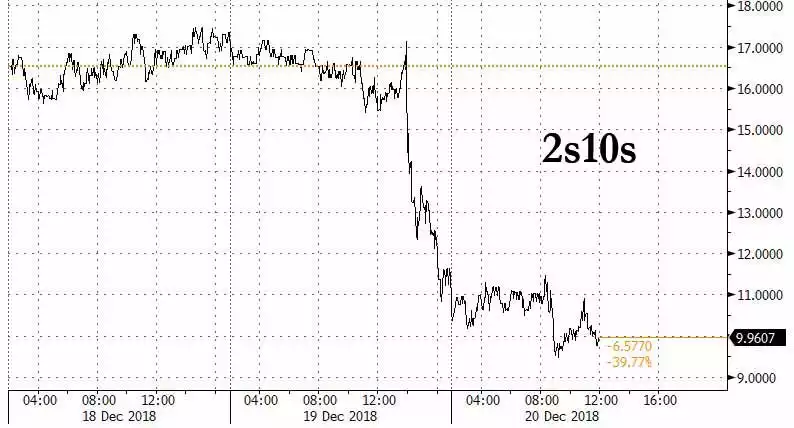

The bellwether 2yr-10yr US Treasury yield spread is perilously close to inverting, entering single digits last night

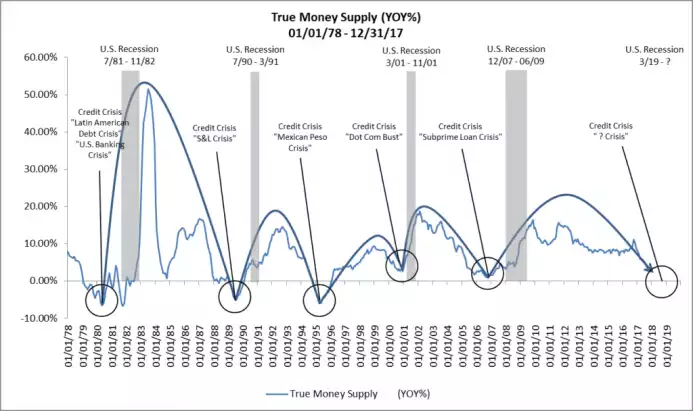

With the Fed hell bent on further rate hikes, having offlaid $450b in bonds this year and determined to continue this at $50b/month for the next couple of years, is it any wonder that True Money Supply (TMS) has shrunk dramatically. The correlation between that and previous recessions is rather compelling:

It’s not just strictly about the money supply either. The market has for 10 years now expected the Fed and other central banks to come to the rescue each time the market tanks. They sent a clear message this week that the Fed’s equities market safety net is no longer there. Wall St legend and billionaire hedge fund manager David Tepper even went so far as to say last night:

“Powell [Fed Chair] basically told you the Fed put is dead.”

“The Fed doesn’t care about the stock market within 400 SPX (S&P 500) points…The Fed are not likely to change their planned policy path dramatically to rescue equity markets unless and until the selloff begins to affect the real economy."

As a reminder, here’s what 400 looks like:

Let’s recall too, it’s not just the Fed. Chinese monetary growth has been slashed severely and the ECB is ending their QE program. Last night the Bank of England blinked and warned that Brexit uncertainty has "intensified considerably" giving grave concerns for the UK economy. They held interest rates at just 0.75%.

We were reminded by the IMF’s Deputy Managing Director David Lipton (speaking at the Bloomberg Global Regulatory Forum) why the Fed is so hell bent on raising rates and reducing their balance sheet. They need to reload the gun before the next crisis…

“Like many of you, I see storm clouds building, and the fear the work of crisis prevention is incomplete…..The impairment of key U.S. capital markets during the global financial crisis, which might have produced crippling spillovers across the globe, was robustly contained by unorthodox Fed action supported by Treasury backstop funding. That capacity is unlikely to be readily available again.” i.e. there is no safety net available.

As we have reported before, the predominance of passive ETF’s and the like has left the market highly exposed to liquidity issues and right on cue we have just seen the lowest liquidity on record in the S&P500 futures (Emini) exchange. Ever. Those managing such instruments (so called CTA’s or Commodity Trading Advisors) are very close to potentially going ‘short’ this market, something that will add considerably to downside capitulation risk:

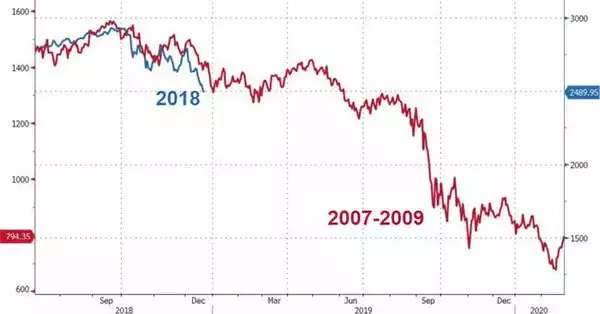

And so the stage is set for a very interesting 2019, and let’s face it, 2018 aint over yet. Here’s a reminder of how this compares to the GFC…

Remember that we close at 4pm today and don’t reopen until 7 January.

Finally:

As a wrap up to our last trading day of the 2018 year, this is what’s happened this year:

USD Gold -3%

AUD Gold +6%

USD Silver -13%

AUD Silver -4% (and a GSR of 85!)

ASX200 -9.2%

S&P500 -7.7%

On behalf of all the team here at Ainslie’s let us wish you a very merry Christmas, a wonderful holiday break, and all the very best for 2019. Thanks for your custom, your support and your friendships. And please be safe.